Public-Private Partnerships

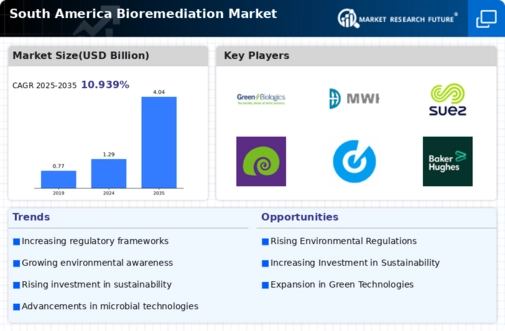

The establishment of public-private partnerships (PPPs) is emerging as a crucial driver for the bioremediation market in South America. These collaborations facilitate the sharing of resources, expertise, and funding, enabling more effective remediation projects. Governments are increasingly partnering with private firms to address environmental challenges, particularly in urban areas facing pollution crises. Such partnerships can lead to innovative bioremediation solutions and enhance project efficiency. The bioremediation market could see a growth rate of 10% annually as a result of these collaborative efforts, fostering a more integrated approach to environmental management.

Investment in Sustainable Practices

There is a notable shift towards sustainable practices among industries in South America, which significantly influences the bioremediation market. Companies are increasingly recognizing the economic and environmental benefits of adopting bioremediation techniques. For example, the mining sector, a major contributor to pollution, is investing heavily in bioremediation to rehabilitate contaminated land. This trend is expected to drive the market, with investments in bioremediation technologies projected to reach $500 million by 2026. The growing emphasis on sustainability not only enhances corporate image but also aligns with consumer preferences for environmentally responsible products and services.

Environmental Regulations and Compliance

The increasing stringency of environmental regulations in South America is a pivotal driver for the bioremediation market. Governments are implementing stricter guidelines to mitigate pollution and promote sustainable practices. For instance, Brazil has introduced regulations that mandate the treatment of contaminated sites, thereby creating a demand for bioremediation solutions. The bioremediation market in South America is projected to grow as industries seek compliance with these regulations, which could lead to a market value increase of approximately 15% by 2027. This regulatory landscape compels companies to adopt bioremediation technologies to avoid penalties and enhance their environmental stewardship.

Rising Awareness of Environmental Issues

The growing awareness of environmental issues among the South American populace is significantly impacting the bioremediation market. As communities become more informed about the effects of pollution and the benefits of bioremediation, there is an increasing demand for eco-friendly remediation solutions. Educational campaigns and community initiatives are driving this awareness, leading to greater public support for bioremediation projects. This heightened consciousness is likely to result in a market expansion, with projections indicating a potential increase in demand for bioremediation services by 25% over the next few years. The societal push for cleaner environments is thus a vital catalyst for market growth.

Technological Innovations in Bioremediation

Technological advancements in bioremediation methods are transforming the market landscape in South America. Innovations such as bioaugmentation and phytoremediation are gaining traction, offering efficient solutions for soil and water decontamination. The introduction of genetically engineered microorganisms has shown promise in enhancing the effectiveness of bioremediation processes. As these technologies become more accessible, the bioremediation market is likely to experience accelerated growth. It is estimated that the adoption of advanced bioremediation technologies could increase market revenues by 20% over the next five years, reflecting the potential for improved environmental outcomes.