Top Industry Leaders in the Soil Conditioners Market

Soil Conditioners Market

Soil Conditioners Market

October 2023- Progressive Planet Solutions Inc, a pioneer in developing environmentally friendly solutions, is launching a new natural soil conditioner that will be applied to approximately 1,355 acres this fall. With the introduction of a fall-application soil conditioner, Progressive Planet is strategically bringing to market a proprietary replacement for chemical fertilizers that can be used in both spring and fall, with CARBON PK and CARBON Ca, respectively. CARBON Ca is a proprietary blend of natural ingredients that provides calcium, carbon (humin), humic acid, and fulvic acid to the soil. The company will look to third parties for support, measurements, and validation of carbon sequestration by assessing any increases in both soil organic matter and soil organic carbon. Their expertise is in developing critical low-carbon and carbon-capturing solutions using their owned mineral assets and recycled materials to create eco-friendly products that combat climate change and safeguard the health of the planet.

August 2023- The Ministry of Agricultural, Fisheries, and Water Resources (MAFWR) has started an innovative project in Barka in South Batinah governorate to produce eco-friendly soil improver. The soil enhancer project stands out as part of the government's support for innovative agricultural solutions, showing Oman's commitment to environmentally sustainable practices. The project aims to provide solutions to the problem of environmental pollution by making use of palm waste. The palm residues contain key elements like nitrogen, phosphorus, potassium, magnesium, calcium, and various micronutrients that nourish plants, he explained. Such a mixture benefits a wide range of crops, including vegetables, fruits, aromatic and natural plants, and even ornamental plants, all suitable for Oman's agricultural environment.

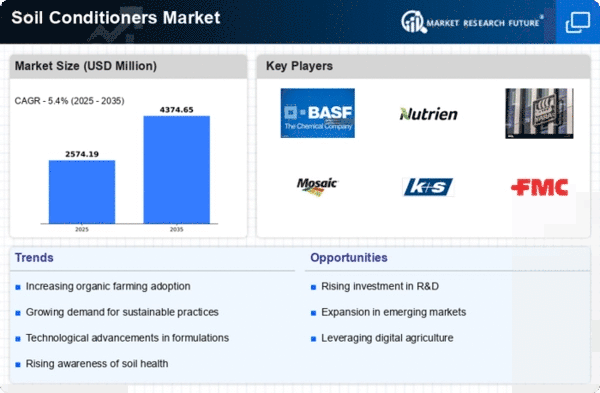

Some of the Soil Conditioners Companies listed below :

- BASF SE

- Syngenta AG

- Novozymes A/S

- The DOW Chemical Company

- Adeka Corporation

- Croda International PLC

- Clariant International AG

- Vantage Specialty Chemicals, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Akzo Nobel N.V

- Solvay S.A.

- Lambent Corp.

- TIMAC AGRO International

- Loveland Products, Inc.