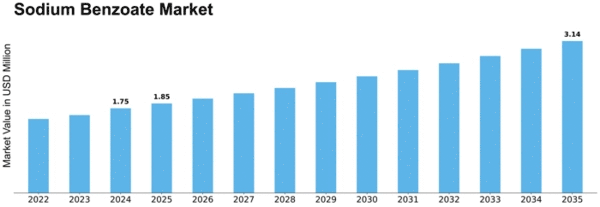

Sodium Benzoate Size

Sodium Benzoate Market Growth Projections and Opportunities

The sodium benzoate market is shaped by a multitude of factors that influence its growth and dynamics. One of the primary drivers in this market is the increasing demand for food preservation and shelf-life extension. Sodium benzoate, a widely used preservative, helps prevent the growth of bacteria, yeasts, and molds in various food and beverage products. As consumers seek convenience and a longer shelf life for their food items, the demand for sodium benzoate continues to rise across the food industry.

Environmental regulations and growing awareness of health concerns contribute significantly to market dynamics. As consumers become more conscious of the ingredients in their food and the potential health risks associated with certain additives, there is a heightened demand for natural and clean-label alternatives. This trend is influencing manufacturers to explore and invest in alternative preservatives, impacting the sodium benzoate market. Regulatory bodies are also playing a role in shaping the market by implementing guidelines and restrictions on the use of certain preservatives, driving the industry towards more sustainable and health-conscious solutions.

The global expansion of the food and beverage industry is another crucial factor influencing the sodium benzoate market. As populations grow and urbanize, there is an increased demand for processed and convenience foods, both domestically and internationally. Sodium benzoate's role as a preservative makes it a vital ingredient for manufacturers looking to extend the shelf life of their products, especially those distributed over long distances. This expanding global market for processed foods is a significant driver for the growth of the sodium benzoate industry.

The beverage industry, including soft drinks and fruit juices, plays a pivotal role in the sodium benzoate market. The demand for beverages with extended shelf life and maintained freshness has driven the use of sodium benzoate as a preservative in these products. Additionally, the rise of ready-to-drink beverages and the convenience they offer further contribute to the demand for sodium benzoate. As consumer preferences shift towards convenient and on-the-go options, the beverage industry's reliance on preservatives like sodium benzoate is expected to continue driving market growth.

Technological advancements in food processing and preservation methods also impact the sodium benzoate market. Innovations in packaging, storage, and transportation technologies contribute to the overall efficiency of the food supply chain. Sodium benzoate plays a crucial role in supporting these advancements by ensuring the preservation of food products throughout their journey from production to consumption. Manufacturers are continuously exploring ways to optimize the use of sodium benzoate while maintaining the quality and safety of their products.

Market competitiveness and cost dynamics are essential factors influencing the sodium benzoate market. As the demand for preservatives increases, manufacturers are faced with the challenge of maintaining competitive pricing while ensuring product quality. The availability of raw materials, production costs, and market competition all contribute to the overall pricing strategy adopted by sodium benzoate manufacturers. Market players need to strike a balance between meeting the rising demand and ensuring cost-effective production to remain competitive in the industry.

Leave a Comment