Snack Food Packaging Size

Market Size Snapshot

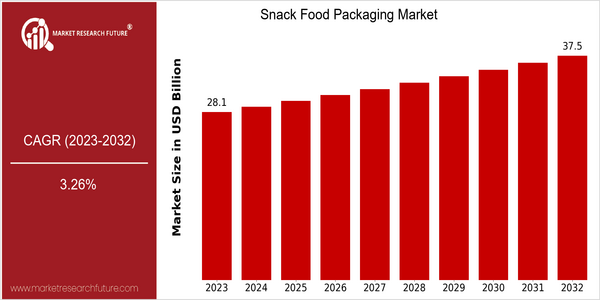

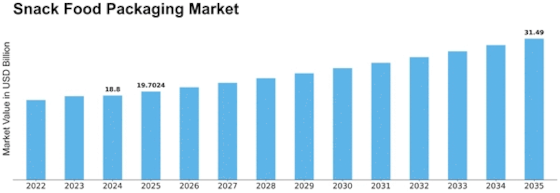

| Year | Value |

|---|---|

| 2023 | USD 28.08 Billion |

| 2032 | USD 37.5 Billion |

| CAGR (2024-2032) | 3.26 % |

Note – Market size depicts the revenue generated over the financial year

The market for snack food packaging is estimated to be worth about $28 billion in 2023 and is projected to reach $37.4 billion by 2032, with a CAGR of 3.16% from 2024 to 2032. This steady growth indicates a strong demand for new packaging solutions that meet the changing needs and preferences of consumers and the growing consumption of snacks worldwide. The rising trend of on-the-go snacking, the growing awareness of consumers for healthy food and sustainable packaging materials are the main factors driving the market growth. Also, the development of new packaging materials, such as biodegradable and recyclable options, is expected to drive the market. Also, the key players, such as Amcor, Mondi Group, and Sealed Air, are investing in R & D to develop new products to meet the changing needs of consumers. Strategic alliances, product launches, and product launches aimed at convenience and freshness are also driving the market. The snack industry is evolving, and the packaging industry is evolving with it, ensuring a dynamic and competitive landscape.

Regional Market Size

Regional Deep Dive

Snacks and Snack Foods are gaining momentum in the market, driven by the increasing demand for convenience, sustainability, and innovations in packaging. In North America, the market is characterized by a strong focus on eco-friendly materials and advanced packaging technology. Europe is characterized by a diversity of snack preferences, which have a strong influence on the design and materials of the packages. The Asia-Pacific region is characterized by a rapid uptake of modern packaging solutions, largely due to urbanization and changing lifestyles. Middle East and Africa are characterized by a unique set of opportunities and challenges, with the growing middle class and the growing awareness of health issues influencing the packaging trends. Latin America is characterized by the emergence of local snack brands, which are characterized by unique packaging to compete in the market.

Europe

- The European Union's stringent regulations on single-use plastics are driving innovation in biodegradable and recyclable packaging materials, with companies like Amcor leading the charge.

- There is a growing trend towards transparent packaging, allowing consumers to see the product inside, which is being adopted by brands like Walkers to enhance consumer trust and engagement.

Asia Pacific

- Rapid urbanization and a shift towards on-the-go consumption are leading to increased demand for flexible packaging solutions, with companies like Sealed Air expanding their operations in the region.

- Innovations in smart packaging, such as QR codes for product information, are gaining traction, particularly in markets like Japan, where technology adoption is high.

Latin America

- Local snack brands are increasingly focusing on unique and culturally relevant packaging designs to appeal to regional tastes, with companies like Grupo Bimbo leading in innovative packaging strategies.

- The rise of health-conscious consumers is pushing brands to adopt transparent packaging that showcases ingredient quality, influencing packaging decisions across the region.

North America

- The rise of e-commerce has led to increased demand for packaging that ensures product safety during transit, prompting companies like Mondi Group to innovate in protective packaging solutions.

- Sustainability is a key focus, with major players such as PepsiCo committing to using 100% recyclable, compostable, or biodegradable packaging by 2025, influencing the entire supply chain.

Middle East And Africa

- The region is witnessing a surge in demand for healthy snack options, prompting packaging innovations that highlight nutritional information, with companies like Al Ain Food & Beverages adapting their packaging strategies.

- Government initiatives aimed at reducing plastic waste are encouraging local manufacturers to explore alternative materials, fostering a shift towards sustainable packaging solutions.

Did You Know?

“Approximately 30% of all snack food packaging is now made from sustainable materials, reflecting a significant shift towards eco-friendly practices in the industry.” — Smithers Pira, 2023

Segmental Market Size

Snack-food packaging is growing steadily. The rising trend towards healthy eating is driving the demand for packaging that maintains freshness and nutritional value, and regulatory policies are promoting the use of more sustainable packaging materials. PepsiCo and Nestlé are responding to the trend towards the use of sustainable materials and the demand for more sustainable products. The market is already at a mature stage of development, with flexible packaging, for example, which enhances shelf life and reduces food waste, playing an important role. Its main applications are for snack foods, such as nuts, crisps and granola bars. The designs enhance the product’s appeal and visibility on the shelf. The use of biodegradable materials and the pandemic swine flu have increased the demand for food hygiene and safety. The evolution of smart packaging, which engages consumers through the use of QR codes, is also driving the market, enabling brands to compete in a rapidly changing marketplace.

Future Outlook

Snack Food Packaging Market is expected to increase at a CAGR of 3.16% from 2023 to 2032, with a market size of $33,519.1 million. This growth is driven by the rising trend of convenience and portable snacking, which is driving the development of packaging solutions. Health-conscious consumers are increasingly opting for snacks that are aligned with their dietary preferences. Therefore, packaging that highlights the nutritional content and the sustainable nature of the product will become increasingly important. It is expected that by 2032, the share of eco-friendly packaging will be over 31% of the total market, as a result of the demand for sustainable packaging solutions. Also, technological developments will play a key role in the future of snack food packaging. Incorporating QR codes and NFC technology into smart packaging will allow consumers to interact with the product and provide real-time information about its freshness and origin. Also, regulations aimed at reducing plastic waste will stimulate the use of biodegradable and recyclable materials in packaging. As manufacturers adapt to these trends and invest in sustainable practices, the snack food packaging market will not only grow, but also evolve to meet the changing needs of consumers and governments.

Leave a Comment