Smart Lock Size

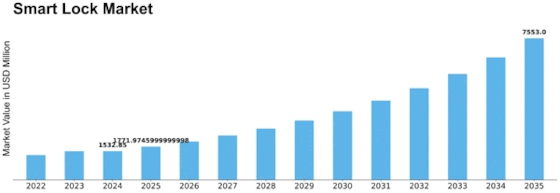

Smart Lock Market Growth Projections and Opportunities

The Smart Lock market is influenced by a multitude of market factors that collectively shape its dynamics and growth trajectory. One crucial factor is the increasing adoption of smart home technologies. As consumers embrace the convenience and connectivity offered by smart devices, the demand for smart locks has surged. The integration of smart locks into comprehensive home automation systems has further fueled this trend, as homeowners seek seamless and secure solutions for managing their living spaces.

Another significant market factor is the rising awareness of security concerns. With traditional locks facing vulnerabilities, consumers are turning to smart locks for enhanced protection. The advanced features of smart locks, such as biometric authentication, remote monitoring, and activity tracking, resonate with individuals seeking robust security measures. As the awareness of these capabilities grows, so does the market for smart locks.

The evolving lifestyle preferences of consumers also play a pivotal role in shaping the Smart Lock market. The desire for a connected and digitally enhanced lifestyle, coupled with the convenience of keyless entry and remote access, has positioned smart locks as a desirable addition to modern living. The increasing urbanization and the fast-paced nature of contemporary life further amplify the appeal of smart locks, aligning with the need for efficient and time-saving solutions.

Interoperability and integration with other smart devices constitute another crucial market factor. As smart homes become more prevalent, consumers seek products that can seamlessly communicate and work together. Smart locks that integrate with virtual assistants, security cameras, and other smart home devices offer a comprehensive solution, driving their market demand. Compatibility with popular platforms and ecosystems enhances the overall user experience, contributing to the success of smart locks in the market.

The competitive landscape also significantly influences the Smart Lock market. As more companies enter the space, innovation becomes a key differentiator. Manufacturers strive to introduce cutting-edge features, improve user interfaces, and enhance the overall functionality of smart locks. This intense competition fosters continuous advancements in technology, ultimately benefiting consumers with more sophisticated and reliable products.

Moreover, regulatory factors and standards compliance play a critical role in the market's development. Adherence to security and privacy standards, along with certification from relevant authorities, instills confidence in consumers regarding the reliability of smart lock systems. Government regulations and industry standards shape the market by establishing a baseline for product quality and safety, influencing purchasing decisions and market growth.

The economic landscape, including factors like disposable income and consumer spending patterns, also contributes to the Smart Lock market dynamics. Economic stability and increased disposable income enable more consumers to invest in smart home technologies, including smart locks. Conversely, economic downturns may temporarily impact market growth as consumers prioritize essential expenditures over discretionary purchases.

Leave a Comment