Smart Labels Size

Smart Labels Market Growth Projections and Opportunities

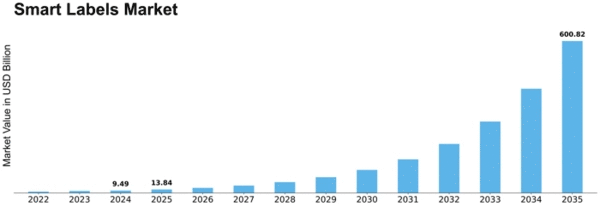

The Smart Labels Market is going through a major expansion driven by various market dynamics indicative of a burgeoning demand for advanced labeling solutions among different industries. Critical to market growth is the increased need for efficient and transparent supply chain management. Real-time monitoring and tracking of products along the supply chain can be made possible thanks to smart labels integrated with technology such as Radio Frequency Identification (RFID) and Near Field Communication (NFC). The value of Smart Labels Market Size was USD 5.5 Billion in 2022. The Smart Labels industry is expected to reach USD 25.17 Billion by 2032 from USD 6.51 Billion in 2023, at a CAGR of 18.41% during the forecast period. Another reason for adopting smart label technologies is counterfeiting prevention within supply chains. By integrating unique identification markers and authentication technologies, smart labels are powerful weapons in the fight against counterfeit products. Faced with counterfeit drugs that are dangerous to human health, industries like pharmaceuticals now rely on smart labeling to guarantee the genuineness as well as traceability of their products. Furthermore, heightened awareness levels coupled with massive acceptance of IoT technologies have been playing significant roles in driving the smart labels market forward. Smart tags provide interfaces between physical objects and Internet of Things (IoT) systems, thus becoming gateways to those applications that facilitate communication amongst devices, enabling data exchange and automation, among others. As such, rising IoT adoption across verticals will lead to an increase in purchasing demands for smart labels. Retailing and e-commerce contribute significantly towards smart label markets, too; this happens because traders require effective inventory control techniques, given the fact that online shopping is currently on an upward trend. The healthcare industry also contributes significantly to the intelligent labeling marketplace. Smart tags are widely used to track medical equipment, pharmaceuticals, and patient records. The efficiency combined with patient healthcare ensures proper accuracy while minimizing the time involved in the processes of the healthcare system. Although there are compelling market factors that drive the adoption of smart labels, some challenges exist, such as matters relating to data privacy and security. The fact that smart tags enable increased communication, as well as data transfer, necessitates enhanced cyber security measures to protect delicate information. Manufacturers and solution providers in the smart labels market are actively addressing these concerns through the development of secure and encrypted labeling solutions.

Leave a Comment