Sleeving Machines Market Share

Sleeving Machines Market Research Report Information By Automation (Automatic, Semi-automatic, and Manual), By Machine Type (Shrink Sleeve Labeling Machine, Stretch Sleeve Labeling Machine, Roll-fed Labeling Machine, Tamper-evident Banding Machine, and Heat Tunnel Machine), By End Use (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Chemicals, Automotive, and Other Industrial), and By Region (North America, Europe, Asia-Pacific, and Rest Of The World) - Growth & Industry Forecast to 2035

FAQs

What is the projected market valuation of the Sleeving Machines Market by 2035?

The projected market valuation of the Sleeving Machines Market is expected to reach 5.088 USD Billion by 2035.

What was the market valuation of the Sleeving Machines Market in 2024?

The market valuation of the Sleeving Machines Market was 3.447 USD Billion in 2024.

What is the expected CAGR for the Sleeving Machines Market during the forecast period 2025 - 2035?

The expected CAGR for the Sleeving Machines Market during the forecast period 2025 - 2035 is 3.6%.

Which companies are considered key players in the Sleeving Machines Market?

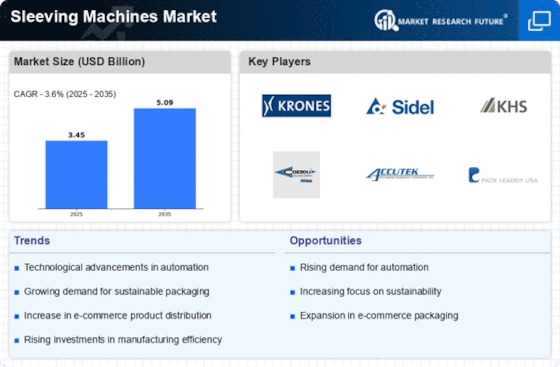

Key players in the Sleeving Machines Market include Krones AG, Sidel Group, KHS GmbH, and Accutek Packaging Equipment Companies, Inc.

What are the main segments of the Sleeving Machines Market?

The main segments of the Sleeving Machines Market include Automation, Machine Type, and End Use.

How did the Automatic segment perform in terms of valuation in 2024?

In 2024, the Automatic segment of the Sleeving Machines Market was valued at 1.5 USD Billion.

Market Summary

As per Market Research Future analysis, the Sleeving Machines Market Size was estimated at 3.447 USD Billion in 2024. The Sleeving Machines industry is projected to grow from USD 3.571 Billion in 2025 to USD 5.088 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 3.6% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Sleeving Machines Market is poised for substantial growth driven by automation and sustainability initiatives.

- North America remains the largest market for sleeving machines, reflecting a strong demand for advanced packaging solutions. The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid industrialization and e-commerce expansion. Automatic sleeving machines dominate the market, while semi-automatic machines are witnessing the fastest growth due to their cost-effectiveness. Key market drivers include the rising demand for packaging solutions and technological advancements in machinery, which enhance efficiency and compliance.

Market Size & Forecast

| 2024 Market Size | 3.447 (USD Billion) |

| 2035 Market Size | 5.088 (USD Billion) |

| CAGR (2025 - 2035) | 3.6% |

| Largest Regional Market Share in 2024 | North America |

Major Players

<a href="https://www.krones.com/en/products/machines/the-labeller-for-sleeves.php">Krones AG</a> (DE), Sidel Group (FR), KHS GmbH (DE), Cozzoli Machine Company (US), Accutek Packaging Equipment Companies, Inc. (US), <a href="https://www.packleaderusa.com/equipment/sl-shrink-sleeve-labeling-machines">Pack Leader USA</a> (US), Aesus Packaging Systems (CA), Karma Packaging (IN), KHS USA (US)

Market Trends

The Sleeving Machines Market is currently experiencing a notable transformation, driven by advancements in technology and increasing demand for efficient packaging solutions. Manufacturers are increasingly adopting automated systems to enhance productivity and reduce labor costs. This shift towards automation appears to be a response to the growing need for faster production cycles and improved accuracy in packaging processes. Additionally, the rise in e-commerce and retail sectors is propelling the demand for versatile sleeving machines that can accommodate various product sizes and shapes. As sustainability becomes a focal point for many industries, there is a noticeable trend towards eco-friendly materials and processes within the Sleeving Machines Market, suggesting a potential shift in consumer preferences towards greener packaging options. Moreover, the competitive landscape of the Sleeving Machines Market is evolving, with numerous players striving to innovate and differentiate their offerings. This environment fosters collaboration between manufacturers and technology providers, leading to the development of advanced features such as smart technology integration and enhanced user interfaces. The emphasis on customization and flexibility in machine design indicates a growing recognition of the diverse needs of end-users across different sectors. As the market continues to expand, it is likely that these trends will shape the future of sleeving technology, influencing both production capabilities and consumer choices.

Automation and Efficiency

The trend towards automation in the Sleeving Machines Market is becoming increasingly pronounced. Manufacturers are investing in automated systems to streamline operations, enhance productivity, and minimize labor costs. This shift is largely driven by the need for faster production cycles and greater precision in packaging.

Sustainability Initiatives

Sustainability is emerging as a critical focus within the Sleeving Machines Market. Companies are exploring eco-friendly materials and processes to meet the growing consumer demand for environmentally responsible packaging solutions. This trend indicates a potential shift in market dynamics as businesses adapt to changing consumer preferences.

Customization and Flexibility

The demand for customization in the Sleeving Machines Market is on the rise. Manufacturers are increasingly offering machines that can be tailored to meet specific requirements of various industries. This trend highlights the importance of flexibility in design and functionality to cater to diverse packaging needs.

Sleeving Machines Market Market Drivers

Focus on Brand Differentiation

In an increasingly competitive marketplace, brand differentiation has become a vital strategy for businesses, thereby driving the Sleeving Machines Market. Companies are recognizing the importance of unique packaging designs to capture consumer attention and convey brand identity. Sleeving machines facilitate the creation of eye-catching labels and packaging that stand out on retail shelves. This focus on aesthetics and branding is supported by Market Research Future indicating that consumers are more likely to purchase products with visually appealing packaging. As brands strive to differentiate themselves, the demand for innovative sleeving solutions is expected to rise, fostering growth within the industry.

Rising Demand for Packaging Solutions

The increasing demand for efficient packaging solutions is a primary driver of the Sleeving Machines Market. As consumer preferences shift towards convenience and sustainability, manufacturers are compelled to adopt advanced packaging technologies. The sleeving machines offer a versatile solution for various products, enhancing shelf appeal and providing essential information through labels. According to recent data, the packaging sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is likely to stimulate investments in sleeving technology, as companies seek to improve their packaging processes and meet evolving consumer expectations.

Growth of E-commerce and Retail Sectors

The rapid growth of e-commerce and retail sectors significantly influences the Sleeving Machines Market. As online shopping continues to gain traction, the demand for efficient packaging solutions that ensure product safety during transit is paramount. Sleeving machines provide an effective means of packaging various products, from beverages to cosmetics, catering to the diverse needs of e-commerce businesses. Recent statistics indicate that e-commerce sales are expected to reach over 6 trillion dollars by 2024, prompting retailers to invest in advanced packaging technologies. This trend is likely to drive the adoption of sleeving machines, as companies seek to enhance their packaging capabilities and improve customer satisfaction.

Technological Advancements in Machinery

Technological advancements play a crucial role in shaping the Sleeving Machines Market. Innovations in automation, robotics, and artificial intelligence are enhancing the efficiency and precision of sleeving machines. These advancements enable manufacturers to achieve higher production rates while minimizing waste and operational costs. For instance, the integration of smart technologies allows for real-time monitoring and adjustments, ensuring optimal performance. As a result, companies are increasingly investing in state-of-the-art sleeving machines to remain competitive. The market for such advanced machinery is expected to expand, with a projected growth rate of around 5% annually, reflecting the industry's shift towards modernization.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Sleeving Machines Market. As governments and organizations implement stricter regulations regarding packaging materials and labeling, manufacturers must adapt their processes to meet these requirements. Sleeving machines offer a reliable solution for ensuring compliance with safety standards, particularly in sectors such as food and pharmaceuticals. The need for transparent labeling and tamper-evident packaging is driving investments in sleeving technology. Market analysis suggests that adherence to these regulations could lead to a growth rate of approximately 3.5% in the sleeving machines sector, as companies prioritize compliance to avoid penalties and enhance consumer trust.

Market Segment Insights

Sleeving Machines Market Automation Insights

The Sleeving Machines Market segmentation, based on Automation, includes automatic, semi-automatic, and manual. Automatic segment dominated the global market in 2022. The firms in the packaging sector need automation and equipment to do the task quickly while keeping quality with a population of over 9 billion people.

Sleeving Machines Market Machine Type Insights

The Sleeving Machines Market segmentation, based on Machine Type, includes shrink sleeve labeling machine, stretch sleeve labeling machine, roll-fed <a href="https://www.marketresearchfuture.com/reports/labeling-equipment-market-8814">labeling machine</a>, tamper-evident banding machine, and heat tunnel machine. Shrink sleeve labeling machine segment dominated the Sleeving Machines Market in 2022. As full-body labelling is made possible by shrink sleeve labelling machines, maximum brand visibility and promotion are achieved. These labelers can also be used to apply labels to containers with complicated or irregular forms.

Sleeving Machines Market End Use Insights

The Sleeving Machines Market segmentation, based on End Use, includes food & beverages, pharmaceuticals, cosmetics & personal care, chemicals, automotive, and other industrial. Food & beverages segment dominated the global market in 2022. The production of beverage goods is being boosted by causes such an expanding population, rising disposable income, and a global trend toward the consumption of health beverages. This is expected to increase demand for labelling equipment.

Figure 1: Sleeving Machines Market, by End Use, 2024 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Sleeving Machines Market Research Report—Global Forecast till 2035

Regional Insights

North America : Market Leader in Innovation

North America is the largest market for sleeving machines, holding approximately 40% of the global market share. The region's growth is driven by increasing demand for automated packaging solutions, stringent regulations on packaging safety, and a strong focus on sustainability. The U.S. and Canada are the primary contributors, with a growing trend towards eco-friendly packaging solutions and advanced manufacturing technologies. The competitive landscape in North America is robust, featuring key players such as Krones AG, Cozzoli Machine Company, and Accutek Packaging Equipment. These companies are investing in R&D to enhance machine efficiency and reduce operational costs. The presence of established manufacturing facilities and a skilled workforce further bolster the market, making it a hub for innovation in packaging technology.

Europe : Regulatory-Driven Market Growth

Europe is the second-largest market for sleeving machines, accounting for approximately 30% of the global market share. The region's growth is significantly influenced by stringent regulations on packaging materials and sustainability initiatives. Countries like Germany and France are leading the market, driven by a strong emphasis on eco-friendly packaging solutions and advanced manufacturing processes that comply with EU regulations. The competitive landscape in Europe is characterized by the presence of major players such as Sidel Group and KHS GmbH. These companies are focusing on innovation and sustainability, aligning their products with regulatory standards. The European market is also witnessing collaborations between manufacturers and technology providers to enhance machine capabilities and efficiency, ensuring compliance with evolving regulations.

Asia-Pacific : Emerging Market with High Potential

Asia-Pacific is an emerging powerhouse in the sleeving machines market, holding approximately 25% of the global market share. The region's growth is fueled by rapid industrialization, increasing consumer demand for packaged goods, and a shift towards automation in manufacturing processes. Countries like China and India are at the forefront, benefiting from government initiatives aimed at enhancing manufacturing capabilities and export potential. The competitive landscape in Asia-Pacific is evolving, with local players like Karma Packaging gaining traction alongside established global brands. The region is witnessing significant investments in technology and infrastructure, aimed at improving production efficiency and meeting the growing demand for packaging solutions. This dynamic environment presents numerous opportunities for both local and international companies to expand their market presence.

Middle East and Africa : Resource-Rich Market Opportunities

The Middle East and Africa region is witnessing a gradual increase in the demand for sleeving machines, holding about 5% of the global market share. The growth is driven by rising consumer markets, particularly in the food and beverage sector, and increasing investments in manufacturing infrastructure. Countries like South Africa and the UAE are leading the charge, supported by government initiatives to diversify economies and enhance local manufacturing capabilities. The competitive landscape in this region is characterized by a mix of local and international players. Companies are focusing on adapting their products to meet regional needs, including compliance with local regulations and preferences. The market is also seeing a rise in partnerships and collaborations aimed at improving technology transfer and enhancing production efficiency, which are crucial for capturing the growing demand in this diverse market.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Sleeve Machines market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Sleeving Machines Industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Sleeving Machines Industry to benefit clients and increase the market sector. In recent years, the Sleeving Machines Industry has offered some of the most significant advantages to medicine. Major players in the sleeve packaging machines market, including Krones AG, Fujiseal International, Finpac Group, Pack Leader Machinery Inc., Sleever International, Tripack Group, Axon Corporation, USLUGA SHPK, Label-Aire Corporation, and Benison Group, are attempting to increase market demand by investing in research and development operations. A provider of varied packaging solutions is CCL Industries Inc (CCL). Bottles, extruded plastic tubes, and aluminium aerosol cans are among the company's product offerings. Along with providing package decorating solutions, it also offers converting pressure-sensitive and film materials for label applications. Bi-Oriented Polypropylene (BOPP) films with several layers and tailored surfaces are available from the company. The company's products are used in a variety of global markets, including the food and beverage, agrochemicals, automotive, electronics, and consumer durables sectors. North America, Latin America, Europe, Asia-Pacific, the Middle East, and Africa are just a few of the regions where the organisation conducts business. Toronto, Ontario, Canada serves as the headquarters of CCL. The purchase of Singapore-based Lux Global Label Asia Pte Ltd by CCL Industries Inc., a producer of specialty label, security, and packaging solutions for governmental organisations, multinational corporations, consumers, and small businesses, was announced in May 2021. Labelling and packaging supplies are provided by Avery Dennison Corp (Avery Dennison). It creates tags, labels, tickets, and other conversion goods in addition to pressure-sensitive materials. Additionally, Avery Dennison produces and markets fasteners, tickets, tags, RFID inlays and tags, imprinting tools, and related services. The business sells goods under the names of Avery Dennison, Yongle, Fasson, Monarch, Freshmarx, JAC, and Mactac, among other brands. Retail, construction, footwear and apparel, logistics, e-commerce, pharmaceuticals, food and grocery, the automotive industry, and the healthcare sector are just a few of the industries it supports. The business has operations in Asia Pacific, Europe, South America, and North America. The United States' Glendale, California, serves as the company's headquarters. Avery Dennison will start operating in its new manufacturing site in Greater Noida in April 2022. In order to better meet consumer needs, the company is attempting to combine its manufacturing activities while utilising the increased efficiencies and maximising the new technologies.

Key Companies in the Sleeving Machines Market include

Industry Developments

May 2022: The Avery Dennison Corporation made two significant investments to increase the manufacturing capacity in Europe and boost factory productivity.

May 2022: In order to meet the expanding demand for decorated aluminium cans in the beverage sector, Tripack LLC has announced the development of a manufacturing plant in Florida. In Lakeland, Florida, Tripack intends to establish a third production facility with more than 30,000 square feet and room for several packing lines.

June 2023: A leading consultant in the packaging industry, Ryback & Ryback Consulting, has introduced a new division, Ryback Machinery. With 25 years of experience in the packaging industry, President Scott Ryback, a third-generation veteran of the industry, is determined to sell the equipment he's been consulting on for several years. Ryback Machinery has inserted its unique line of shrink sleeve converting, slitting equipment, and application to its product offerings. Ryback Machinery stands out from usual OEM suppliers. Ryback said that they are concentrating on providing their customers with quality machinery at an affordable price without overselling unnecessary accessories.

Their consulting services match their equipment offerings, guaranteeing their clients' success in the market. With nearly 25 years of hands-on experience, the company caters as the premier consulting service to the shrink sleeve industry. Ryback Machinery is the only shrink sleeve OEM that offers consulting services to guarantee the customer's success in the market.

Services offered by Ryback Machinery kick off with a detailed pre-installation audit. This means the company will go to your facility to help recognize the right location for the customer's new converting equipment, ensuring ideal workflow and sufficient workspace for each piece of machinery.

The business also offers training for the sales team, targeting success in the shrink sleeve market. In addition, training incorporates measuring and determining correct sleeve sizes and pricing shrink sleeves to guarantee maximum profitability. Guidance will be offered to the pre-press department on how to layout artwork, and the quality control staff will be trained to offer high-quality products to customers. The vice president of operations at Ryback Machinery, Janice Ryback, said that their oath doesn't end with the deployment of your equipment. The business ensures that your staff is completely trained before the installation process concludes.

Future Outlook

Sleeving Machines Market Future Outlook

The Sleeving Machines Market is projected to grow at a 3.6% CAGR from 2025 to 2035, driven by automation, demand for sustainable packaging, and technological advancements.

New opportunities lie in:

- <p>Integration of IoT for real-time monitoring and maintenance solutions. Development of eco-friendly sleeve materials to meet sustainability demands. Expansion into emerging markets with tailored product offerings.</p>

By 2035, the Sleeving Machines Market is expected to achieve robust growth, driven by innovation and strategic market positioning.

Market Segmentation

Sleeving Machines Market End Use Outlook

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemicals

- Automotive

- Other Industrial

Sleeving Machines Market Automation Outlook

- Automatic

- Semi-automatic

- Manual

Sleeving Machines Market Machine Type Outlook

- Shrink Sleeve Labeling Machine

- Stretch Sleeve Labeling Machine

- Roll-fed Labeling Machine

- Tamper-evident Banding Machine

- Heat Tunnel Machine

Report Scope

| MARKET SIZE 2024 | 3.447(USD Billion) |

| MARKET SIZE 2025 | 3.571(USD Billion) |

| MARKET SIZE 2035 | 5.088(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 3.6% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Krones AG (DE), Sidel Group (FR), KHS GmbH (DE), Cozzoli Machine Company (US), Accutek Packaging Equipment Companies, Inc. (US), Pack Leader USA (US), Aesus Packaging Systems (CA), Karma Packaging (IN), KHS USA (US) |

| Segments Covered | Automation, Machine Type, End Use, Region |

| Key Market Opportunities | Integration of automation and smart technology enhances efficiency in the Sleeving Machines Market. |

| Key Market Dynamics | Technological advancements and rising demand for automation drive growth in the sleeving machines market. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

FAQs

What is the projected market valuation of the Sleeving Machines Market by 2035?

The projected market valuation of the Sleeving Machines Market is expected to reach 5.088 USD Billion by 2035.

What was the market valuation of the Sleeving Machines Market in 2024?

The market valuation of the Sleeving Machines Market was 3.447 USD Billion in 2024.

What is the expected CAGR for the Sleeving Machines Market during the forecast period 2025 - 2035?

The expected CAGR for the Sleeving Machines Market during the forecast period 2025 - 2035 is 3.6%.

Which companies are considered key players in the Sleeving Machines Market?

Key players in the Sleeving Machines Market include Krones AG, Sidel Group, KHS GmbH, and Accutek Packaging Equipment Companies, Inc.

What are the main segments of the Sleeving Machines Market?

The main segments of the Sleeving Machines Market include Automation, Machine Type, and End Use.

How did the Automatic segment perform in terms of valuation in 2024?

In 2024, the Automatic segment of the Sleeving Machines Market was valued at 1.5 USD Billion.

-

SECTION I: EXECUTIVE SUMMARY AND KEY HIGHLIGHTS

-

EXECUTIVE SUMMARY

- Market Overview

- Key Findings

- Market Segmentation

- Competitive Landscape

- Challenges and Opportunities

- Future Outlook 2

-

EXECUTIVE SUMMARY

-

SECTION II: SCOPING, METHODOLOGY AND MARKET STRUCTURE

-

MARKET INTRODUCTION

- Definition

- Scope of the study

-

RESEARCH METHODOLOGY

- Overview

- Data Mining

- Secondary Research

- Primary Research

- Forecasting Model

- Market Size Estimation

- Data Triangulation

- Validation 3

-

MARKET INTRODUCTION

-

SECTION III: QUALITATIVE ANALYSIS

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

- Value chain Analysis

- Porter's Five Forces Analysis

- COVID-19 Impact Analysis

-

MARKET DYNAMICS

-

SECTION IV: QUANTITATIVE ANALYSIS

-

Sleeving Machines Market, BY Automation (USD Billion)

- Automatic

- Semi-automatic

- Manual

-

Sleeving Machines Market, BY Machine Type (USD Billion)

- Shrink Sleeve Labeling Machine

- Stretch Sleeve Labeling Machine

- Roll-fed Labeling Machine

- Tamper-evident Banding Machine

- Heat Tunnel Machine

-

Sleeving Machines Market, BY End Use (USD Billion)

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Chemicals

- Automotive

- Other Industrial

-

Sleeving Machines Market, BY Region (USD Billion)

- North America

- Europe

- APAC

- South America

- MEA

-

Sleeving Machines Market, BY Automation (USD Billion)

-

SECTION V: COMPETITIVE ANALYSIS

-

Competitive Landscape

- Overview

- Competitive Analysis

- Market share Analysis

- Major Growth Strategy in the Healthcare

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Healthcare

- Key developments and growth strategies

- Major Players Financial Matrix

-

Company Profiles

- Krones AG (DE)

- Sidel Group (FR)

- KHS GmbH (DE)

- Cozzoli Machine Company (US)

- Accutek Packaging Equipment Companies, Inc. (US)

- Pack Leader USA (US)

- Aesus Packaging Systems (CA)

- Karma Packaging (IN)

- KHS USA (US)

-

Appendix

- References

- Related Reports 6 LIST OF FIGURES

- MARKET SYNOPSIS

- NORTH AMERICA MARKET ANALYSIS

- US MARKET ANALYSIS BY AUTOMATION

- US MARKET ANALYSIS BY MACHINE TYPE

- US MARKET ANALYSIS BY END USE

- CANADA MARKET ANALYSIS BY AUTOMATION

- CANADA MARKET ANALYSIS BY MACHINE TYPE

- CANADA MARKET ANALYSIS BY END USE

- EUROPE MARKET ANALYSIS

- GERMANY MARKET ANALYSIS BY AUTOMATION

- GERMANY MARKET ANALYSIS BY MACHINE TYPE

- GERMANY MARKET ANALYSIS BY END USE

- UK MARKET ANALYSIS BY AUTOMATION

- UK MARKET ANALYSIS BY MACHINE TYPE

- UK MARKET ANALYSIS BY END USE

- FRANCE MARKET ANALYSIS BY AUTOMATION

- FRANCE MARKET ANALYSIS BY MACHINE TYPE

- FRANCE MARKET ANALYSIS BY END USE

- RUSSIA MARKET ANALYSIS BY AUTOMATION

- RUSSIA MARKET ANALYSIS BY MACHINE TYPE

- RUSSIA MARKET ANALYSIS BY END USE

- ITALY MARKET ANALYSIS BY AUTOMATION

- ITALY MARKET ANALYSIS BY MACHINE TYPE

- ITALY MARKET ANALYSIS BY END USE

- SPAIN MARKET ANALYSIS BY AUTOMATION

- SPAIN MARKET ANALYSIS BY MACHINE TYPE

- SPAIN MARKET ANALYSIS BY END USE

- REST OF EUROPE MARKET ANALYSIS BY AUTOMATION

- REST OF EUROPE MARKET ANALYSIS BY MACHINE TYPE

- REST OF EUROPE MARKET ANALYSIS BY END USE

- APAC MARKET ANALYSIS

- CHINA MARKET ANALYSIS BY AUTOMATION

- CHINA MARKET ANALYSIS BY MACHINE TYPE

- CHINA MARKET ANALYSIS BY END USE

- INDIA MARKET ANALYSIS BY AUTOMATION

- INDIA MARKET ANALYSIS BY MACHINE TYPE

- INDIA MARKET ANALYSIS BY END USE

- JAPAN MARKET ANALYSIS BY AUTOMATION

- JAPAN MARKET ANALYSIS BY MACHINE TYPE

- JAPAN MARKET ANALYSIS BY END USE

- SOUTH KOREA MARKET ANALYSIS BY AUTOMATION

- SOUTH KOREA MARKET ANALYSIS BY MACHINE TYPE

- SOUTH KOREA MARKET ANALYSIS BY END USE

- MALAYSIA MARKET ANALYSIS BY AUTOMATION

- MALAYSIA MARKET ANALYSIS BY MACHINE TYPE

- MALAYSIA MARKET ANALYSIS BY END USE

- THAILAND MARKET ANALYSIS BY AUTOMATION

- THAILAND MARKET ANALYSIS BY MACHINE TYPE

- THAILAND MARKET ANALYSIS BY END USE

- INDONESIA MARKET ANALYSIS BY AUTOMATION

- INDONESIA MARKET ANALYSIS BY MACHINE TYPE

- INDONESIA MARKET ANALYSIS BY END USE

- REST OF APAC MARKET ANALYSIS BY AUTOMATION

- REST OF APAC MARKET ANALYSIS BY MACHINE TYPE

- REST OF APAC MARKET ANALYSIS BY END USE

- SOUTH AMERICA MARKET ANALYSIS

- BRAZIL MARKET ANALYSIS BY AUTOMATION

- BRAZIL MARKET ANALYSIS BY MACHINE TYPE

- BRAZIL MARKET ANALYSIS BY END USE

- MEXICO MARKET ANALYSIS BY AUTOMATION

- MEXICO MARKET ANALYSIS BY MACHINE TYPE

- MEXICO MARKET ANALYSIS BY END USE

- ARGENTINA MARKET ANALYSIS BY AUTOMATION

- ARGENTINA MARKET ANALYSIS BY MACHINE TYPE

- ARGENTINA MARKET ANALYSIS BY END USE

- REST OF SOUTH AMERICA MARKET ANALYSIS BY AUTOMATION

- REST OF SOUTH AMERICA MARKET ANALYSIS BY MACHINE TYPE

- REST OF SOUTH AMERICA MARKET ANALYSIS BY END USE

- MEA MARKET ANALYSIS

- GCC COUNTRIES MARKET ANALYSIS BY AUTOMATION

- GCC COUNTRIES MARKET ANALYSIS BY MACHINE TYPE

- GCC COUNTRIES MARKET ANALYSIS BY END USE

- SOUTH AFRICA MARKET ANALYSIS BY AUTOMATION

- SOUTH AFRICA MARKET ANALYSIS BY MACHINE TYPE

- SOUTH AFRICA MARKET ANALYSIS BY END USE

- REST OF MEA MARKET ANALYSIS BY AUTOMATION

- REST OF MEA MARKET ANALYSIS BY MACHINE TYPE

- REST OF MEA MARKET ANALYSIS BY END USE

- KEY BUYING CRITERIA OF HEALTHCARE

- RESEARCH PROCESS OF MRFR

- DRO ANALYSIS OF HEALTHCARE

- DRIVERS IMPACT ANALYSIS: HEALTHCARE

- RESTRAINTS IMPACT ANALYSIS: HEALTHCARE

- SUPPLY / VALUE CHAIN: HEALTHCARE

- Sleeving Machines Market, BY AUTOMATION, 2024 (% SHARE)

- Sleeving Machines Market, BY AUTOMATION, 2024 TO 2035 (USD Billion)

- Sleeving Machines Market, BY MACHINE TYPE, 2024 (% SHARE)

- Sleeving Machines Market, BY MACHINE TYPE, 2024 TO 2035 (USD Billion)

- Sleeving Machines Market, BY END USE, 2024 (% SHARE)

- Sleeving Machines Market, BY END USE, 2024 TO 2035 (USD Billion)

- BENCHMARKING OF MAJOR COMPETITORS 7 LIST OF TABLES

- LIST OF ASSUMPTIONS

-

North America MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

US MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Canada MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Europe MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Germany MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

UK MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

France MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Russia MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Italy MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Spain MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Rest of Europe MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

APAC MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

China MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

India MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Japan MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

South Korea MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Malaysia MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Thailand MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Indonesia MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Rest of APAC MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

South America MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Brazil MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Mexico MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Argentina MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Rest of South America MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

MEA MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

GCC Countries MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

South Africa MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

-

Rest of MEA MARKET SIZE ESTIMATES; FORECAST

- BY AUTOMATION, 2025-2035 (USD Billion)

- BY MACHINE TYPE, 2025-2035 (USD Billion)

- BY END USE, 2025-2035 (USD Billion)

- PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

- ACQUISITION/PARTNERSHIP

-

Competitive Landscape

Sleeving Machines Market Segmentation

Sleeving Machines Automation Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Machine Outlook (USD Billion, 2024-2032)

Shrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines End Use Outlook (USD Billion, 2024-2032)

Food & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Sleeving Machines Regional Outlook (USD Billion, 2024-2032)

North America Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

US Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Canada Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Europe Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Germany Outlook (USD Billion, 2024-2032)

Sleeving Machines Market by AutomationAutomatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

France Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

UK Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Italy Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Spain Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Rest Of Europe Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Asia-Pacific Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

China Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Japan Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

India Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Australia Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Rest of Asia-Pacific Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Rest of the World Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Middle East Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Africa Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Latin America Outlook (USD Billion, 2024-2032)

Automatic

Semi-automatic

Manual

Sleeving Machines Market by MachineShrink Sleeve Labeling Machine

Stretch Sleeve Labeling Machine

Roll-fed Labeling Machine

Tamper-evident Banding Machine

Heat Tunnel Machine

Sleeving Machines Market by End UseFood & Beverages

Pharmaceuticals

Cosmetics & Personal Care

Chemicals

Automotive

Other Industrial

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment