Shredder Blades Size

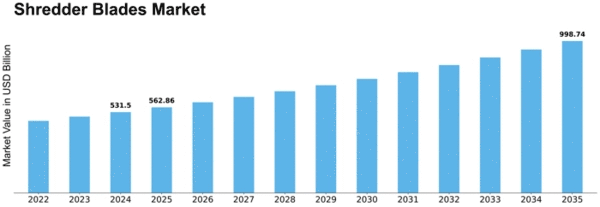

Shredder Blades Market Growth Projections and Opportunities

The market for shredder blades markets is driven by a number of factors that influence its dynamics within the industry and waste recycling sectors. One of the most significant factors is consumer demand for efficient shredding solutions in waste management and recycling procedures. Shredder blades are widely used in different industrial activities such as plastic, wood, metal and paper recycling processes or for the purpose of size reduction needs. The market is also increasingly connected to the rising demand for efficient material processing, minimizing waste and recycling various materials. The shredder blade design innovation and manufacturing impact the market growth. The developments in blade materials, advanced geometries and heat treatment processes also play their part in the progression of technologies for use with shredders. As such, the dynamics of these aspects are influenced by efforts made in the industry to improve blade longevity, sharpness and thus overall performance resulting from shredding operations within various applications. Environmental regulation and sustainability factors are important in the market drivers of shredder blades. The complex interconnections are shaped due to the requirements for compliance with environmental standards, waste minimization goals and promote circular economy principles. With the increased priority of governments and industries to circular economy-friendly practices related to waste management, there is an increasing demand for superior shredder blades that enable respectively efficient recycling and material recovery. The market forces are also affected due to increasing focus on the circular economy and recycling of different elements. The shape of these dynamics is determined by the strategic investment into bladed shredding machinery made from industries and their waste management facilities to facilitate the recycling of plastics, metals wood etc. The Shredder blades are a key element in the material size reduction, making downstream processing feasible but more importantly promoting advanced recycling. Prices and accessibility of raw materials play a role in the market dynamics regarding shredder blades. Materials utilized in blade manufacturing, such as high-strength steels and alloys, have a major role to play that are both costly. Changes in the raw material prices can influence a shredder blade manufacturer’s total production costs and pricing strategy; thus, impacts their product competitive position on the market. Materials being shredded and the unique industrial applications play a significant role in defining the market dynamics of shredder blades. Each material is specific to blade designs and configurations that are meant to provide optimum performance as well as longevity. Currently, the system of dynamics is formed due to such a broad scope of different applications – from plastic shredding that can be recycled to wood processing and forestry industry.

Leave a Comment