Senior Friendly Packaging Size

Senior Friendly Packaging Market Growth Projections and Opportunities

The Senior Friendly Packaging Market is significantly influenced by several market factors that cater to the unique needs and preferences of the elderly population. One of the key drivers is the global demographic shift toward an aging population. As the proportion of seniors in the population continues to rise, there is a growing demand for packaging solutions that address the specific challenges faced by older individuals. Seniors often encounter difficulties such as reduced dexterity, limited vision, and arthritis, making it crucial for packaging to be user-friendly and accessible.

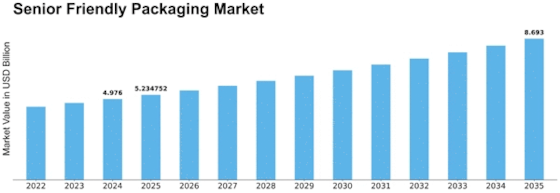

The global Senior Friendly Packaging market is accounted to register a CAGR of 5.20% during the forecast period and is estimated to reach USD 7.10 billion by 2032.

Another influential market factor is the increasing awareness and emphasis on health and wellness among seniors. With a greater focus on leading healthy and independent lives, seniors are seeking packaging that ensures the safety and preservation of their medications, supplements, and nutritional products. Senior-friendly packaging plays a pivotal role in supporting the health-related needs of this demographic by offering features like easy-open lids, large and legible fonts, and blister packs that help in medication adherence.

In addition to demographic shifts and health consciousness, regulatory considerations contribute significantly to the dynamics of the Senior Friendly Packaging Market. Governments and regulatory bodies are increasingly recognizing the importance of packaging that meets the needs of the aging population. Regulatory guidelines and standards are being developed to ensure that packaging is not only safe and secure but also designed with the specific requirements of seniors in mind. Compliance with these regulations is a critical factor for companies operating in the senior-friendly packaging space.

Furthermore, technological advancements play a pivotal role in shaping the market landscape. Innovations in packaging materials and design are allowing manufacturers to create solutions that enhance the usability and accessibility of packaging for seniors. Features such as easy-grip handles, tear-off openings, and audible cues are being integrated into packaging designs to make them more senior-friendly. The adoption of smart packaging technologies, such as QR codes for easy information retrieval, adds another layer of sophistication to cater to the tech-savvy senior demographic.

Cost considerations also play a role in the Senior Friendly Packaging Market. While seniors are willing to invest in products that enhance their quality of life, cost-effective solutions remain a priority. Packaging manufacturers need to strike a balance between incorporating senior-friendly features and maintaining affordability. This balance is crucial for widespread adoption and market penetration, ensuring that senior-friendly packaging is accessible to a broad spectrum of the aging population.

Lastly, consumer preferences and feedback are shaping the market dynamics of senior-friendly packaging. As seniors become more vocal about their needs and preferences, manufacturers are actively seeking input to improve and refine their packaging solutions. This feedback loop not only helps in the continuous improvement of existing products but also drives innovation by identifying new features and designs that resonate with the senior consumer base.

Leave a Comment