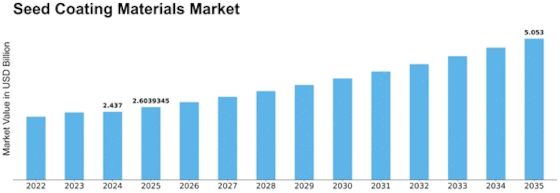

Seed Coating Materials Size

Seed Coating Materials Market Growth Projections and Opportunities

The seed coating materials market is dependent upon the impact of various elements that assume a joined part in forming its development, elements, and cutthroat climate. A fundamental determinant is the heightening overall people, which thusly prompts a flood in the requirement for food. As the worldwide populace keeps on growing, it turns out to be progressively essential to work on rural efficiency. Seed covering materials are of central significance in this specific setting as they upgrade the viability of seeds, give sickness security, and work with even germination. The interest in these materials is propelled by the general target of expanding horticultural efficiency to fulfill the necessities of a growing worldwide populace.

Agribusiness related innovative improvements altogether influence the market elements of the seed coating materials market. The market elements are affected by continuous progressions in seed covering advancements, which envelop the joining of nanotechnology, biologicals, and wise coatings. There is a developing pattern among ranchers to embrace complex seed coatings that give improved execution, accuracy, and proficiency. The advancement of seed covering materials relates to the rural business' overall propensity to use innovation to streamline activities, support yields, and assurance practical cultivating techniques.

Supportability in the climate is a critical determinant of the seed coating materials market. A rising acknowledgment of natural worries has prompted a more prominent spotlight on the execution of feasible and ecologically cognizant farming techniques. There is a critical interest for seed covering materials that assist to diminish the natural effect, dispense with the need for unnecessary substance medicines, and promoter for mindful cultivating. Producers are encountering mounting requests to make definitions that are as per manageability targets, which reflects the more extensive development towards horticulture that is all the more naturally mindful.

Administrative elements impact the seed coating materials market. Guidelines relating to the use of seed covering materials administer the utilization of agrochemicals and their ecological and wellbeing results. Makers should comply with these guidelines to acquaint their items with the market effectively. Market elements can be altogether affected by changes in administrative norms, which might include constraints on specific compound substances or the underwriting of eco-accommodating definitions. These alterations can affect the availability and acknowledgment of specific seed coating materials.

Extensive market impact is applied by the globalization of the horticulture area on seed coating materials. The rising trade of horticultural practices and innovations between countries has produced a requirement for seed coating materials arrangements that are normalized and perceived universally. While creating seed coating materials, makers should consider different provincial particulars, alter definitions to oblige unmistakable harvests and climatic circumstances, and move through the complexities of global exchange. For market achievement, the ability to give versatile seed covering materials that fulfill the requests of overall customers is basic.

Leave a Comment