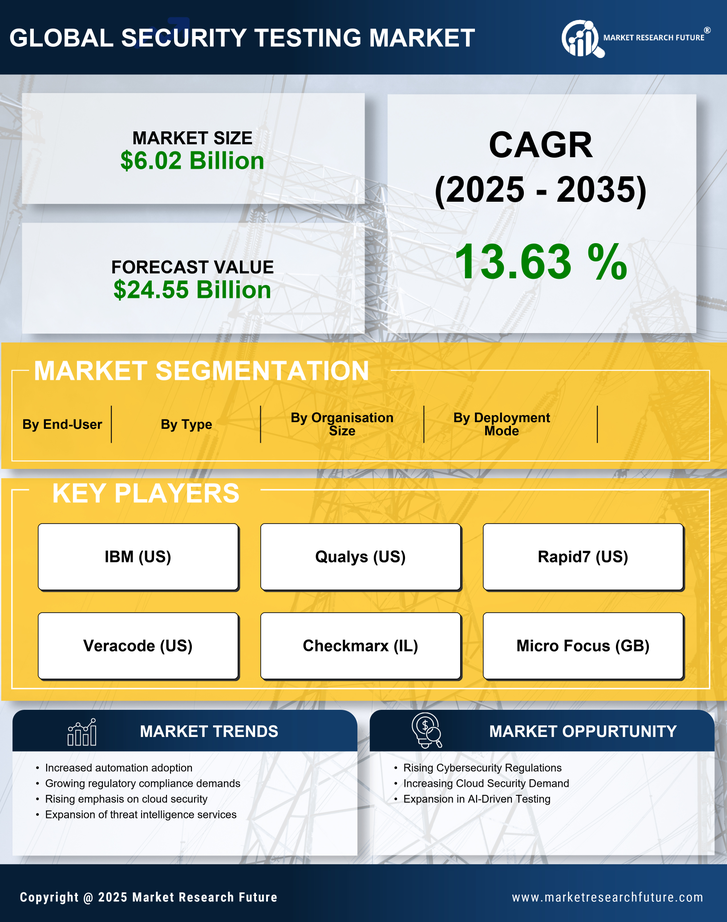

The Security Testing Market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for robust cybersecurity solutions across various sectors. Key players are actively engaging in strategies that emphasize innovation, partnerships, and regional expansion to enhance their market presence. Leading vendors are differentiating through advanced security solutions technology, integrating AI-driven analytics, automation, and cloud-native architectures. Notably, IBM (US) has positioned itself as a leader in the market by focusing on AI-driven security solutions, which are increasingly vital in addressing sophisticated cyber threats. Similarly, Qualys (US) has adopted a cloud-centric approach, enabling organizations to streamline their security testing processes while ensuring compliance with evolving regulations. These strategic orientations collectively contribute to a competitive environment that is both fragmented and rapidly evolving, as companies strive to differentiate themselves through technological advancements and customer-centric solutions. In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to respond swiftly to market demands. The Security Testing Market appears moderately fragmented, with several players vying for market share. This fragmentation is indicative of a landscape where innovation and agility are paramount, as companies leverage their unique strengths to capture diverse customer segments. The collective influence of key players, such as Rapid7 (US) and Veracode (US), further shapes the market structure, as they engage in strategic partnerships and acquisitions to bolster their service offerings and expand their geographical reach.

In August Rapid7 (US) announced a strategic partnership with a leading cloud service provider to enhance its security testing capabilities. This collaboration is expected to integrate advanced analytics and machine learning into Rapid7's existing platform, thereby improving threat detection and response times. The strategic importance of this partnership lies in its potential to provide customers with a more comprehensive security solution, addressing the growing complexity of cyber threats in cloud environments.

In September Veracode (US) launched a new suite of automated security testing tools designed to streamline the application development lifecycle. This initiative reflects a growing trend towards integrating security into DevOps processes, allowing organizations to identify vulnerabilities earlier in the development phase. The significance of this launch is underscored by the increasing emphasis on agile methodologies, where speed and security must coexist to meet market demands.

In July Checkmarx (IL) expanded its global footprint by entering into a strategic alliance with a prominent European cybersecurity firm. This move is indicative of Checkmarx's commitment to enhancing its service delivery capabilities in the European market, where regulatory pressures are intensifying. The strategic importance of this alliance lies in its potential to leverage local expertise and resources, thereby positioning Checkmarx as a formidable player in the region.

As of October the competitive trends in the Security Testing Market are increasingly defined by digitalization, AI integration, and a focus on sustainability. Strategic alliances are playing a crucial role in shaping the current landscape, as companies seek to combine their strengths to deliver comprehensive solutions. Looking ahead, it is likely that competitive differentiation will evolve, with a pronounced shift from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This evolution suggests that companies that prioritize these aspects will be better positioned to thrive in an increasingly complex and competitive environment.