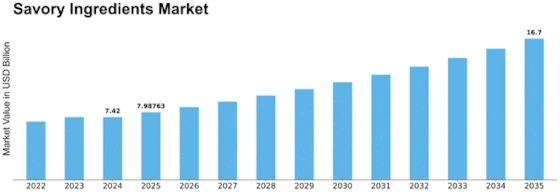

Savory Ingredients Size

Savory Ingredients Market Growth Projections and Opportunities

The Savory Ingredients Market is influenced by a myriad of factors that collectively contribute to its growth and evolution. One significant driver of this market is the changing consumer preferences and the increasing demand for unique and bold flavors in food products. As consumers seek diverse culinary experiences, the demand for savory ingredients like herbs, spices, and flavor enhancers has risen. The market responds to this trend by offering a wide range of savory components that add depth and richness to various dishes, meeting the evolving taste preferences of consumers.

Economic factors play a crucial role in shaping the Savory Ingredients Market. The market is sensitive to economic conditions that influence consumer spending on food products. During economic downturns, consumers may prioritize cost-effective and staple ingredients, impacting the demand for premium or specialty savory ingredients. Conversely, in periods of economic growth, there may be an increased willingness to spend on gourmet and exotic flavors, driving the market for unique and high-quality savory ingredients.

Changing dietary patterns and lifestyles contribute significantly to the market dynamics of savory ingredients. As consumers become more health-conscious, there is a growing interest in flavorful yet nutritious food options. Savory ingredients, including herbs and spices, offer a way to enhance the taste of dishes without relying on excessive salt or unhealthy additives. The market is witnessing a shift towards healthier flavoring alternatives as consumers seek to strike a balance between taste and nutritional value.

Globalization is a key factor influencing the supply chain of the Savory Ingredients Market. The market is interconnected globally, with the production and distribution of savory ingredients sourced from various regions around the world. Changes in international trade policies, currency exchange rates, and geopolitical events can impact the availability and pricing of savory ingredients. Companies in this market need to navigate these global factors to ensure a stable supply chain and remain competitive on an international scale.

Government regulations and standards are pivotal market factors for savory ingredients. Regulations regarding food safety, labeling, and quality standards directly impact the production and sale of savory components. Compliance with these regulations is essential for ensuring consumer safety and building trust in the market. Additionally, adherence to international standards for food exports is crucial for companies aiming to participate in global markets.

Technological advancements contribute to the innovation and competitiveness of the Savory Ingredients Market. Continuous research and development efforts lead to the discovery of new flavor compounds, extraction methods, and processing techniques. Advanced technologies help maintain the freshness and quality of savory ingredients, meeting consumer expectations for authentic and flavorful food experiences. Innovation in savory ingredient formulations also allows manufacturers to create unique blends and profiles that cater to specific culinary trends.

Environmental sustainability is an increasingly important consideration in the Savory Ingredients Market. Consumers are placing greater emphasis on sustainable and responsibly sourced ingredients. Companies adopting eco-friendly practices, such as sustainable farming methods and ethical sourcing, are gaining favor among environmentally conscious consumers. The market is witnessing a growing demand for savory ingredients that align with principles of environmental stewardship.

Leave a Comment