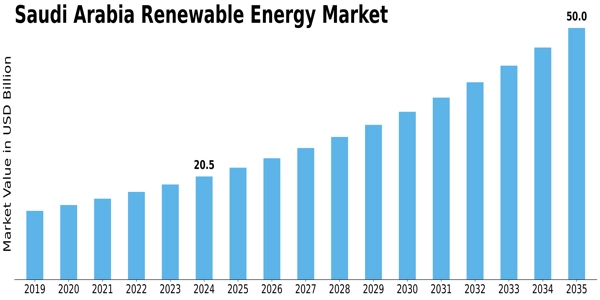

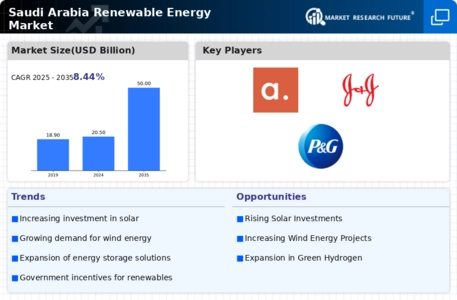

Saudi Arabia Renewable Energy Size

Saudi Arabia Renewable Energy Market Growth Projections and Opportunities

The Saudi Arabia Renewable Energy Market is experiencing a significant transformation driven by various market factors that are shaping its growth and development. One of the key drivers is the country's commitment to diversifying its energy mix and reducing its dependency on traditional fossil fuels. As part of its Vision 2030 initiative, Saudi Arabia aims to increase the share of renewable energy in its total energy consumption, aligning with global efforts to combat climate change.

Government policies and regulations play a pivotal role in shaping the renewable energy market in Saudi Arabia. The government has introduced ambitious targets to increase the share of renewable energy in the total energy mix. The Renewable Energy Project Development Office (REPDO) was established to oversee the implementation of these projects and ensure the success of the renewable energy sector. Supportive policies, such as power purchase agreements (PPAs) and attractive incentives for investors, contribute to the overall positive investment climate in the market.

Technological advancements are another crucial factor driving the growth of the renewable energy market in Saudi Arabia. The country has been actively investing in research and development to adopt the latest and most efficient renewable energy technologies. Solar energy, in particular, has gained significant traction, with large-scale solar projects contributing substantially to the overall renewable energy capacity. The advancement of storage technologies also enhances the reliability and stability of renewable energy sources, addressing one of the primary challenges in the sector.

The increasing awareness of environmental sustainability and the global shift towards clean energy sources are influencing consumer behavior and corporate decision-making. Both domestic and international stakeholders are expressing growing interest in sustainable practices, leading to a surge in demand for renewable energy in Saudi Arabia. This heightened awareness is encouraging businesses to adopt renewable energy solutions, contributing to the overall market growth.

Collaborations and partnerships with international entities are playing a vital role in advancing the renewable energy market in Saudi Arabia. The country has engaged in strategic alliances with global renewable energy leaders to leverage their expertise and accelerate the deployment of sustainable energy solutions. These collaborations not only bring in valuable knowledge but also attract foreign investments, fostering a more dynamic and competitive market environment.

Infrastructure development is a critical market factor that significantly influences the growth and sustainability of the renewable energy sector in Saudi Arabia. The government has been investing in building the necessary infrastructure, such as transmission and distribution networks, to facilitate the integration of renewable energy into the existing grid. This ensures a smooth transition and efficient utilization of the generated renewable energy, addressing one of the key challenges in the sector.

Economic factors, such as the decreasing cost of renewable energy technologies, are contributing to the competitiveness of the market. The declining costs of solar and wind power make renewable energy more economically viable, attracting both public and private investments. As the market becomes more cost-competitive, it further accelerates the adoption of renewable energy solutions in Saudi Arabia.

The Saudi Arabia Renewable Energy Market is experiencing a transformative journey, driven by a combination of government initiatives, technological advancements, consumer awareness, international collaborations, infrastructure development, and economic factors. The convergence of these market factors creates a favorable environment for the growth and sustainability of the renewable energy sector, aligning with the country's Vision 2030 goals and contributing to global efforts in combating climate change.

Leave a Comment