Emergence of New Space Economies

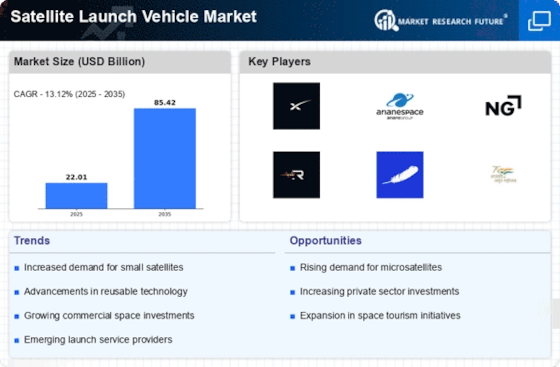

The emergence of new space economies is reshaping the Satellite Launch Vehicle Market. As more countries and private companies enter the space sector, the demand for launch services is diversifying. This trend is particularly evident in regions that have historically been less active in space exploration. The rise of small satellite constellations for applications such as Earth observation and Internet of Things (IoT) connectivity is driving the need for tailored launch solutions. Consequently, the Satellite Launch Vehicle Market is adapting to meet these new demands, with a focus on providing flexible and cost-effective launch options that cater to a broader range of customers, including startups and research institutions.

Growing Interest in Space Tourism

The Satellite Launch Vehicle Market is witnessing a burgeoning interest in space tourism, which could redefine the landscape of commercial spaceflight. As private companies develop suborbital and orbital tourism experiences, the demand for reliable launch vehicles is expected to increase. This sector is attracting significant investment, with projections suggesting that space tourism could become a multi-billion dollar industry in the coming years. The implications for the Satellite Launch Vehicle Market are profound, as it may lead to the development of specialized launch systems designed specifically for tourism purposes. This evolving market segment presents both challenges and opportunities, compelling stakeholders to innovate and adapt to the changing dynamics of space travel.

Government Investments in Space Programs

Government initiatives and investments in space exploration are significantly influencing the Satellite Launch Vehicle Market. Many nations are ramping up their space programs, recognizing the strategic importance of satellite technology for national security, scientific research, and economic development. For instance, countries are allocating substantial budgets to develop indigenous launch capabilities, which is expected to stimulate the market. The increasing number of public-private partnerships is also noteworthy, as governments collaborate with private entities to enhance launch services. This trend not only boosts the Satellite Launch Vehicle Market but also fosters innovation and competition, ultimately benefiting end-users through improved services and reduced costs.

Advancements in Launch Vehicle Technology

Technological innovations are playing a crucial role in shaping the Satellite Launch Vehicle Market. The development of reusable launch systems, for instance, has the potential to drastically reduce launch costs and increase the frequency of satellite deployments. Companies are investing heavily in research and development to enhance the performance and reliability of launch vehicles. Recent advancements have led to the introduction of hybrid propulsion systems and improved payload capacities, which are likely to attract more customers to the market. As these technologies mature, they may enable the Satellite Launch Vehicle Market to support a wider array of missions, from small satellite launches to interplanetary exploration, thereby expanding the overall market landscape.

Increasing Demand for Communication Satellites

The Satellite Launch Vehicle Market is experiencing a surge in demand for communication satellites, driven by the growing need for enhanced connectivity and data transmission capabilities. As the world becomes increasingly interconnected, the requirement for reliable communication infrastructure is paramount. According to recent data, the number of communication satellites launched annually has risen significantly, with projections indicating that this trend will continue. This demand is further fueled by advancements in technology, enabling the deployment of more sophisticated satellites that can cater to diverse applications, including broadband internet and mobile communications. Consequently, the Satellite Launch Vehicle Market is poised for growth as companies seek to capitalize on this expanding market, necessitating the development of more efficient and cost-effective launch vehicles.