Rising Energy Demand

The increasing energy demand in Russia is a critical driver for the hydropower market. With a projected annual growth rate of 2.5% in energy consumption, the need for sustainable and reliable energy sources has never been more pressing. Hydropower, being one of the most efficient renewable energy sources, is well-positioned to meet this demand. The government aims to increase the share of renewable energy in the national energy mix to 30% by 2035, with hydropower playing a pivotal role. This rising demand for energy is likely to propel investments and innovations within the hydropower market, ensuring its relevance in the future energy landscape.

Regulatory Support for Renewable Energy

Regulatory frameworks in Russia are increasingly favoring renewable energy sources, including hydropower. The government has implemented policies that provide incentives for the development of renewable energy projects, such as tax breaks and feed-in tariffs. These measures are designed to attract private investment into the hydropower market, facilitating the construction of new plants and the expansion of existing ones. As a result, the regulatory environment is becoming more conducive to growth, potentially leading to a 25% increase in hydropower capacity by 2030. This supportive regulatory landscape is crucial for the long-term sustainability of the hydropower market.

Environmental Sustainability Initiatives

Environmental sustainability is becoming a focal point for the hydropower market in Russia. The government is actively promoting initiatives aimed at minimizing the ecological impact of hydropower projects. This includes implementing stricter environmental assessments and encouraging the use of eco-friendly technologies. As public awareness of environmental issues grows, there is increasing pressure on energy producers to adopt sustainable practices. The hydropower market is likely to benefit from this shift, as projects that prioritize sustainability may receive preferential treatment in terms of funding and regulatory approvals. This trend indicates a potential for growth in the hydropower sector, aligning economic development with environmental stewardship.

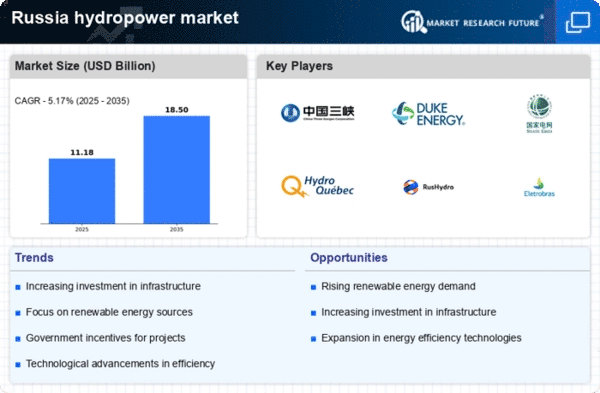

Investment in Infrastructure Development

The hydropower market in Russia is experiencing a surge in investment aimed at enhancing infrastructure. The government has allocated approximately $10 billion for the modernization of existing facilities and the construction of new plants. This investment is expected to increase the total installed capacity by 15% by 2030. Enhanced infrastructure not only improves efficiency but also reduces operational costs, making hydropower a more attractive option for energy generation. Furthermore, the focus on infrastructure development is likely to create job opportunities, thereby stimulating local economies. As a result, the hydropower market is poised for growth, driven by these substantial investments.

Technological Innovations in Energy Generation

Technological advancements are reshaping the hydropower market in Russia. Innovations such as improved turbine designs and digital monitoring systems are enhancing efficiency and reducing maintenance costs. For instance, the introduction of variable speed turbines has shown to increase energy output by up to 20%. These advancements not only optimize performance but also contribute to the sustainability of hydropower projects. As technology continues to evolve, the hydropower market is likely to benefit from increased operational efficiency and reduced environmental impact, making it a more viable option for energy generation in the long term.