Market Share

Robotic Process Automation Market Share Analysis

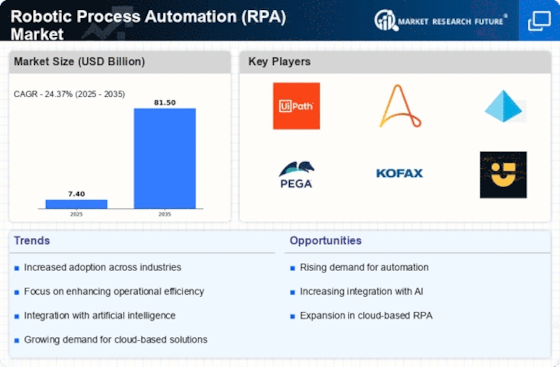

The Robotic Process Automation (RPA) market share is rising due to the competitive edge of companies to establish their market standing by implementing strategies such as innovation and product differentiation. Companies strive to distinguish their RPA solutions by introducing advanced features, user-friendly interfaces, and integration capabilities. RPA providers are observed to seek partnerships with other technology companies, system integrators, and other industry-specific experts. These partnerships enable the development of comprehensive solutions that combine RPA with corresponding technologies, expanding the overall value proposition. By doing so, these collaborative efforts lead companies to tap into new markets, improve their services, and strengthen their position within the competitive scenario. Moreover, established companies may acquire innovative startups or niche players to widen their portfolio and gain access to cutting-edge technologies. These strategic moves strengthen their market position, enhance their competitive advantage, and rise to a better market share. Companies may also adopt competitive pricing structures to attract a larger customer base. Flexible and transparent pricing strategies, coupled with clear value propositions, enhance the appeal of RPA solutions, making them more accessible to businesses of varying sizes and industries. Moreover, companies that prioritize customer satisfaction, provide excellent support, and offer modifiable solutions tend to build strong and loyal customer bases, leading to better business, referrals, and an enhanced reputation, all of which contribute to market share growth. Additionally, a customer-focused approach often involves continuous engagement and feedback mechanisms, allowing companies to adapt and improve their offerings based on real-world user experiences. Market penetration is also a fundamental focus of RPA providers to increase their market share, by expanding the adoption of RPA within existing customer bases and entering new geographic regions. By demonstrating the value of RPA through successful operations, companies can capture additional market share and establish themselves as leaders in the broader automation sector.

Leave a Comment