Technological Advancements in Auto Finance

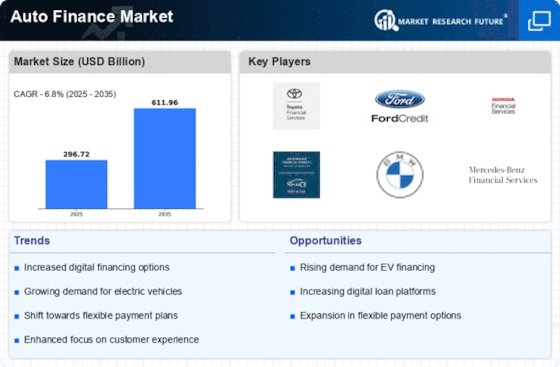

The Auto Finance Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as artificial intelligence and machine learning are streamlining the loan approval process, enhancing customer experience, and reducing operational costs. For instance, automated underwriting systems are now capable of processing applications in real-time, which significantly shortens the time from application to approval. Furthermore, the integration of mobile applications allows consumers to manage their financing options conveniently, leading to increased engagement. According to recent data, the adoption of digital platforms in auto financing has surged, with a significant percentage of consumers preferring online applications over traditional methods. This shift not only reflects changing consumer preferences but also indicates a broader trend towards digitization within the Auto Finance Market.

Consumer Demand for Flexible Financing Options

In the current landscape, the Auto Finance Market is witnessing a surge in consumer demand for flexible financing options. As consumers increasingly seek personalized solutions, lenders are adapting their offerings to include a variety of payment plans, such as lease-to-own and subscription models. This flexibility caters to diverse financial situations and preferences, allowing consumers to choose terms that best fit their needs. Recent surveys indicate that a considerable portion of potential car buyers prioritize financing options that offer lower monthly payments and the ability to adjust terms mid-contract. This trend suggests that lenders who can provide adaptable financing solutions are likely to gain a competitive edge in the Auto Finance Market, as they align more closely with consumer expectations.

Regulatory Changes and Compliance Requirements

The Auto Finance Market is significantly influenced by ongoing regulatory changes and compliance requirements. Governments are increasingly implementing stricter regulations aimed at protecting consumers and ensuring fair lending practices. These regulations often require lenders to enhance transparency in their financing processes, which can lead to increased operational costs. However, compliance also presents an opportunity for lenders to build trust with consumers, as adherence to regulations can enhance brand reputation. For example, recent legislation has mandated clearer disclosures regarding interest rates and fees, which may impact how lenders structure their financing products. As the regulatory landscape continues to evolve, companies in the Auto Finance Market must remain agile to adapt to these changes while maintaining competitive offerings.

Impact of Economic Conditions on Financing Trends

Economic conditions play a crucial role in shaping the Auto Finance Market, influencing consumer behavior and lending practices. Factors such as interest rates, employment rates, and overall economic stability directly affect consumers' purchasing power and willingness to finance a vehicle. For instance, lower interest rates typically encourage more consumers to seek financing, leading to increased vehicle sales. Conversely, economic downturns may result in tighter lending standards, making it more challenging for consumers to secure financing. Recent economic indicators suggest a gradual recovery, which may lead to a resurgence in auto sales and financing activity. As the economy stabilizes, lenders in the Auto Finance Market must remain vigilant, adapting their strategies to align with changing economic conditions and consumer sentiment.

Shift Towards Electric Vehicles and Financing Solutions

The growing shift towards electric vehicles (EVs) is reshaping the Auto Finance Market, as consumers increasingly seek financing solutions tailored to these new technologies. With the rise in environmental awareness and government incentives for EV purchases, lenders are developing specialized financing products that cater to the unique needs of electric vehicle buyers. This includes lower interest rates, longer loan terms, and incentives for eco-friendly purchases. Data indicates that the market for electric vehicles is expanding rapidly, with sales projections showing a significant increase in the coming years. As a result, lenders who can effectively address the financing needs of EV buyers are likely to capture a larger share of the Auto Finance Market, positioning themselves as leaders in this evolving segment.