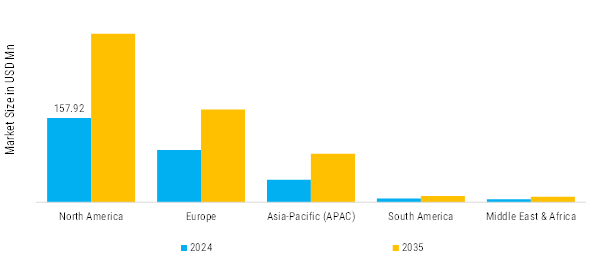

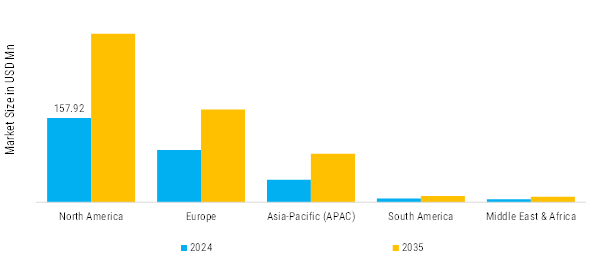

Based on region, the Global Aircraft Video Surveillance Market is segmented into North America, Europe, Asia-Pacific, South America and Middle East and Africa. North America accounted for the largest market share in 2024 and is anticipated to reach USD 2,674.2 Million by 2035. Asia-Pacific is projected to grow at the highest CAGR of 8.2% during the forecast period.

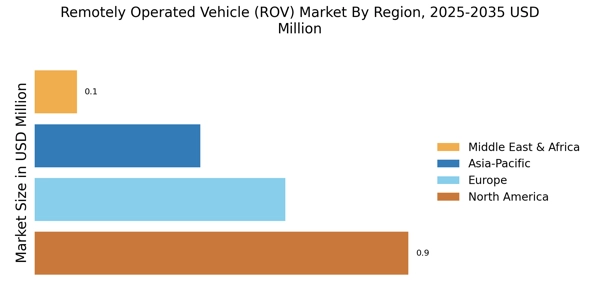

North America: Deepwater offshore operations hub

North America dominates the world ROV marketplace by means of a large number of offshore oil and gas activities especially in the deepwater and ultra-deepwater fields. The high emphasis on offshore asset inspection, maintenance, and repair in the region is enhancing the introduction of sophisticated ROV systems. Also, the market is growing as a result of high investments in underwater infrastructure, naval defense applications, and underwater research activities. On-going technological developments in imaging, navigation and automation, and restrictive safety requirements reducing the scope of human diving activities further reinforce ROV demand in the region.

Europe: Offshore renewables and inspection

Europe is an advanced ROV market that is backed by the vast number of offshore wind energy installations, cable networks, and oil and gas in the North Sea. The need to maintain offshore wind farms and the growing focus on renewable energy has boosted the demand of both inspection-class and work-class ROVs by a significant margin. Also, stringent environmental and safety conditions are promoting the application of remote operated systems in place of the traditional ones. The further market growth in the region is provided by constant innovation in underwater robotics and close cooperation of energy companies with technology providers.

Asia-pacific: Rapid offshore infrastructure growth

The most rapidly growing region of the ROV market is Asia Pacific, which is promoted by the rise in the number of offshore exploration projects, the development of underwater infrastructure, and the intensification of naval modernization. The ROV solutions are in high demand as the countries in the region invest in underwater surveillance, mapping of seabed, and offshore energy projects. Moreover, increased use of ROVs in marine research, aquaculture research, and port inspection is facilitating the growth of the market. The market perspective in the Asia Pacific is still getting better owing to the rapid industrialization and technological developments.

South America: Offshore energy-driven demand

The South American market of ROV is also showing a stable growth and this growth has been facilitated by the exploration of offshore oil and gas, especially in deepwater fields. The demand of work-class ROVs is increasing as due to the growing investment in the inspection and maintenance of subsea pipelines. Although the market development can be affected by the change in energy prices, the long-term offshore development projects still contribute to the adoption of ROV. Also, there is a gradual market growth in the region due to an enhancement of regulatory frameworks and an increase in attention to the operational safety.

Middle-East & Africa: Harsh environment subsea operations

The region of the Middle East and Africa is experiencing an increasing adoption of ROVs as a result of the growing offshore oil and gas production, the development of underwater infrastructure and the growing interest of underwater asset security. ROVs are more frequently applied in the inspection, maintenance and monitoring of severe marine environments where human intervention is restricted. Also, an increase in investments in offshore energy projects and slow uptake of new technologies in the subsea are also contributing to the growth of the market. The focus on strategic protection of underwater properties is yet another boost to regional demand.