Market Analysis

In-depth Analysis of Refrigeration Insulation Materials Market Industry Landscape

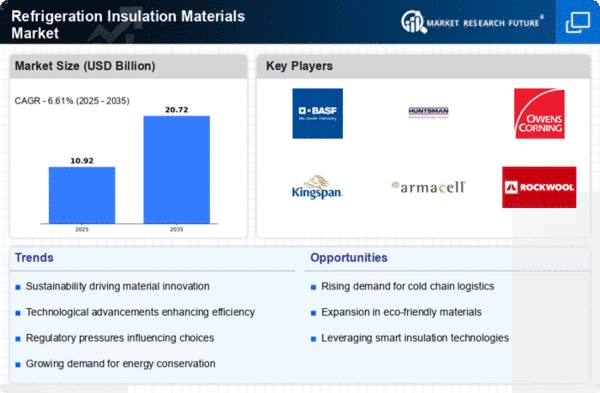

The Refrigeration Insulation Materials Market is going through a transformational phase caused by different factors influencing its landscape. This market, which plays a vital role in maintaining the performance of refrigeration systems, is characterized by significant changes resulting from industry dynamics, environmental concerns and technological advances.

One of the major forces behind these market dynamics is growing focus on energy efficiency and sustainability. In view of increased awareness about environmental issues among stakeholders in the refrigeration sector who are interested in having environmentally good materials for example; manufacturers have been compelled to invest heavily into research thereby leading into innovative insulation systems that possess better thermal properties while minimizing environment impacts.

Global push for refrigeration and cold chain infrastructure particularly in developing nations, drive growth in market for refrigeration insulation materials. This, as a result of economic growth and urbanization in these regions, has increased the demand for refrigeration systems in food storage, pharmaceuticals logistics among others. As such there is also need for high quality insulation materials that will ensure energy efficiency and regulatory compliance. Besides, another factor shaping the market dynamics is price volatility of raw materials. In this respect raw materials like polyurethane, polystyrene and polyisocyanurate are vital inputs to the Refrigeration Insulation Materials Industry. Price fluctuations in these raw materials could significantly affect production costs thereby impacting pricing strategies adopted by players operating within this market. To remain competitive within the market manufacturers often find themselves striking a delicate balance between cost-effectiveness on one hand product quality on the other hand.

Similarly, industries’ competitive environment also influences market dynamics. Therefore, companies struggle to gain more segment by differentiating their products based on their performance vis-à-vis environmental impact or cost effectiveness as they compete for increasing demand of insulating refrigerator(s). Strategic alliances mergers & acquisitions become common trends where companies aim at strengthening their positions and expanding their product portfolios so as to cater for diverse customer needs.

Leave a Comment