Refrigerated Sea Transportation One Size

Refrigerated Sea Transportation Market Growth Projections and Opportunities

The multi-faceted sea refrigerated transport market is highly affected by a multitude of influential factors all operating together to regulate dynamics. The primary engine of the global demand for perishable goods to move around the world is one of the market drivers for this purpose. In response to the growing demand amongst consumers for a large selection of fresh products including fruits, vegetables and seafood which ought to be refreshed as often as possible, the refrigerated sea transportation becomes crucial more than ever before. Besides, market development was extend and gave births to various trading relations with far-away lands, thus emerging economies are becoming more important for both production and consumption throughout the planet.

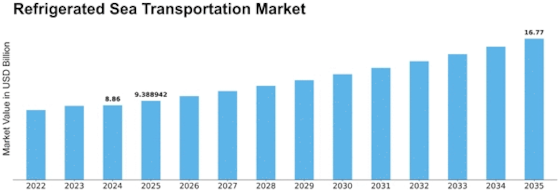

The market of refrigerated sea transport reaches the size of US$ 7.8 Billion in 2022. The Refrigerated Sea Transportation Market Application forecasted a CAGR of 6.80% between the years 2023 and 2032 at a baseline figure of USD 8.3 Billion in 2023 and USD 14.1 Billion in the end year 2032.

Refrigeration systems technology is a factor which has played the most important role during the market's development. Industry has gone through a continuing evolution from the end thermodynamic of cooling to more advanced and powerful technologies that are energy efficient. This shift, besides fine-tuning the quality and safety of the delivered goods, also plays a role in environmental impact issues. With sustainability as the main topic for businesses and consumers, the increasing of green refrigeration solutions serves as the key selection factor driving market developments.

Besides the evolving regulatory landscape, a key factor shaping the refrigerated sea transportation market is the fact that it plays a pivotal role. the strict governmental standards and regulations cultured by local and international regions of food industry have stimulated the hunger for compliant shipping methods. Along with the demand for perishable goods, the transportation companies must also conform to the necessary standard regulations set by the governing body to maintain the consistency for its products during transit will be essential. Therefore, the sale is not possible without investment in technological and institutional equipment corresponding to such controlling requirements, which reshapes the competitive environment today.

The ice-cream industry is also affected by the market competition and market consolidation which makes no exception. The markets can be differentiated by some key players and most of them are small regional companies. Extremely cutthroat competition guides companies to be creative in technological application, quality assurance and competent pricing. A frequent strategic move used by the industry's leading enterprises to consolidate the market and global dominance, as well as to merge the operations to ensure high-efficiency, is mergers and acquisitions.

Energy market conditions that base on the price of fuel are among the key factors defining the services and operation cost structure of refrigerated sea transportation providers. The uncertainty in the price fuel presents a chain reaction of this to transport rates and toward the end total cost of moving perishable goods to the end consumers.

Leave a Comment