Ready Meal Trays Size

Ready Meal Trays Market Growth Projections and Opportunities

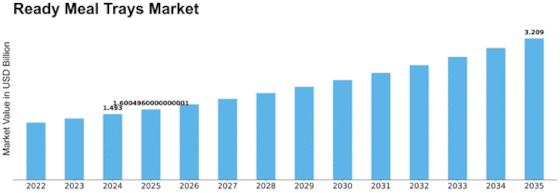

Ready Meal Trays Market Size was valued at USD 1.3 Billion in 2022. The Ready Meal Trays industry is projected to grow from USD 1.393 Billion in 2023 to USD 2.430 Billion by 2032, exhibiting a compound yearly growth rate (CAGR) of 7.20%

The market for ready meal trays is shaped by various factors that impact its growth and dynamics within the food packaging industry. Convenience emerges as a primary driver influencing the market, as consumers increasingly seek quick and easy meal solutions. Ready meal trays offer a convenient packaging option for a variety of prepared foods, allowing consumers to enjoy restaurant-quality meals at home without the need for extensive preparation. As the demand for time-saving and hassle-free meal options rises, the ready meal tray market experiences substantial growth, catering to the busy lifestyles of modern consumers.

Economic factors play a significant role in the ready meal tray market. Consumer spending patterns, disposable income levels, and overall economic conditions impact the demand for convenience foods, subsequently influencing the market for ready meal trays. During periods of economic growth, there is often an increase in consumer spending on convenience products, including ready meals, contributing to a higher demand for associated packaging solutions. Conversely, economic downturns may lead to changes in consumer behavior, affecting the market for ready meal trays. Understanding these economic trends is essential for stakeholders in the food packaging industry to adapt to market fluctuations effectively.

The regulatory environment plays a crucial role in shaping the ready meal tray market. Stringent regulations related to food safety, labeling, and environmental impact influence the materials and manufacturing processes used in ready meal tray production. Compliance with food safety standards is paramount to ensure the integrity of the packaged meals, and adherence to environmental regulations contributes to sustainable packaging practices. Additionally, government initiatives promoting eco-friendly packaging solutions and waste reduction impact the market dynamics, encouraging businesses to adopt environmentally responsible practices in the production of ready meal trays.

Technological advancements in packaging materials and design contribute to innovation in the ready meal tray market. Continuous improvements in materials, such as the development of recyclable and sustainable options, enhance the environmental profile of ready meal trays. Advanced manufacturing processes allow for the creation of trays with features like microwavability, oven-safe capabilities, and improved insulation, catering to consumer preferences for versatile and user-friendly packaging. Innovations in sealing technologies and barrier coatings also contribute to the preservation of food quality and safety in ready meal trays.

Consumer preferences for healthier and sustainable food options significantly influence the ready meal tray market. As awareness of health and environmental issues grows, consumers seek ready meals that align with their dietary preferences and values. Ready meal trays that use eco-friendly materials, showcase transparent labeling of nutritional information, and promote clean and natural ingredients gain favor among health-conscious consumers. Additionally, the visual appeal and convenience of ready meal trays contribute to their popularity, providing a satisfying and efficient dining experience for consumers.

Market competition in the ready meal tray industry is shaped by factors such as pricing, branding, and distribution channels. Competitive pricing strategies that consider production costs, material expenses, and market demand influence a company's market position. Building a strong brand reputation for quality, innovation, and sustainability is crucial for attracting and retaining customers. Effective distribution networks and strategic partnerships with food retailers contribute to market accessibility and competitiveness. Manufacturers and distributors must navigate these competitive factors strategically to establish a strong presence in the ready meal tray market.

Leave a Comment