Quantum Dot Display Market Summary

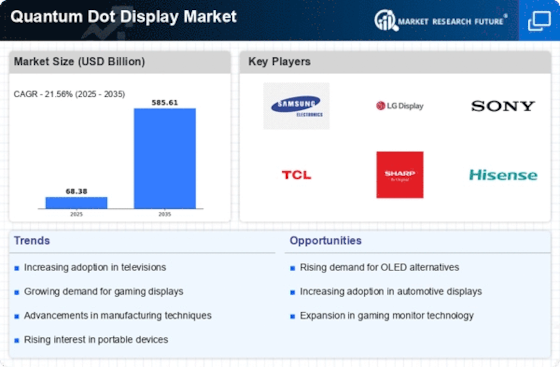

As per Market Research Future analysis, the Quantum Dot Display Market Size was estimated at 68.38 USD Billion in 2024. The Quantum Dot Display industry is projected to grow from 83.12 USD Billion in 2025 to 585.61 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 21.56% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Quantum Dot Display Market is poised for substantial growth driven by technological advancements and increasing demand for high-quality displays.

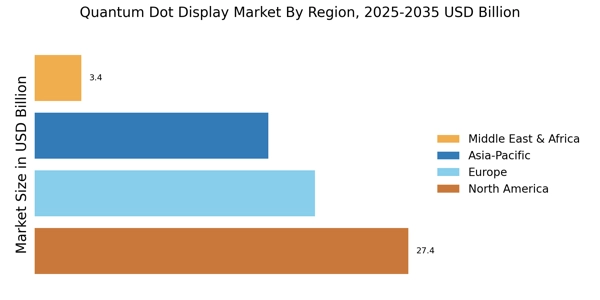

- North America remains the largest market for quantum dot displays, driven by consumer electronics and high-end televisions.

- Asia-Pacific is emerging as the fastest-growing region, fueled by rising disposable incomes and a burgeoning middle class.

- The cadmium-based segment continues to dominate the market, while cadmium-free displays are rapidly gaining traction due to sustainability concerns.

- Key market drivers include the rising demand for high-quality displays and the expansion of the gaming industry, which is propelling innovation.

Market Size & Forecast

| 2024 Market Size | 68.38 (USD Billion) |

| 2035 Market Size | 585.61 (USD Billion) |

| CAGR (2025 - 2035) | 21.56% |

Major Players

Samsung Electronics (KR), LG Display (KR), Sony Corporation (JP), TCL Technology (CN), Sharp Corporation (JP), Hisense Group (CN), AU Optronics (TW), QLED (KR), Panasonic Corporation (JP)