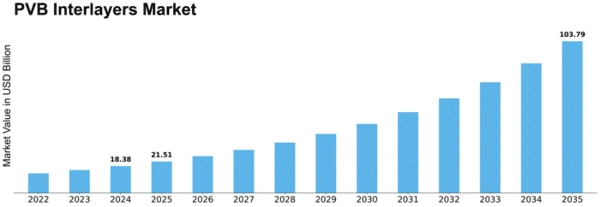

Pvb Interlayers Size

PVB Interlayers Market Growth Projections and Opportunities

The Polyvinyl Butyral (PVB) interlayers market is shaped by many factors. The vehicle industry, where PVB interlayers are crucial to windshield overlay glass, is a major driver. As security standards tighten, demand for covered glass with better strength and effect obstruction rises, affecting the PVB interlayers market. PVB interlayers find several uses in engineering overlaid glass for windows, exteriors, and overhangs, which boosts the market. PVB interlayers can improve covered glass's thermal and acoustic insulation, which boosts their popularity.

By 2030, the global PVB interlayers market might reach $5 billion with a 7.5% CAGR.

Mechanical advances also shape the PVB interlayers industry. Creative products with increased UV blocking, optical clarity, and compatibility with smart glass technologies result from continuous innovation. These advances meet end-user needs and enable new usage paths, expanding the market. PVB interlayers can also benefit from the growing interest in electric and autonomous automobiles, which often combine advanced glass technologies for improved safety and comfort.

International financial and currency patterns strongly impact the PVB interlayers market. Cash trade rates, geopolitical tensions, and economic deals affect unrefined component prices and production costs. Exchange barriers and levies can disrupt retail networks and market factors. Thus, PVB interlayers market players closely monitor international events and trade agreements to alter their methods and ensure production network stability.

Supportability and environmental restrictions are shaping the PVB interlayers industry. State-run administrations are strictly reducing fossil fuel wastes and promoting eco-friendly goods. PVB interlayers meet these environmental goals because they are recyclable and energy-efficient. Thus, market makers are investing in cost-effective techniques and promoting PVB interlayers as an eco-friendly option, winning over environmentally conscious consumers and businesses.

Cutthroat competition affects PVB interlayers market components. significant players, market share, and significant drivers like consolidations, acquisitions, and organizations affect seriousness. Organizations compete on product creation, quality, and cost, creating a vibrant market. Client preferences and brand reliability also shape market trends, as end-clients seek reliable and respected PVB interlayer providers.

Overall, the PVB interlayers market is shaped by industrial demands and global financial conditions. PVB interlayers will likely remain popular as car and development companies grow due to health and maintainability concerns. Innovative advances, natural contemplations, and serious factors complicate this market, thus industry partners must be open to these variables to find and exploit opportunities.

Leave a Comment