Market Trends

Key Emerging Trends in the PU Sole Footwear Polyurethane Market

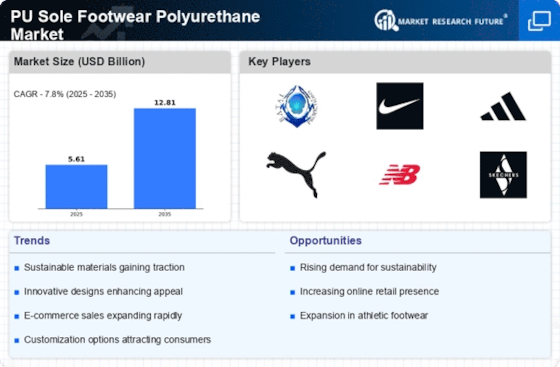

The market trends of PU sole footwear in the polyurethane (PU) market have seen significant growth in recent years. Polyurethane is a versatile material known for its durability, flexibility, and lightweight properties, making it an ideal choice for footwear applications. PU sole footwear has become increasingly popular due to its comfort, affordability, and ability to mimic the appearance of other materials such as leather and rubber.

One of the key trends driving the growth of PU sole footwear is the increasing demand for sustainable and eco-friendly products. With growing awareness about environmental issues, consumers are seeking out footwear options that have a lower carbon footprint and are made from renewable or recycled materials. Polyurethane can be produced using sustainable processes and can be recycled or repurposed at the end of its lifecycle, making it a preferred choice for environmentally conscious consumers.

Another trend shaping the market for PU sole footwear is the rise of athleisure and casual footwear styles. With more people adopting active lifestyles and prioritizing comfort in their footwear choices, there has been a growing demand for sneakers, sandals, and other casual footwear with PU soles. These shoes offer the perfect combination of style, comfort, and performance, making them popular choices for everyday wear.

In addition to athleisure and casual footwear, PU sole footwear is also gaining traction in the fashion and luxury segments. Designers and brands are incorporating PU soles into their footwear collections to offer consumers trendy and fashionable options that are also comfortable and durable. PU sole footwear can be found in a wide range of styles, from classic pumps and boots to trendy sneakers and slides, catering to diverse consumer preferences.

The growing popularity of online shopping and e-commerce platforms has also contributed to the growth of the PU sole footwear market. Consumers can now easily browse and purchase a wide variety of footwear options from the comfort of their own homes, leading to increased sales and market penetration for PU sole footwear. Additionally, online retailers often offer competitive prices and convenient shipping options, further driving demand for PU sole footwear among consumers.

Furthermore, technological advancements in PU sole manufacturing processes have led to improvements in product quality and performance. Manufacturers are constantly innovating to develop new formulations and production techniques that enhance the comfort, durability, and aesthetics of PU sole footwear. These advancements have helped to expand the market for PU sole footwear and attract new customers looking for high-quality and innovative footwear options.

Leave a Comment