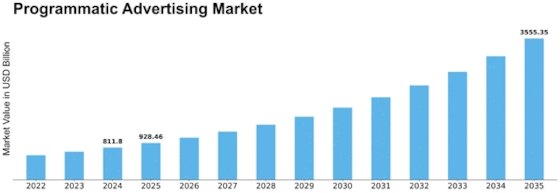

Programmatic Advertising Size

Programmatic Advertising Market Growth Projections and Opportunities

The Programmatic Advertising market is influenced by factors shaping its dynamics and growth trajectory. One of the key drivers of this market is the increasing penetration of digital devices and the internet. As more consumers across the globe are connected online, advertisers seek efficient ways to reach their target audiences, leading to a surge in programmatic advertising adoption. The proliferation of smartphones and the rise of digital media consumption have further propelled the demand for programmatic advertising solutions.

Moreover, the ever-evolving consumer behavior plays a crucial role in shaping the programmatic advertising landscape. Consumers are now more discerning and expect personalized and relevant content. Advertisers are turning to programmatic advertising to leverage data-driven insights and algorithms that enable them to tailor their messages to specific demographics, increasing the effectiveness of their campaigns. This shift toward personalized advertising is a significant factor driving the growth of the programmatic advertising market. The increasing complexity of the advertising ecosystem is another market factor influencing the programmatic advertising landscape.

Advertisers and marketers face the challenge of managing diverse channels, formats, and data sources. Programmatic advertising offers a streamlined solution by automating the ad-buying process, making it more efficient and cost-effective. This automation reduces the complexity of managing multiple advertising channels and enhances the precision and speed of ad placements. Data-driven decision-making is at the core of programmatic advertising, and the availability of vast amounts of consumer data is a pivotal market factor. The advent of big data and advanced analytics enables advertisers to analyze user behavior, preferences, and demographics, allowing for more targeted and personalized advertising strategies. This data-centric approach not only enhances the relevance of ads but also contributes to better ROI for advertisers.

Additionally, the transparency and real-time capabilities of programmatic advertising are essential to market factors driving its adoption. Advertisers can gain real-time insights into the performance of their campaigns, allowing for quick adjustments and optimizations. The transparency in the ad buying process ensures that advertisers have visibility into where their ads are being displayed and the associated costs, fostering trust and accountability in the advertising ecosystem. Conversely, challenges such as ad fraud and brand safety concerns are market factors that must be addressed for sustained growth in programmatic advertising. Advertisers are increasingly focused on ensuring their ads are displayed in brand-safe environments and are not susceptible to fraudulent activities. Efforts to enhance fraud detection mechanisms and improve brand safety measures are crucial for building and maintaining advertiser confidence in the programmatic advertising space.

Leave a Comment