Top Industry Leaders in the Privileged Access Management Solutions Market

Competitive Landscape of Privileged Access Management Solutions Market

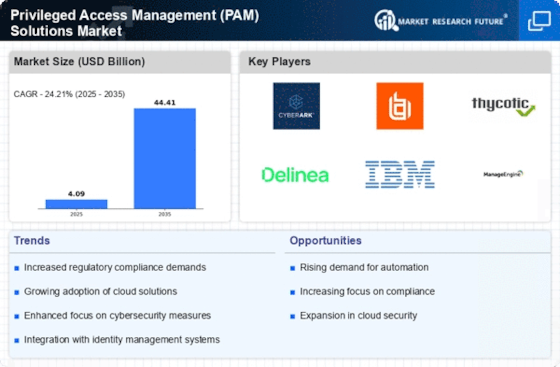

The Privileged Access Management (PAM) solutions market is experiencing rapid growth, fueled by escalating cybersecurity threats and the increasing sophistication of cyberattacks targeting privileged accounts. With such immense potential, the competitive landscape is dynamic and fiercely competitive, with established players vying for market dominance alongside innovative newcomers.

Key Players:

- CA Technologies

- Wallix

- CyberArk

- Centrify

- ManageEngine

- ARCON

- Hitachi ID Systems

- Beyond Trust

- Thycotic

- Devolutions

- One Identity LLC

Strategies Adopted:

- Product Innovation: Leading players are constantly innovating their offerings to stay ahead of the curve. This includes incorporating features like machine learning-based anomaly detection, multi-factor authentication (MFA), and endpoint privilege management.

- Cloud-Based Solutions: The shift towards cloud adoption is driving the demand for cloud-based PAM solutions. This allows for easier deployment, scalability, and cost-effectiveness.

- Integration with Security Tools: PAM vendors are increasingly integrating their solutions with other security tools, such as SIEM and IAM, to provide a holistic security posture.

- Focus on User Experience: Simplifying user interfaces and focusing on ease of use are crucial for attracting and retaining customers.

- Channel Partnerships: Partnering with channel partners, such as managed service providers (MSPs) and resellers, helps expand reach and market penetration.

Factors for Market Share Analysis:

- Product Portfolio: The breadth and depth of the PAM solution portfolio is a key differentiator. Leading players offer a comprehensive suite of solutions covering all aspects of privileged access management.

- Customer Base: A large and loyal customer base indicates strong market presence and brand recognition.

- Financial Performance: Robust financial performance demonstrates a company's ability to invest in research and development, expand its market reach, and remain competitive.

- Technological Innovation: Continuous introduction of innovative features and functionalities is crucial for staying ahead of the competition.

- Partnerships & Collaborations: Strategic partnerships with other industry players help expand market reach and expertise.

- Customer Reviews & Analyst Recognition: Positive customer reviews and analyst recognition are powerful endorsements that can significantly impact market share.

New and Emerging Companies:

Several new and emerging companies are entering the PAM market, offering innovative solutions and challenging the established players. Some notable examples include:

- Thycotic: Offers a cloud-based PAM solution with a focus on user behavior analytics and session recording.

- Vault by HashiCorp: Provides a unified platform for managing all secrets, including privileged credentials.

- Avecto Defender: Focuses on endpoint privilege management and application whitelisting.

- CyberArk Identity: Offers a cloud-based identity management solution that integrates with PAM solutions.

Investment Trends:

Companies are investing heavily in research and development to keep pace with the evolving cyber threat landscape. This includes developing new features, integrating with other security tools, and exploring emerging technologies like blockchain and artificial intelligence (AI). Additionally, vendors are investing in expanding their sales and marketing teams to reach new customer segments and expand their market share.

Latest Company Updates:

2024 will see With a focus on privileged users, Cross Identity has introduced a Privileged Identity and Access Management (PIAM) solution with the goal of improving financial institution security. PIAM secures privileged access in on-premises, cloud, and hybrid configurations to provide defense against cyber attacks. This development follows the Reserve Bank of India's (RBI) publication of cybersecurity recommendations that are intended to strengthen financial institutions' security posture, with a particular focus on privileged users.

Leading supplier of identity security and privileged access solutions, Securden, Inc., announced today the release of Unified PAM MSP, a revolutionary new solution for Managed Service Providers that will be available in 2024. With full data segregation and a scalable, multi-tenant architecture, the Unified PAM MSP offers all the essential Privileged Access Management (PAM) features in one convenient package. With total operational freedom, it allows MSPs to provide PAM-as-a-Service to their clients or manage client infrastructure across various settings, including on-premise, multi-cloud, and hybrid systems.

Software as a service (SaaS) organizations will be assisted in managing user accounts and customer identities within their products by Frontegg Forward, which will be released in 2023, according to the identity and access management platform Frontegg. According to a press release from the company, the new solution offers four key user management advances that SaaS organizations need to satisfy their growth imperatives over the next ten years. These include AI-driven app intelligence, self-service and delegated security, dynamic entitlement management, and simple configuration of complicated organizational hierarchies.