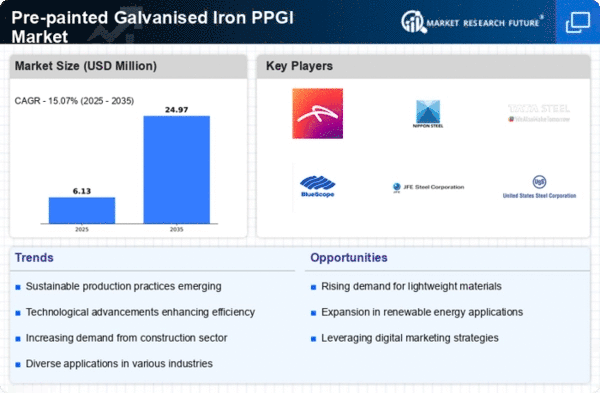

Market Analysis

In-depth Analysis of Pre-painted Galvanised Iron PPGI Market Industry Landscape

Farming and metallurgy have been pivotal to various technological and agricultural advancements throughout history, contributing to a shift in the power dynamic that favored humans over nature. Modern farming operations owe much of their efficiency to advanced metallurgical developments, such as the utilization of galvanized steel, which proves instrumental in helping farmers save time, reduce costs, and increase profitability.

Pre-painted galvanized iron (PPGI) emerges as a cost-effective alternative compared to other treated steel and iron, requiring lower capital expenditure from farmers. Its maintenance costs are also significantly lower than those of other coated metals, translating to time and cost savings on repairs and replacements. Boasting properties like damage resistance, durability, and anti-corrosion capabilities, PPGI proves resilient in outdoor environments, making it highly effective for agricultural use. Moreover, its self-healing property ensures automatic protection for damaged areas, as the coating corrodes preferentially to the steel, creating a safeguard for vulnerable sections. PPGI eliminates the need for additional surface preparation, such as painting before installation, adding to its practicality in agricultural settings.

In modern agricultural operations, PPGI finds applications across various equipment and structures. Farmers now use PPGI and galvanized high-strength steel in feeding equipment, farm tools, fencing, gates, grain elevators and conveyors, milk storage containers, irrigation systems, tractor parts, veterinary equipment, wheel hubs, slotted floors, storage racks, outdoor buildings, silo extraction equipment, refrigeration shelves, watering troughs, and high-speed freezing equipment.

The versatility of PPGI extends beyond agriculture to include a wide range of applications in the electronic household appliances sector. It is commonly employed in refrigerators, freezers, washing machines, clothes dryers, dishwashers, microwaves, cookers, heaters, satellite decoders, computers, light fittings, air conditioners, LED TVs, microwave ovens, furniture, electrical cabinets, and various other appliances. Domestic appliances demand materials with superior coatings and mechanical properties, and PPGI meets these requirements with its core properties, facilitating drawing, bending, forming, and other essential functions.

The telecommunications industry also benefits from the use of hot-galvanized steel, especially in applications such as phone wiring and equipment boxes. The durability of hot-galvanized steel reduces the risk of damage and minimizes maintenance needs, particularly for tall and challenging-to-reach phone lines.

Therefore, the widespread applications of pre-painted galvanized iron in agriculture and the electronic industry play a significant role in boosting the global pre-painted galvanized iron market. Its cost-effectiveness, durability, and diverse applications make PPGI a valuable asset in modern farming and electronic household appliances, contributing to the overall efficiency and success of these industries.

Leave a Comment