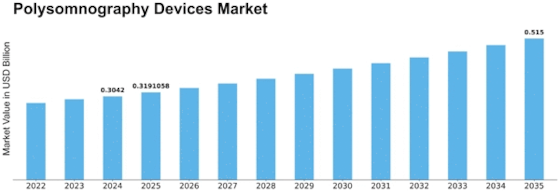

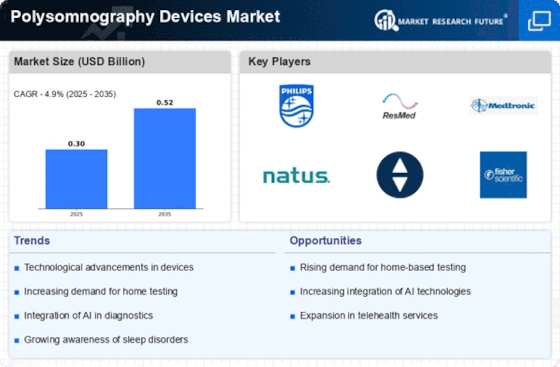

Polysomnography Devices Size

Polysomnography Devices Market Growth Projections and Opportunities

The polysomnography devices market is crucial to healthcare as it assists in diagnosing and treating sleeping disorders. Polysomnography also referred to as sleep study is done at night-time, where different physiological parameters are monitored such as brain waves, eye movement, heart rate, respiratory effort and oxygen saturation. Over time, the global polysomnography devices market has grown considerably due to rising incidence of such diseases combined with increasing awareness about their general health impacts.

High prevalence of insomnia, sleep apnea and restless legs syndrome among other sleep related conditions has led this sector’s expansion. Lifestyle changes like work-related stress and conditions such as obesity have resulted into more people seeking treatment because of sleep problems. Also, there is a tendency among health care providers to opt for extensive research on individual sleep by using polysomnography equipment’s given what they know regarding quality rest.

These incorporate more advanced polysomnography equipment with enhanced diagnostic capabilities together with patient comfort. For example, there are new portable home-based sleeping monitors which means that patients now have more options when it comes to accessing them than ever before. This implies that these advancements will meet changing needs of both clients and practitioners thereby driving overall industry growth.

In particular Europe North America and Asia Pacific are seen as experiencing noticeable growth trends in the field of Polysomnography Devices Market. The two continents show high market presence in terms of well-developed healthcare systems plus high levels of awareness on sleeping disorders along proactiveness in health care systems respectively. Conversely Asian-Pacific region records skyrocketing market expansion rates caused by increased health spending, emerging middle-class populations beside growing understanding on effects related with non-goodnight rests thereof.

Manufacturers now prefer unattended testing tools for sleep monitoring at home while the patients are asleep mostly resulting from this development. There has been a wider adoption of home sleep apnea testing devices due to the fact that people can now use them right from their beds. Apart from improving patient comfort, this shift also tends to overcome problems characterizing laboratory-based sleep studies including cost and accessibility.

The leading manufacturers in Polysomnography Equipment Market have been identified by a strong drive for innovation through research and development. They would like to increase the usability of these devices beyond question on the account of their reliability as well as accuracy improvements are made. This has led to a number of partnerships between them designed to extend their reach worldwide as well as diversify product lines.

Leave a Comment