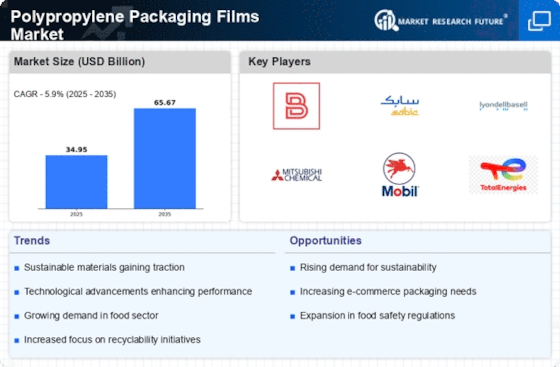

Market Share

Polypropylene Packaging Films Market Share Analysis

In the competitive landscape of the polypropylene packaging films market, market share positioning strategies play a crucial role in determining the success of companies. These strategies involve various approaches aimed at capturing a larger portion of the market and establishing a strong foothold against competitors.

One common strategy employed by companies operating in the polypropylene packaging films market is product differentiation. By offering unique features, functionalities, or benefits, companies can distinguish their products from those of competitors and attract customers seeking specific qualities. This may involve investing in research and development to innovate new types of films with enhanced properties such as improved barrier protection, sustainability, or aesthetics. By consistently introducing innovative products, companies can strengthen their market position and gain a competitive edge.

Another important strategy is pricing. Companies may adopt different pricing strategies to gain market share depending on factors such as production costs, competitor pricing, and perceived value by customers. Some companies may opt for a cost leadership strategy, offering their products at lower prices to appeal to price-sensitive customers and capture a larger market share. Others may choose a premium pricing strategy, positioning their products as high-quality or luxury options and targeting customers willing to pay a premium for superior features or brand image. Additionally, companies may use promotional pricing or discounts strategically to stimulate sales and gain temporary market share advantages.

Distribution channels also play a significant role in market share positioning strategies. Companies need to ensure their products are readily available to customers through efficient distribution networks. This may involve partnering with distributors, wholesalers, retailers, or e-commerce platforms to reach target markets effectively. By expanding distribution channels and improving accessibility, companies can increase their market penetration and capture a larger share of customers.

Furthermore, branding and marketing efforts are essential for market share positioning in the polypropylene packaging films market. Building a strong brand identity and promoting brand awareness can help companies differentiate themselves from competitors and establish a loyal customer base. Effective marketing strategies may include advertising campaigns, social media presence, participation in trade shows and industry events, as well as engaging with customers through various channels. By conveying the unique value proposition of their products and building trust with customers, companies can increase their market share and drive growth.

In addition to these strategies, strategic partnerships and collaborations can also contribute to market share positioning in the polypropylene packaging films market. By forming alliances with complementary businesses or industry stakeholders, companies can leverage each other's strengths and resources to enhance competitiveness and expand market reach. This may involve collaborations in areas such as product development, distribution, marketing, or research initiatives. Strategic partnerships can enable companies to access new markets, technologies, or capabilities, leading to increased market share and sustained growth.

Overall, market share positioning strategies in the polypropylene packaging films market require a combination of product innovation, pricing, distribution, branding, and strategic partnerships. By effectively executing these strategies and adapting to changing market dynamics, companies can strengthen their competitive position, increase market share, and achieve long-term success in the industry.

Leave a Comment