Polymeric Surfactants Size

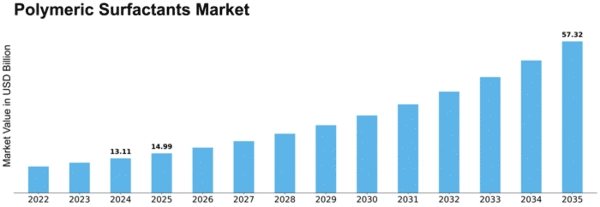

Polymeric Surfactants Market Growth Projections and Opportunities

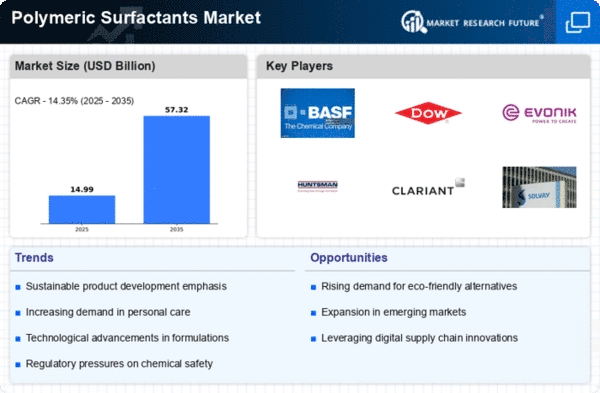

Many factors affect the Polymeric Surfactants industry. Personal care, domestic items, and agriculture demand are major factors. The unique structure and improved performance of polymeric surfactants make them popular in these fields. These industries' growth and performance affect polymeric surfactant demand, making them crucial in many formulations.

The Polymeric Surfactants market is driven by regulations and environmental consciousness. Polymeric surfactants, used in personal care and household goods, must meet strict safety and environmental regulations. Manufacturers must follow these requirements to meet regulations and satisfy environmentally concerned consumers. Bio-based polymeric surfactants meet the growing demand for sustainable and biodegradable formulations.

Global economic conditions shape the Polymeric Surfactants market. Economic factors like industrial activity, consumer expenditure, and agriculture affect surfactant product demand. Polymeric surfactant demand rises during economic growth as manufacturing and agriculture increase. Conversely, economic downturns may restrict industrial and agricultural activity, hurting market dynamics.

Technological advances in surfactant formulations drive market growth. Polymeric surfactant structure and production innovations improve performance, stability, and adaptability. Companies investing in R&D to remain ahead of technological advances can better meet industry needs and gain a competitive edge in the Polymeric Surfactants market.

In the Polymeric Surfactants market, raw material availability and pricing are crucial. Monomers and polymerization agents are common surfactant raw sources. Raw material price fluctuations affect production costs and market dynamics. To avoid disruptions and maintain market stability, polymeric surfactants must be supplied by a stable and efficient supply chain.

Geopolitics and trade policies also influence the Polymeric Surfactants market. Tariffs, trade agreements, and geopolitical conflicts affect chemical supply and demand. Market players must adjust to these external influences to manage global trade dynamics.

Key players, market share, and strategic efforts affect Polymeric Surfactants market competition. To gain market share, companies innovate, extend their product portfolios, and develop strategic collaborations. Acquisitions and mergers are traditional ways to gain market share and a competitive edge.

Leave a Comment