Polymer Gel Size

Polymer Gel Market Growth Projections and Opportunities

The Polymer Gel Market is influenced by a myriad of market factors that collectively shape its dynamics. One key determinant is the demand for polymers across various industries. As industries like healthcare, agriculture, and personal care continue to expand, so does the need for polymer gels. For instance, in healthcare, polymer gels find applications in wound care, drug delivery systems, and tissue engineering. This surge in demand from diverse sectors propels the growth of the polymer gel market.

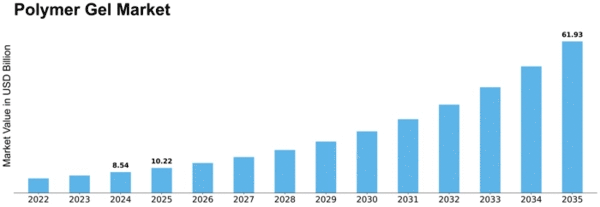

Polymer Gel Market is expected to surpass the market value of over USD 55 billion by the year 2024 while registering a CAGR of 6% during the forecast period.

Additionally, technological advancements play a pivotal role in shaping the market landscape. Continuous research and development activities in polymer science lead to the introduction of innovative polymer gel products with enhanced properties. These advancements not only cater to existing applications but also open doors to new possibilities, widening the market scope. Manufacturers and suppliers are often compelled to stay abreast of the latest technological trends to remain competitive in the dynamic polymer gel market.

Furthermore, economic factors significantly impact the polymer gel market. The overall economic health of a region or country influences consumer spending, which, in turn, affects the demand for polymer gel products. Economic growth and stability contribute to increased investments in various sectors, fostering the utilization of polymer gels in different applications. Conversely, economic downturns may lead to a temporary decline in demand, prompting market players to strategize and adapt to the changing economic landscape.

Environmental considerations have become increasingly crucial in recent years, driving the polymer gel market towards sustainable practices. With a growing emphasis on eco-friendly solutions, manufacturers are exploring and adopting greener alternatives in the production of polymer gels. This shift aligns with the global push for sustainability, and companies incorporating environmentally friendly practices may gain a competitive edge in the market.

Government regulations and policies also exert a significant influence on the polymer gel market. Regulatory frameworks governing the use and production of polymers impact market players, shaping their strategies and product development processes. Compliance with these regulations is imperative for market participants to ensure product safety and meet environmental standards. Additionally, government initiatives supporting research and development in the polymer industry contribute to market growth.

The competitive landscape and market structure are crucial factors affecting the dynamics of the polymer gel market. The presence of numerous manufacturers and suppliers fosters healthy competition, prompting innovation and quality improvements. Market players often engage in strategic collaborations, mergers, and acquisitions to strengthen their market position and expand their product portfolios. Understanding the competitive environment is essential for companies seeking sustained growth and success in the polymer gel market.

Consumer trends and preferences play a vital role in shaping the market as well. Changing consumer lifestyles and preferences drive the demand for specific types of polymer gel products. For instance, the preference for natural and organic ingredients in personal care products influences the development and marketing strategies of polymer gel manufacturers catering to the cosmetic industry.

Leave a Comment