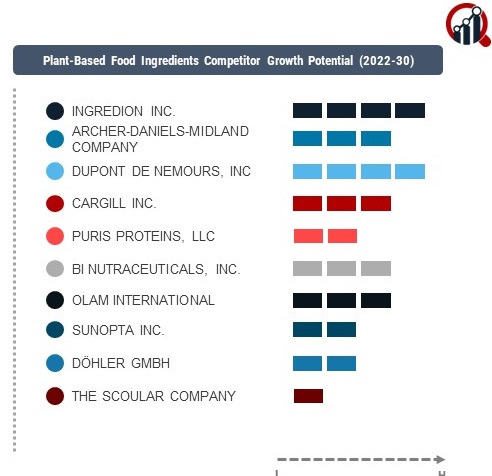

Top Industry Leaders in the Plant Based Food Ingredients Market

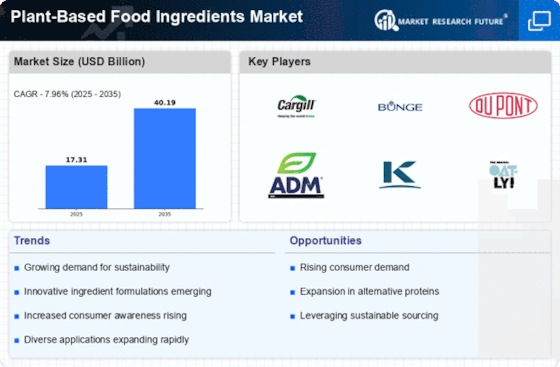

The competitive landscape of the plant-based food ingredients market is characterized by a mix of established players and emerging companies, all navigating the shifting consumer preferences towards plant-based diets. Understanding the competitive dynamics in this sector requires a comprehensive analysis, encompassing the strategies adopted, market share factors, news related to emerging companies, industry trends, current investment patterns, and the overall competitive landscape. Key players in the plant-based food ingredients market have strategically positioned themselves to capitalize on the rising demand for sustainable and plant-derived alternatives in the food industry.

Key Players:

Ingredion Inc. (US)

Archer-Daniels-Midland Company (US)

DuPont de Nemours Inc. (US)

Cargill Inc. (US)

Puris Proteins LLC (US)

BI Nutraceuticals Inc. (US)

Olam International (Singapore)

SunOpta Inc. (Canada)

Döhler GmbH (Germany)

The Scoular Company (US).

Strategies Adopted:

The plant-based food ingredients market revolve around product innovation, sustainability initiatives, and strategic partnerships. Cargill, for instance, has focused on research and development to create plant-based ingredients that mimic the taste and texture of traditional animal-based products. Ingredion has adopted a strategy of diversification, expanding its plant-based offerings beyond proteins to include starches and fibers. Roquette Frères has emphasized sustainability, investing in supply chain transparency and responsible sourcing. Companies like Beyond Meat and Impossible Foods have pioneered plant-based meat alternatives, creating a new category within the market.

Market Share Analysis:

The plant-based food ingredients sector involves evaluating various factors, including brand recognition, product quality, sustainability practices, and global distribution networks. Established players like Cargill and Ingredion, with their longstanding reputation for quality and commitment to sustainability, often command a significant market share. Emerging companies strive to gain market share by offering differentiated plant-based solutions, addressing specific taste and texture challenges faced by the food industry. Effective marketing strategies, adaptability to changing consumer preferences, and the ability to scale production are crucial factors influencing market share dynamics.

News & Emerging Companies:

The plant-based food ingredients market includes the emergence of new companies and strategic collaborations. Emerging companies such as Givaudan and Kerry Group have gained attention by introducing innovative plant-based flavor solutions, enhancing the overall sensory experience of plant-based products. Collaborations between plant-based ingredient manufacturers and food producers to develop new formulations and improve the taste profile of plant-based offerings have become a notable trend, contributing to the expansion of plant-based options in the food industry.

Industry Trends:

The industry is currently witnessing investment trends focused on sustainability, research and development, and expanding production capacities. Key players are investing in sustainable sourcing practices, aligning with the growing consumer demand for ethically produced and environmentally friendly products. Research and development efforts are directed towards creating plant-based ingredients with specific functional properties, such as improved texture, taste, and nutritional profiles. Additionally, there is a trend towards expanding production capacities to meet the increasing demand for plant-based food ingredients in various food applications globally.

Competitive Scenario:

The plant-based food ingredients market is characterized by intense competition and a constant pursuit of innovation. Established players leverage their global reach, expertise, and commitment to sustainability to maintain market share, while emerging companies focus on agility and innovation to capture niche markets. The market is influenced by factors such as changing consumer preferences, regulatory considerations, and the need for effective and sustainable alternatives in the food industry. As the food landscape continues to evolve, the demand for plant-based food ingredients as versatile and eco-friendly alternatives provides significant growth opportunities for both established and emerging players.

Recent Development

The plant-based food ingredients market was the introduction of a breakthrough technology by a major player. This technology aimed to enhance the sensory attributes of plant-based proteins, addressing one of the key challenges in plant-based product acceptance. By utilizing advanced processing techniques and flavor enhancement technologies, the development aimed to make plant-based products more palatable and appealing to a broader consumer base.

Furthermore, there was a notable industry-wide initiative promoting collaboration between plant-based ingredient manufacturers and culinary professionals to develop a wider range of plant-based recipes and applications. This development reflected the industry's recognition of the importance of culinary expertise in making plant-based foods more accessible and enjoyable for consumers. The collaborative effort sought to bridge the gap between innovative plant-based ingredients and the creation of flavorful and satisfying plant-based dishes. The competitive landscape in 2023 showcased a balance between established players adapting to new trends and emerging companies driving innovation, resulting in a vibrant and competitive plant-based food ingredients market.