Market Share

Pharmaceutical Cartridges Market Share Analysis

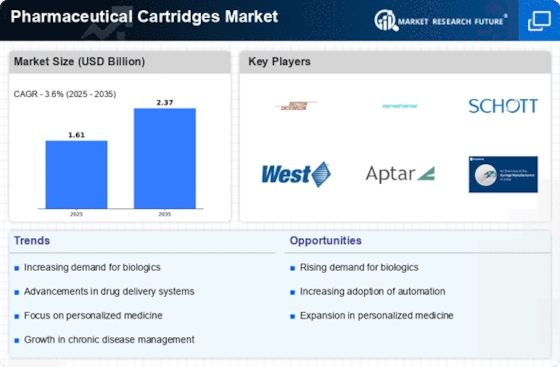

Pharmaceutical Cartridges Market growth is driven by the growing pharmaceutical sector, technical advances, and parenteral drug delivery system demand. Pharmaceutical cartridges, consisting of glass or plastic, hold injectable medications and are essential to prefilled syringes and pen injectors. This market is favoring prefilled syringes for their exact dosing, fewer pharmaceutical errors, and patient convenience. The tendency toward self-administration of injectable drugs makes pharmaceutical cartridges essential for developing user-friendly and patient-centric drug delivery solutions.

Additionally, the Pharmaceutical Cartridges Market is adopting sophisticated materials and manufacturing processes. Good borosilicate glass and polymer cartridges are popular because they work with many drug formulas, are break-resistant, and last longer. Cartridges with dual-chamber systems for lyophilized and liquid drugs are also being introduced to improve functionality. The market is responding to higher sustainability and environmental concerns.

Pharmaceutical businesses and cartridge manufacturers are changing the Pharmaceutical Cartridges Market through partnerships. These relationships encourage collaboration on specialized solutions, research, and technology integration. Increased research and development improves cartridge designs, materials, and production methods.

As the biopharmaceutical industry grows, the Pharmaceutical Cartridges Market adapts to biologics and biosimilars. Biopharmaceutical cartridges use unique coatings and materials to prevent medicinal product interactions and assure stability. Biologics require bigger doses, hence the market is seeing larger cartridges.

RTF cartridges, which pharmaceutical businesses receive sterilized and ready to use, are in high demand. RTF cartridges simplify medicine manufacture, reduce in-house sterilization, and reduce contamination. Pharmaceutical manufacturers prioritize operational efficiency and quality assurance."

Leave a Comment