- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

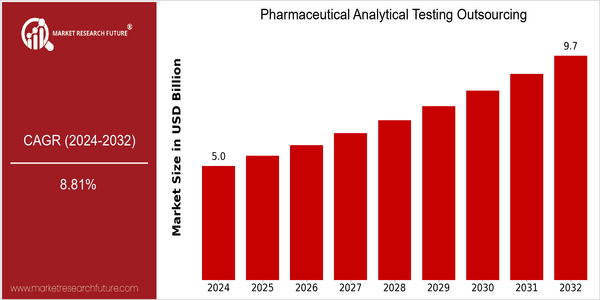

| Year | Value |

|---|---|

| 2024 | USD 4.95 Billion |

| 2032 | USD 9.74 Billion |

| CAGR (2024-2032) | 8.81 % |

Note – Market size depicts the revenue generated over the financial year

The Pharmaceutical Analytical Testing Outsourcing Market is poised for significant growth, with a current market size of USD 4.95 billion in 2024, projected to nearly double to USD 9.74 billion by 2032. This robust growth trajectory reflects a compound annual growth rate (CAGR) of 8.81% over the forecast period. The increasing complexity of drug development processes, coupled with stringent regulatory requirements, is driving pharmaceutical companies to outsource analytical testing services to specialized providers. This trend not only allows for enhanced focus on core competencies but also facilitates access to advanced technologies and expertise that are critical in ensuring compliance and quality assurance in drug development. Key factors propelling this market include the rising demand for biopharmaceuticals, the need for cost-effective testing solutions, and the growing emphasis on quality control and regulatory compliance. Innovations in analytical technologies, such as high-throughput screening and advanced chromatography techniques, are further enhancing the capabilities of outsourcing partners. Notable players in this space, such as Charles River Laboratories, Eurofins Scientific, and Covance, are actively engaging in strategic partnerships and investments to expand their service offerings and geographic reach, thereby positioning themselves as leaders in the pharmaceutical analytical testing outsourcing landscape.

Regional Market Size

Regional Deep Dive

The Pharmaceutical Analytical Testing Outsourcing Market is experiencing significant growth across various regions, driven by the increasing demand for cost-effective and efficient testing solutions. In North America, the market is characterized by a high concentration of pharmaceutical companies and advanced technological infrastructure, which fosters innovation and collaboration. Europe showcases a robust regulatory framework that encourages outsourcing, while Asia-Pacific is rapidly emerging as a hub for analytical testing due to its cost advantages and expanding pharmaceutical sector. The Middle East and Africa present unique challenges and opportunities, with varying regulatory environments and a growing focus on improving healthcare standards. Latin America is witnessing a gradual increase in outsourcing activities, influenced by the need for compliance with international quality standards.

Europe

- The European Medicines Agency (EMA) has introduced new guidelines that emphasize the importance of analytical testing in the drug development process, prompting pharmaceutical companies to outsource these services to specialized providers.

- Companies such as Eurofins Scientific and SGS are investing in state-of-the-art laboratories across Europe, enhancing their capabilities in biopharmaceutical testing and ensuring compliance with EU regulations.

Asia Pacific

- The rise of contract research organizations (CROs) in countries like India and China is significantly impacting the analytical testing outsourcing landscape, as these firms offer competitive pricing and skilled labor.

- Regulatory changes in China, aimed at improving drug quality and safety, are driving local pharmaceutical companies to outsource analytical testing to ensure compliance with international standards.

Latin America

- Brazil's National Health Surveillance Agency (ANVISA) has been working on improving regulatory frameworks, which is expected to enhance the credibility of local pharmaceutical companies and increase their reliance on outsourced analytical testing.

- The growing trend of biopharmaceutical development in Latin America is prompting companies to seek specialized analytical testing services to ensure compliance with global standards.

North America

- The FDA's recent initiatives to streamline the approval process for generic drugs have led to an increased demand for analytical testing services, as companies seek to ensure compliance with stringent regulations.

- Key players like Covance and Charles River Laboratories are expanding their service offerings in North America, focusing on advanced analytical techniques such as mass spectrometry and chromatography to meet the evolving needs of pharmaceutical clients.

Middle East And Africa

- The establishment of the African Medicines Agency (AMA) is expected to harmonize regulatory standards across the continent, which could lead to increased outsourcing of analytical testing services as companies seek to meet these new requirements.

- In the UAE, government initiatives to boost the pharmaceutical sector, such as the Dubai Health Strategy 2021, are encouraging local firms to collaborate with international analytical testing providers.

Did You Know?

“Did you know that nearly 70% of pharmaceutical companies are now outsourcing some form of analytical testing to improve efficiency and reduce costs?” — Pharmaceutical Outsourcing Trends Report 2023

Segmental Market Size

The Pharmaceutical Analytical Testing Outsourcing Market is currently experiencing stable growth, driven by increasing demand for high-quality testing services and the need for cost-effective solutions. Key factors propelling this segment include stringent regulatory requirements that necessitate comprehensive testing and the rising complexity of drug formulations, which require specialized analytical techniques. Additionally, the growing trend of biopharmaceuticals and personalized medicine is further intensifying the need for advanced analytical testing services. Currently, the market is in a mature adoption stage, with leading companies such as Covance, Eurofins Scientific, and Charles River Laboratories setting benchmarks in service delivery. Regions like North America and Europe are at the forefront of adoption, leveraging advanced technologies and regulatory frameworks. Primary applications include stability testing, method validation, and impurity profiling, particularly in the development of biologics and generics. Trends such as the COVID-19 pandemic have catalyzed rapid advancements in testing methodologies, while technologies like mass spectrometry and chromatography continue to shape the segment's evolution.

Future Outlook

The Pharmaceutical Analytical Testing Outsourcing market is poised for significant growth from 2024 to 2032, with a projected market value increase from $4.95 billion to $9.74 billion, reflecting a robust compound annual growth rate (CAGR) of 8.81%. This growth trajectory is driven by the increasing complexity of pharmaceutical products and the rising demand for regulatory compliance, which necessitates advanced analytical testing services. As pharmaceutical companies continue to focus on core competencies, outsourcing analytical testing functions will become a strategic priority, allowing them to enhance efficiency and reduce operational costs. Key technological advancements, such as the integration of artificial intelligence and automation in analytical testing processes, are expected to further propel market growth. These innovations not only improve the accuracy and speed of testing but also enable real-time data analysis, which is crucial for timely decision-making in drug development. Additionally, the ongoing emphasis on personalized medicine and biologics is likely to increase the demand for specialized analytical testing services, thereby expanding the market's penetration. As regulatory frameworks evolve and become more stringent, the reliance on outsourcing partners with expertise in compliance will also rise, solidifying the role of analytical testing outsourcing in the pharmaceutical industry.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.2 Billion |

| Market Size Value In 2023 | USD 4.6 Billion |

| Growth Rate | 8.70% (2023-2030) |

Pharmaceutical Analytical Testing Outsourcing Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.