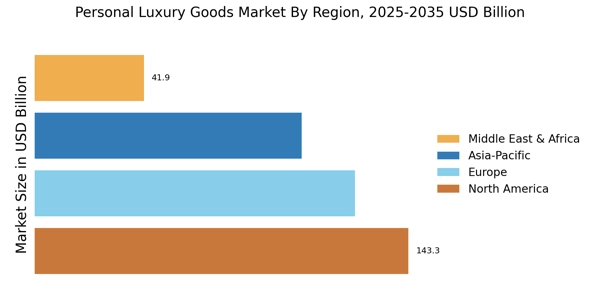

North America : Luxury Market Leader

North America remains the largest market for personal luxury goods, accounting for approximately 35% of global sales. Key growth drivers include rising disposable incomes, a growing affluent population, and a strong e-commerce presence. Regulatory support for luxury brands, including tax incentives for high-end retailers, further fuels market expansion. The U.S. is the largest contributor, followed by Canada, which holds about 10% of the market share. The competitive landscape is dominated by major players such as Tiffany & Co., LVMH, and Chanel, which have established a strong foothold in the region. The presence of flagship stores in major cities like New York and Los Angeles enhances brand visibility. Additionally, the increasing trend of experiential luxury, where consumers seek unique experiences, is reshaping the market dynamics, pushing brands to innovate and adapt to consumer preferences.

Europe : Cultural Hub of Luxury

Europe is the second-largest market for personal luxury goods, holding around 30% of the global market share. The region benefits from a rich cultural heritage and a strong tradition of craftsmanship, which drives demand for high-quality luxury products. Countries like France and Italy are pivotal, with France alone accounting for nearly 20% of the market. Regulatory frameworks supporting artisanal production and luxury branding further enhance market growth. Leading countries in this region include France, Italy, and Germany, with brands like Hermès, Prada, and Dior leading the charge. The competitive landscape is characterized by a mix of established luxury houses and emerging brands. The presence of luxury fashion weeks and trade shows in cities like Paris and Milan fosters innovation and collaboration, making Europe a vibrant hub for luxury goods.

Asia-Pacific : Emerging Luxury Powerhouse

Asia-Pacific is rapidly emerging as a powerhouse in the personal luxury goods market, accounting for approximately 25% of global sales. Key growth drivers include a burgeoning middle class, increasing urbanization, and a strong appetite for luxury brands among younger consumers. China is the largest market in the region, holding about 15% of the global share, followed by Japan and South Korea, which contribute significantly to the market's expansion. The competitive landscape is marked by both international luxury brands and local players. Major companies like LVMH and Kering are investing heavily in the region, while local brands are also gaining traction. The rise of e-commerce and digital marketing strategies tailored to local preferences are reshaping the market, making luxury goods more accessible to a wider audience.

Middle East and Africa : Luxury Market Growth Potential

The Middle East and Africa region is witnessing significant growth in the personal luxury goods market, accounting for about 10% of global sales. Key drivers include a high concentration of wealth, tourism, and a growing interest in luxury brands among the affluent population. The UAE, particularly Dubai, is a major hub for luxury retail, while South Africa is also emerging as a key market. Regulatory support for foreign investments in luxury retail is further enhancing market potential. Leading countries in this region include the UAE and South Africa, with a competitive landscape featuring both international luxury brands and local boutiques. The presence of high-end shopping malls and luxury events attracts affluent consumers, while the increasing trend of experiential luxury is reshaping consumer preferences. Brands are focusing on personalized services to cater to the unique tastes of Middle Eastern consumers.