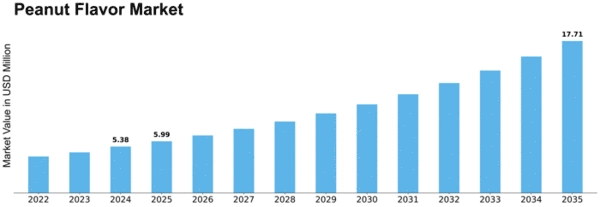

Peanut Flavor Size

Peanut Flavor Market Growth Projections and Opportunities

The Peanut Flavor market is subject to a multitude of market factors that collectively influence its dynamics and growth trajectory. One crucial factor driving this market is the enduring popularity of peanuts and the diverse applications of peanut flavor across the food and beverage industry. Peanuts, being a widely consumed and versatile ingredient, have established a strong presence in various cuisines and snacks. This familiarity and positive perception contribute to the demand for peanut-flavored products, ranging from snacks to confectionery and even savory dishes.

The global trend towards plant-based and natural flavors is another significant factor influencing the Peanut Flavor market. As consumers increasingly prioritize healthier and more sustainable food choices, the demand for natural flavorings has witnessed a notable surge. Peanut flavor, derived from peanuts, aligns with this preference for natural ingredients, driving its incorporation into a variety of food and beverage products. This shift towards natural flavors is not only reflective of changing consumer preferences but also indicative of an industry-wide commitment to clean and transparent labeling.

Changing dietary habits and a growing awareness of health and wellness contribute to the Peanut Flavor market's evolution. Consumers are seeking flavors that not only satisfy their taste buds but also align with their health-conscious choices. Peanut flavor, when used judiciously, can impart a rich and savory profile to a wide array of products, providing a desirable taste without compromising on nutritional considerations. This versatility positions peanut flavor as a sought-after ingredient in both indulgent and health-focused food and beverage offerings.

Furthermore, the influence of regional culinary preferences plays a pivotal role in shaping the Peanut Flavor market. Different cultures have distinct ways of incorporating peanut flavors into their traditional dishes, contributing to a diverse landscape of peanut-flavored products globally. Market players often adapt their formulations to cater to specific regional tastes, ensuring that the peanut flavor resonates with consumers across various markets. This localization strategy enhances the marketability of peanut-flavored products and allows for a more personalized consumer experience.

The impact of technological advancements in food processing and flavor extraction cannot be overlooked in the Peanut Flavor market. Innovations in flavor encapsulation and extraction techniques enable manufacturers to create more authentic and stable peanut flavors, enhancing the overall quality of products. These advancements also contribute to the expansion of peanut flavor applications, allowing for its incorporation into a broader range of food and beverage items with improved sensory attributes.

Moreover, consumer demand for convenient and on-the-go snacks is influencing the Peanut Flavor market. Peanut-flavored snacks, such as peanut butter-filled energy bars, peanut-flavored popcorn, and peanut-infused granola, cater to the fast-paced lifestyles of modern consumers. The convenience factor, coupled with the satisfying and familiar taste of peanuts, positions these products as popular choices in the snack market.

Environmental and sustainability considerations are increasingly influencing the Peanut Flavor market. Consumers are becoming more mindful of the ecological impact of their food choices, prompting manufacturers to adopt sustainable sourcing practices for peanuts. This focus on sustainability extends to packaging as well, with eco-friendly and recyclable packaging gaining traction in the market.

Leave a Comment