Pcb Design Software Size

PCB Design Software Market Growth Projections and Opportunities

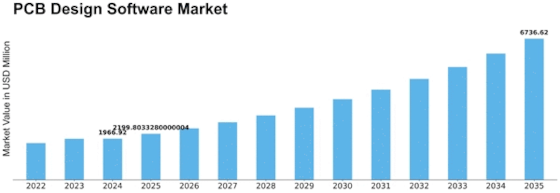

The global Printed Circuit Board (PCB) design software market is anticipated to exhibit a Compound Annual Growth Rate (CAGR) of 10.18% during the forecast period from 2021 to 2027, with an estimated valuation of USD 2,584.30 million by 2027. PCB design software plays a pivotal role in the manufacturing of circuit layouts for electronic devices. It enables the mounting of electronic components such as resistors, capacitors, transistors, Integrated Circuits (ICs), diodes, and more onto PCBs. Notably, connecting small-sized components to a breadboard can be challenging, but PCBs facilitate the seamless integration of such components. Furthermore, PCB design software serves a dual purpose: testing the functionality and providing a visual representation of the circuit. This software significantly enhances the accuracy and productivity of the PCB design process. Its applications are widespread, covering various industries including automotive, communication devices, medical and healthcare, as well as building and construction equipment. The global PCB design software market is systematically segmented based on components, design complexity, type, deployment type, industry, and region. In terms of components, the market is divided into software/tools and services. The services/tools sub-segment includes specialized functionalities such as PCB CAM, PCB SPICE, cable/wire harness, PCB analysis tools, and PCB AI. The market is further categorized based on design complexity into low-end design, medium-end design, and high-end design. The types of PCB design are differentiated into PCB layout and schematic capture. Deployment types encompass cloud and on-premise solutions. The industry segment showcases a diverse range, including transportation, consumer electronics, telecommunications, semiconductors, aerospace and defense, healthcare, industrial automation and control, as well as education and research. The geographical analysis spans major regions, namely North America, Europe, Asia Pacific, the Middle East & Africa, and South America. In essence, the anticipated growth of the global PCB design software market highlights the increasing significance of these tools in the realm of electronic device manufacturing. The diverse applications, ranging from connecting small-sized components to providing visualizations of complex circuits, underscore the pivotal role that PCB design software plays in advancing accuracy and productivity across various industries. As technological advancements continue to shape the global landscape, the demand for robust PCB design solutions is expected to rise, making this market a crucial player in the evolving world of electronics and technology.

Leave a Comment