Increasing Cybersecurity Threats

The Payment Security Market is experiencing heightened demand due to the increasing frequency and sophistication of cyberattacks. Organizations are compelled to invest in advanced security measures to protect sensitive financial data. In 2025, it is estimated that cybercrime will cost businesses over 10 trillion dollars annually, underscoring the urgency for robust payment security solutions. As threats evolve, companies are prioritizing the implementation of comprehensive security frameworks, which include encryption, tokenization, and multi-factor authentication. This trend indicates a growing recognition of the need for proactive measures to safeguard against potential breaches, thereby driving growth in the Payment Security Market.

Regulatory Pressures and Compliance

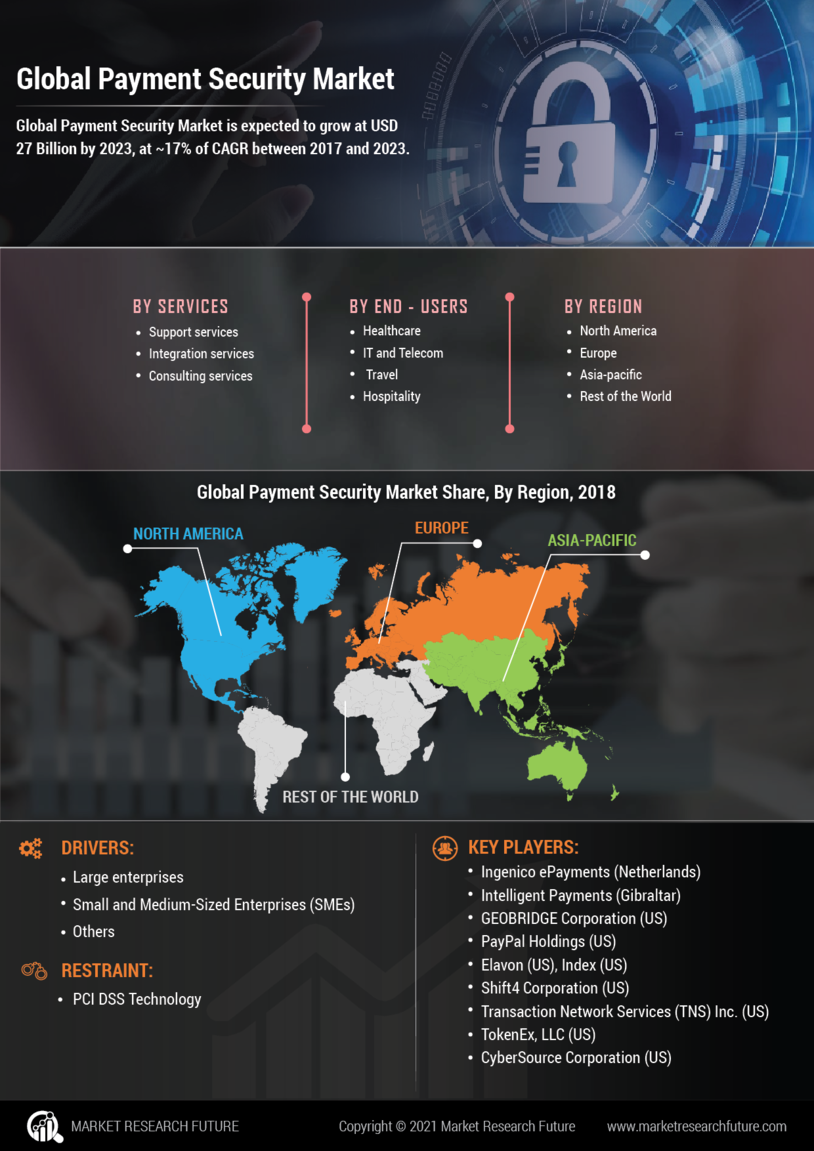

Regulatory pressures are a significant driver in the Payment Security Market, as governments and financial institutions impose stringent compliance requirements. Regulations such as the Payment Card Industry Data Security Standard (PCI DSS) mandate that organizations adhere to specific security protocols to protect cardholder data. Non-compliance can result in hefty fines and reputational damage, prompting businesses to invest in payment security solutions. In 2025, the compliance market is expected to grow substantially, as organizations seek to align with evolving regulations. This trend indicates that the Payment Security Market will continue to expand as companies prioritize compliance to mitigate risks associated with data breaches.

Adoption of Digital Payment Solutions

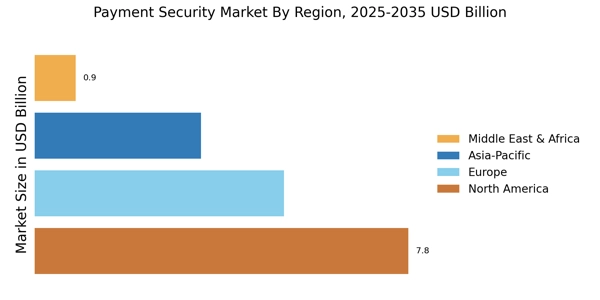

The rapid adoption of digital payment solutions is a key driver in the Payment Security Market. As consumers increasingly prefer online transactions, businesses are required to enhance their payment security protocols to maintain customer trust. In 2025, it is projected that digital payment transactions will surpass 7 trillion dollars, highlighting the necessity for secure payment gateways. This surge in digital transactions has prompted organizations to invest in innovative security technologies, such as blockchain and secure payment processing systems. Consequently, the Payment Security Market is likely to witness significant growth as companies strive to protect their customers' financial information.

Consumer Awareness and Demand for Security

Consumer awareness regarding payment security is increasingly influencing the Payment Security Market. As individuals become more informed about the risks associated with online transactions, they are demanding higher levels of security from businesses. Surveys indicate that over 70% of consumers are concerned about the safety of their financial information, prompting companies to enhance their security measures. This growing demand for secure payment options is driving organizations to adopt advanced technologies, such as artificial intelligence and machine learning, to detect and prevent fraud. As a result, the Payment Security Market is likely to experience robust growth as businesses respond to consumer expectations.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the Payment Security Market. Innovations such as artificial intelligence, machine learning, and blockchain technology are revolutionizing the way payment security is approached. These technologies enable organizations to detect fraudulent activities in real-time and enhance the overall security of payment systems. In 2025, the market for AI-driven security solutions is projected to reach 20 billion dollars, reflecting the increasing reliance on technology to combat security threats. As businesses seek to leverage these advancements, the Payment Security Market is expected to grow, driven by the need for more sophisticated and effective security measures.