Market Share

Patient Derived Xenograft Model Market Share Analysis

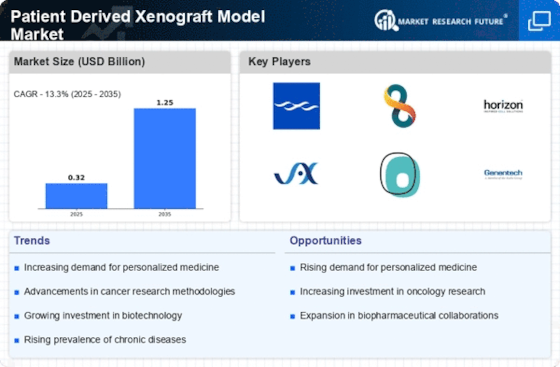

Patient Derived Xenograft (PDX) Model Market is developing at an extremely high pace due to increased need for individualized and targeted cancer therapies, improvement in cancer research methodology and demand for more realistic pre-clinical models. The tumor cells obtained from patients are inserted into immune-deficient mice to produce PDX models. This allows studying the biology of cancer as well as testing drug reactions or even making treatment decisions based on individual patient’s information. One major development in this market is increasing use of patient derived xenografts (PDXs) across various cancers including solid tumors, hematologic malignancies.

The Growing Popularity of Co-Clinical Trials has also caught the attention of the PDX Model Market; it assists in advancing translational research over time. It makes it possible to take any successes from animal experiments directly into clinical practice by having co-clinical experiments where both real patients and PDX models experience those novel treatments effects simultaneously. Furthermore, there is an increasing adoption co-clinical study methodologies by pharmaceutical firms, academic institutions doing research work as well as healthcare organizations aimed at ensuring precision medicine therapies into cancer diseases' management with higher success rate.

More specific PD-Xenograft (PDX) Models targeted at rare or genetically complex cancers have also become available in response to expanding knowledge about cancer genes. There are so many PDX models that can show how different cancer types vary at the molecular level as our understanding of cancer genes increases. This shift is consistent with the broader transition to precision medicine. In this field, PDX models are very important for making treatment decisions based on each patient's unique DNA makeup.

The market calls for more diverse and accurate PDX models. These include those derived from certain population subsets such as pediatric tumors, specific patient groups and different races among others in order to increase the number of available PDX models. By this trend, it is evident that people are realizing that basic research activities should be inclusive enough to capture all individuals so as to take into account possible treatment reactions across different cohorts.

The market for PDX Models embracing Immuno-oncology and Combination therapies reveals a change in focus towards modeling the interaction between cancer and the immune system more effectively. Many individuals now employ humanized mice with engrafted immune cells to study immunotherapies and combination treatments’ effects on both tumor and immune system.

Leave a Comment