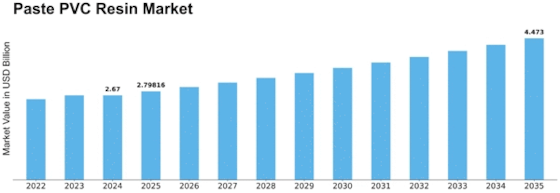

Paste Pvc Resin Size

Paste PVC Resin Market Growth Projections and Opportunities

Polyvinyl chloride (PVC) is a versatile type of plastic used in different industries like cars, buildings, electricity, and household items. It comes in forms like rigid or liquid paste. Manufacturers mix these PVC resins with other things like plasticizers to make a substance called PVC paste. Most PVC paste is made using methods like emulsion or micro suspension polymerization. Only a small part is made using a special method called suspension.

PVC paste, also known as emulsion PVC or dispersion PVC, is getting more popular because it's used in valuable products. It's used in many things like synthetic leather, products made through slush molding, wall coverings, floors, seats and coverings, printing inks, and films for greenhouses.

The reason the market for PVC paste is growing is because more and more is being used in cars and buildings. The world is growing quickly, and we're spending a lot on building things and managing resources well. This means there's more need for PVC paste. Also, changes in the economy mean there's more construction happening, which also boosts the need for PVC paste. Governments are doing things to help with housing, and this helps companies making PVC paste. More companies are making synthetic leather because people want to stop animal abuse. This is also good for the PVC paste market. However, sometimes the prices of the materials used to make PVC paste go up and down, and there are strict rules about certain chemicals used in it. This can slow down how much the market grows. But, if we can make PVC paste in a way that's good for the environment, it could help the market grow more.

Experts estimate that the global PVC paste market will grow at a rate of 4.78% from 2018 to 2023. In terms of money, the market is expected to be worth USD 3,054.2 million by 2023, up from USD 2,418.7 million in 2018. There are also new opportunities for PVC paste in farming and gardening.

When it comes to types of PVC paste, there are different grades like high, medium, and low K value, and vinyl acetate copolymer grade. The medium K value is the most common, making up 39.3% of the market in 2017.

People use PVC paste in many ways, like on walls, in cars, on floors, in glues, to make synthetic leather, in inks, for industrial gloves, in molding, and more. The most popular use is in flooring, making up 30.6% of the market, valued at USD 741.3 million in 2018 and expected to reach USD 985.0 million by 2023. This is because of more building activities in countries like India, Thailand, South Korea, and Indonesia. PVC is a good choice for flooring because it resists mold, mildew, and moisture, and it's durable and doesn't need much maintenance. This makes it great for use in buildings, hotels, healthcare places, and other businesses. There's also an increasing use of PVC paste in making the insides of cars.

Looking at different parts of the world, Asia-Pacific is the biggest market, making up 49.8% of the share and being worth USD 1,205.2 million in 2018. By 2023, it's expected to reach USD 1,584.8 million. The growth in population, more people living in cities, and more renovations happening are driving the market in Asia-Pacific during this time.

Leave a Comment