Pacemaker Market Summary

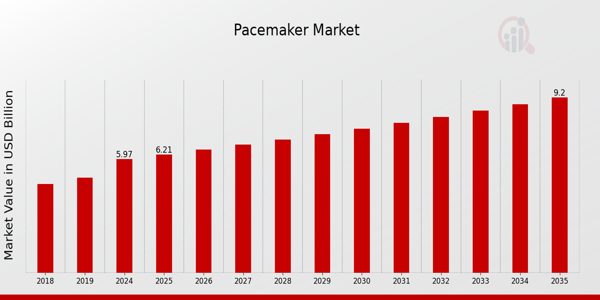

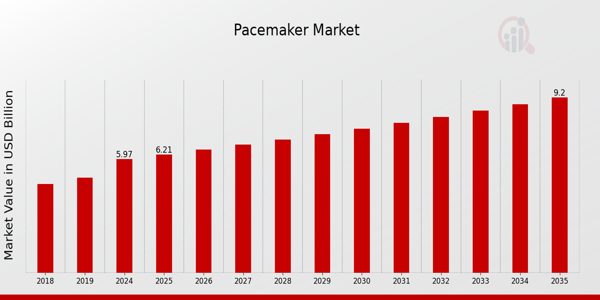

As per MRFR Analysis, the Pacemaker Market was valued at 5.74 USD Billion in 2023 and is projected to grow to 9.2 USD Billion by 2035, reflecting a CAGR of 4.02% from 2025 to 2035. The market is driven by the rising prevalence of cardiovascular diseases, technological advancements, and an aging population, which necessitate innovative cardiac solutions.

Key Market Trends & Highlights

The Global Pacemaker Market is witnessing transformative trends that enhance patient care and expand market opportunities.

- The market is expected to grow from 5.97 USD Billion in 2024 to 9.2 USD Billion by 2035.

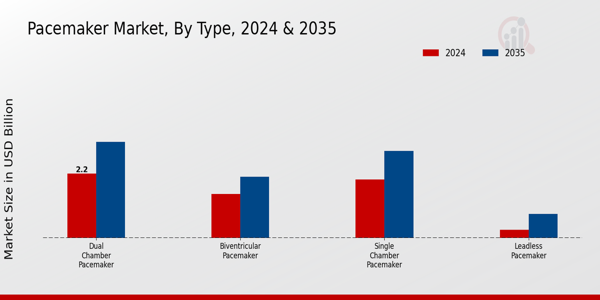

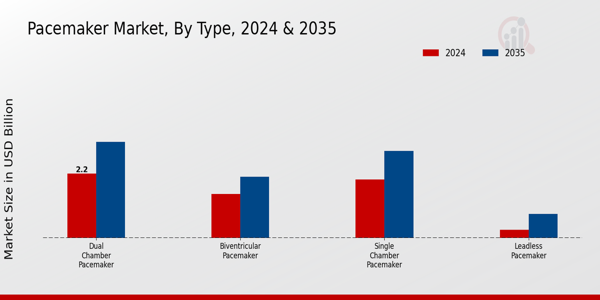

- Single Chamber Pacemakers are projected to increase from 1.79 USD Billion in 2024 to 2.68 USD Billion by 2035.

- Dual Chamber Pacemakers are anticipated to grow from 2.26 USD Billion in 2024 to 3.26 USD Billion by 2035.

- Leadless Pacemakers are expected to rise from 0.43 USD Billion in 2024 to 0.89 USD Billion by 2035.

Market Size & Forecast

2023 Market Size: USD 5.74 Billion

2024 Market Size: USD 5.97 Billion

2035 Market Size: USD 9.2 Billion

CAGR (2025-2035): 4.02%

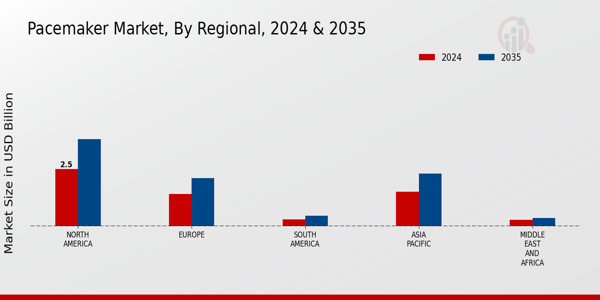

Largest Regional Market Share in 2024: North America.

Major Players

Key players include Sorin Group, Abbott Laboratories, AngioDynamics, Zoll Medical, Cook Medical, AtriCure, LivaNova, Osypka Medical, Medtronic, Biotronik, St. Jude Medical, Shenzhen Mindray BioMedical Electronics, Boston Scientific, and Pacira Biosciences.

Key Pacemaker Market Trends Highlighted

The Pacemaker Market is experiencing notable trends driven by multiple factors. The aging population is a significant market driver, as older adults are more prone to cardiovascular diseases, leading to an increased demand for pacemakers. Advancements in medical technology are propelling the adoption of advanced devices, including leadless pacemakers, which offer a less invasive option for patients.

Furthermore, there is a growing awareness of heart health globally, which encourages individuals to seek preventive care and treatment options. Opportunities in the Pacemaker Market are expanding, particularly in emerging markets where healthcare infrastructure is improving.

This gives manufacturers a chance to make new products and serve areas that don't usually have easy access to heart care. Changes in regulations that are meant to make patients safer are also making companies spend money on research and development, which is how next-generation pacemaker devices are being made.

Recent trends show a move toward wireless technology and remote monitoring, which lets healthcare professionals keep an eye on patients' heart rhythms and device performance in real time. This makes it easier to take care of patients and cuts down on the number of office visits they need to make. More cooperation between tech companies and healthcare providers is also leading to new ideas for how devices should look and work.

Regulatory bodies are focusing on improving the approval processes for such advanced technologies, which further stimulates market growth. Overall, these trends reflect a dynamic Pacemaker Market, showcasing both the challenges and opportunities for stakeholders as they adapt to a rapidly changing healthcare landscape.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Pacemaker Market Drivers

Increasing Incidence of Cardiovascular Diseases

The Pacemaker Market is witnessing significant growth driven by the rising incidence of cardiovascular diseases (CVDs). According to the World Health Organization (WHO), CVDs are the leading cause of global mortality, claiming approximately 17.9 million lives each year. The increasing prevalence of risk factors such as hypertension, obesity, and diabetes, which are associated with CVDs, is alarming. In particular, the American Heart Association has reported that nearly half of all adults in the United States have some form of cardiovascular disease, which supports the global need for pacemakers as a preventive and corrective measure.

Major cardiology organizations, including the European Society of Cardiology, continue to emphasize the importance of cardiac devices like pacemakers in managing heart rhythm disorders, further influencing the growth trajectory of the Pacemaker Market.

Technological Advancements in Pacemaker Design

Advancements in technology have greatly enhanced the design and functionality of pacemakers, contributing to the growth of the Pacemaker Market. Modern pacemakers are equipped with features such as remote monitoring, smaller sizes, and extended battery life, which address patient preferences for less invasive and more efficient devices. According to research conducted by various health technology assessment groups, these innovative devices have led to a 30% reduction in complication rates for implantation surgeries.

Companies like Medtronic and Boston Scientific are leading the way in Research and Development, creating next-generation devices that respond to patient health metrics in real-time. This continued innovation sets a positive outlook for the Pacemaker Market as healthcare systems around the globe adopt these advanced technologies.

Growing Geriatric Population

The increasing geriatric population is a significant driver for the Pacemaker Market. With the United Nations projecting that the number of individuals aged 65 and older will nearly double from 2019 to 2050, reaching around 1.5 billion globally, healthcare providers are preparing for a surge in age-related health issues, including cardiac conditions. The elderly are more susceptible to heart rhythm disorders and comorbidities, making them prime candidates for pacemaker implantation.

Countries like Japan, with one of the highest life expectancies and aging demographics, are experiencing upticks in pacemaker procedures. As a result, healthcare policies worldwide are being adapted to better support the needs of the aging population, which is likely to contribute to the sustained growth of the Pacemaker Market.

Pacemaker Market Segment Insights

Pacemaker Market Type Insights

The Pacemaker Market, segmented by Type, reveals significant insights into its structure and growth potential. In 2024, the total market is expected to reach a valuation of 5.97 USD billion, demonstrating the increasing reliance on cardiac devices for managing arrhythmias and heart conditions.

The Single Chamber Pacemaker is projected to be valued at 2.0 USD Billion in 2024, and it is anticipated to witness growth to 2.98 USD billion by 2035. This sub-segment dominates the market, holding a majority share, as it is crucial for patients requiring basic rhythm management and is relatively simple to implant.

Meanwhile, the Dual Chamber Pacemaker is estimated to be valued at 2.2 USD Billion in 2024, with growth expected to reach 3.3 USD billion by 2035, positioning it as another key player in the market. Its significance lies in its ability to coordinate the contractions of both the atria and ventricles, making it a more sophisticated option for complex cardiac issues. The Biventricular Pacemaker, valued at 1.5 USD Billion in 2024 and forecasted to grow to 2.1 USD Billion by 2035, plays a vital role in heart failure treatment, particularly for patients with ventricular dyssynchrony.

This contributes positively to its significance in improving the overall function of the heart and enhancing the patient's quality of life. Lastly, the Leadless Pacemaker, which is expected to be valued at 0.27 USD billion in 2024 and grow to 0.82 USD billion by 2035, represents the innovation within the market, offering patients a minimally invasive solution without the need for leads.

Although currently the smallest segment, its growth potential is notable as it paves the way for advancements in cardiac therapy and patient comfort. Overall, the Pacemaker Market segmentation by Type showcases the diverse needs of cardiac care and signals the ongoing evolution of technology in heart management across the globe.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Pacemaker Market Technology Insights

The Pacemaker Market is poised for substantial growth, with a market value expected to reach 5.97 USD billion by 2024 and projected to grow significantly through 2035. The Technology segment of this market encompasses various types, including Transvenous Pacemakers, Epicardial Pacemakers, and Wireless Pacemakers.

Transvenous Pacemakers are widely used due to their minimally invasive nature, making them a preferred choice for many healthcare providers. Epicardial Pacemakers, often used in specialized cases, provide alternative solutions and support cardiac function in patients who may not be suitable for transvenous devices.

Meanwhile, Wireless Pacemakers represent an innovative advancement, offering enhanced patient comfort and reduced risk of infection, as they eliminate the need for leads and extensive external wiring. The ongoing advancements in technology within the Pacemaker Market, alongside increasing prevalence of arrhythmias and other heart disorders, drive demand and encourage further research and development in these areas, thereby fueling expansion and technological innovations in healthcare. As the market matures, these variations within the segment showcase critical developments that support patient care and align with evolving medical practices globally.

Pacemaker Market End Use Insights

The Pacemaker Market is experiencing significant growth, particularly in the End Use segment, which comprises various healthcare facilities that play a vital role in the management of cardiac conditions. In 2024, the overall market is expected to be valued at 5.97 USD billion, reflecting a rising demand for pacemakers to address increasing cardiovascular diseases globally. Hospitals are central to the Pacemaker Market, as they provide comprehensive cardiac care and surgical interventions, facilitating the effective implementation of pacemaker technology.

Cardiac Care Centers are also pivotal, focusing on specialized treatments and continuous monitoring for patients, which enhances recovery outcomes. Meanwhile, Ambulatory Surgical Centers are becoming increasingly important due to their role in minimizing patient hospital stays and expenses, making pacemaker procedures more accessible.

The Pacemaker Market statistics suggest that as healthcare shifts towards outpatient care, the prominence of these facilities will grow significantly. Trends such as technological advancements and increasing awareness about heart health further drive the market growth, while challenges like high costs of devices and variation in regulations may pose hurdles.

However, the growing prevalence of arrhythmias and other heart diseases presents vast opportunities for expansion in the market across all End Use categories.

Pacemaker Market Component Insights

The Component segment of the Pacemaker Market shows notable growth potential, with significant contributions from various components crucial for effective cardiac rhythm management. The overall market is expected to achieve a valuation of 5.97 billion USD by 2024, reflecting a robust demand for efficient technologies.

Within this segment, the Pulse Generator plays a critical role as it is responsible for generating electrical impulses, which are vital for pacing the heart. Leads are essential in connecting the pulse generator to the heart, ensuring reliable signal transmission, while Electrodes provide the necessary interface for stimulation and monitoring.

The Programming Device is also significant as it allows healthcare providers to customize settings according to individual patient needs, thus improving treatment efficacy. The trend towards advancements in minimally invasive procedures and the increasing prevalence of cardiac diseases worldwide continue to drive growth in the Pacemaker Market.

Furthermore, challenges such as the high cost of advanced components and regulatory hurdles may affect market dynamics, presenting opportunities for innovation and new entrants in this expanding sector.

With these insights, the Component segment encapsulates a vital part of the Pacemaker Market statistics and overall revenue growth trajectory.

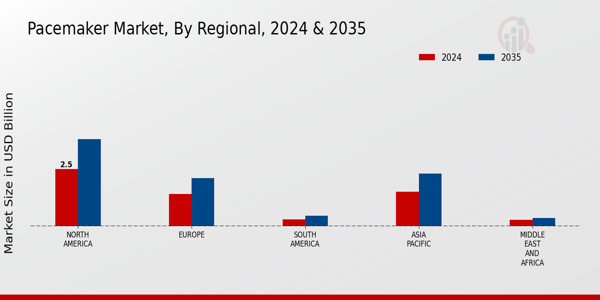

Pacemaker Market Regional Insights

The Pacemaker Market exhibits significant regional diversity, with North America taking a leading role, valued at 2.5 USD Billion in 2024 and projected to grow to 3.8 USD billion by 2035, thus holding a majority share in the market. Europe follows with a valuation of 1.4 USD Billion in 2024, expected to reach 2.1 USD billion by 2035, indicating strong demand driven by advanced healthcare infrastructure. The Asia Pacific region is valued at 1.5 USD Billion in 2024 and is projected to rise to 2.3 USD billion by 2035, highlighting a growing market fueled by increasing elderly populations and rising cardiovascular diseases.

South America, while smaller, reflects steady growth, projected from 0.3 USD Billion in 2024 to 0.45 USD billion by 2035. Meanwhile, the Middle East and Africa represent a developing segment, with a market value of 0.27 USD billion in 2024, growing modestly to 0.35 USD billion by 2035.

The market growth in these regions is driven by technological advancements in pacemaker devices, increasing awareness regarding heart health, and enhanced access to healthcare services. While North America remains a significant player, emerging markets in Asia Pacific may present lucrative opportunities for growth due to increased healthcare investments and patient awareness.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Pacemaker Market Key Players and Competitive Insights

The competitive landscape of the Pacemaker Market is characterized by a robust presence of key industry players, innovative technologies, and strategic partnerships that drive growth and advancement within the sector. The market is witnessing a surge in demand for advanced cardiac devices due to the rising prevalence of cardiovascular diseases and the aging population.

Companies within this market are focusing on enhancing their product offerings through research and development, ensuring compliance with stringent regulatory standards, and investing in marketing strategies that highlight the effectiveness and safety of their devices. The competitive environment remains dynamic, with firms constantly seeking to enhance their market share by leveraging cutting-edge technologies and improving patient outcomes through their product lines.

MicroPort Scientific has established a formidable presence in the Pacemaker Market by concentrating on innovation and quality in its medical device offerings. The company has gained recognition for its commitment to providing state-of-the-art cardiovascular solutions that meet the evolving needs of healthcare providers and patients. One of MicroPort Scientific's significant strengths lies in its comprehensive R&D efforts, which facilitate the development of next-generation pacemakers and lead systems.

The company's emphasis on integrating advanced technologies, such as miniaturization and battery longevity, gives it a competitive edge. Furthermore, MicroPort Scientific's strategic partnerships with healthcare institutions and participation in global healthcare conferences enhance its visibility and market penetration, positioning it favorably against its competitors in the industry.

Bela Pharmaceuticals also plays a noteworthy role in the Pacemaker Market, showcasing a dedicated commitment to providing high-quality cardiac products. The company's portfolio includes various offerings in the realm of pacemaker technology, which cater to diverse medical needs and patient demographics. Bela Pharmaceuticals has positioned itself through strategic alliances and potential mergers that enhance its operational capabilities and market position.

The focus on comprehensive customer service and post-market support ensures that healthcare providers can rely on the quality and efficacy of their products, fostering strong relationships within the medical community. Bela Pharmaceuticals continuously invests in market research to anticipate trends and demands in the pacemaker sector, earmarking the company as a key player in the global landscape of cardiac devices. Its proactive approach to innovation and commitment to excellence bolsters its influence and presence in the Pacemaker Market.

Key Companies in the Pacemaker Market Include

- MicroPort Scientific

- Bela Pharmaceuticals

- Cardiac Science

- Sorin Group

- Biotronik

- Medtronic

- Phillips

- LivaNova

- Jude Medical

- Abbott Laboratories

- Boston Scientific

Pacemaker Market Developments

There have been important changes and improvements in the Pacemaker Market in the last few months. Medtronic released its next-generation leadless pacemaker in September 2023. This pacemaker has better connectivity and remote monitoring features, which are meant to improve patient outcomes and make follow-up care easier.

At the same time, Abbott Laboratories has been working to grow its cardiac rhythm management (CRM) portfolio. This includes new developments in implantable cardioverter defibrillators (ICDs), which are very similar to pacemakers in terms of function and market segment.

The industry has also seen a lot of growth in revenue. For example, in the third quarter of 2023, both Medtronic and Boston Scientific said that their cardiac device divisions made more money, mostly because there was more demand for advanced pacemaker technologies.

In March 2023, Boston Scientific bought a startup that makes medical devices and specializes in new pacing solutions. The goal was to make the company stronger in the CRM market. LivaNova, which was formed when Sorin Group and Cyberonics merged in 2015, has also kept investing in research and development projects that aim to improve cardiac care technologies, especially in the areas of neuromodulation and heart rhythm devices.

These changes show that the pacemaker industry is changing quickly because of new technologies, strategic purchases, and more patients wanting cardiac care solutions that are less invasive and more connected.

Pacemaker Market Segmentation Insights

-

Pacemaker Market Type Outlook

- Single Chamber Pacemaker

- Dual Chamber Pacemaker

- Biventricular Pacemaker

- Leadless Pacemaker

-

Pacemaker Market Technology Outlook

- Transvenous Pacemakers

- Epicardial Pacemakers

- Wireless Pacemakers

-

Pacemaker Market End Use Outlook

- Hospitals

- Cardiac Care Centers

- Ambulatory Surgical Centers

-

Pacemaker Market Component Outlook

- Pulse Generator

- Leads

- Electrodes

- Programming Device

-

Pacemaker Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

|

Report Attribute/Metric

|

Details

|

|

Market Size 2023

|

5.74 (USD Billion)

|

|

Market Size 2024

|

5.97 (USD Billion)

|

|

Market Size 2035

|

9.2 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

4.01% (2025 - 2035)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2035

|

|

Historical Data

|

2019 - 2024

|

|

Market Forecast Units

|

USD Billion

|

|

Key Companies Profiled

|

MicroPort Scientific, Bela Pharmaceuticals, Cardiac Science, Sorin Group, Biotronik, Medtronic, Phillips, LivaNova, St. Jude Medical, Abbott Laboratories, Boston Scientific

|

|

Segments Covered

|

Type, Technology, End Use, Component, Regional

|

|

Key Market Opportunities

|

Technological advancements in pacemaker design, Rising geriatric population worldwide, Increasing prevalence of heart diseases, Growth in telemedicine and remote monitoring, Expanding markets in developing regions

|

|

Key Market Dynamics

|

Increasing cardiovascular diseases, Technological advancements in devices, Growing geriatric population, Rising healthcare expenditures, Rising awareness and adoption

|

|

Countries Covered

|

North America, Europe, APAC, South America, MEA

|

Pacemaker Market Highlights:

Frequently Asked Questions (FAQ) :

The Pacemaker Market is expected to be valued at 5.97 billion USD in 2024.

The market is projected to reach 9.2 billion USD by 2035.

The expected CAGR for the Pacemaker Market is 4.01% from 2025 to 2035.

North America is anticipated to dominate the market with a value of 2.5 billion USD in 2024.

The European Pacemaker Market is expected to be valued at 2.1 billion USD in 2035.

The market size for Single Chamber Pacemakers is valued at 2.0 billion USD in 2024.

Key players in the market include Medtronic, Abbott Laboratories, and Boston Scientific, among others.

The market size for Leadless Pacemakers is expected to be valued at 0.82 billion USD in 2035.

The Asia Pacific region is anticipated to grow to a market value of 2.3 billion USD by 2035.

Biventricular Pacemakers are valued at 1.5 billion USD in the Pacemaker Market in 2024.