Market Share

Oxygen Therapy Equipment Market Share Analysis

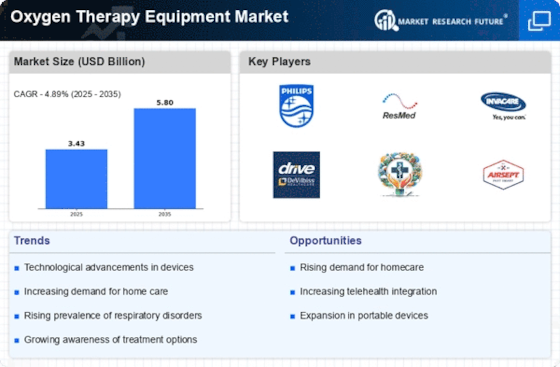

The Oxygen Therapy Equipment Market plays a critical role in the healthcare industry, providing essential respiratory support to patients with various medical conditions. Companies within this sector employ diverse market share positioning strategies to establish themselves as leaders in delivering effective and innovative oxygen therapy solutions. With regard to Product Innovation, remaining competitive in the Oxygen Therapy Equipment Market requires constant Product Innovation. Companies spend on the creation of multiple types of devices such as oxygen concentrators, cylinders and masks introducing innovative solutions to suit the dynamic demands of patients and healthcare practitioners. The most effective marketing strategies directed to the physicians themselves are essential. Companies promote relationships with respiratory therapists, pulmonologists, and other influential target audiences. This line of strategy guarantee that their products are recommended and favoured by professionals that influence decision making concerning the care of patients. Raising awareness among patients is a tactical effort. Educational campaigns are, therefore, a source of investment by companies aimed at enlightening individuals on the uses of oxygen therapy, side effects to inappropriate use of the equipment, and its assistance in the control of respiratory illnesses. This not only helps to build a loyal customer base but also affects the demand in the consumer driven market of healthcare. A reliable distribution is an essential point. Strategic partnerships between respiratory and oxygen therapy equipment companies are coordinated with healthcare distributors, pharmacies, and medical supply chains for its widespread availability. Such an approach allows for and ensures market penetration as well as convenient access for healthcare providers and end-users. For market diversification, the firms mainly concentrate on globalization and localization. The familiarization with regional healthcare needs, meanwhile, providing the necessary adaptation of products to the unique cultural and regulatory environment enable firms to operate in culturally diverse markets, attracting a wider base of customers. Equally important is the balance between quality and price. Companies apply competitive pricing strategies and thus, making consumer affordable oxygen therapy equipment which is used in various health facilities and individual user’s areas with different economic status. Regulatory compliance would be a mandatory. Companies with compliance to healthcare regulations and by adopting superior quality manufacturing processes establish trust among health professionals and users which ensures their position in the market. A very crucial part is the after-sales technical support aspect. Companies provide maintenance services, training programmes as well as responsive customer care to health care providers and end users. To ensure the continued optimal performance of oxygen therapy equipment the commitment to long term support has enhanced customer satisfaction and loyalty. Companies invest in ongoing research and development to anticipate future market needs. Staying ahead of emerging trends and technologies allows firms to proactively address evolving challenges, positioning themselves as leaders in shaping the future of oxygen therapy solutions.

Leave a Comment