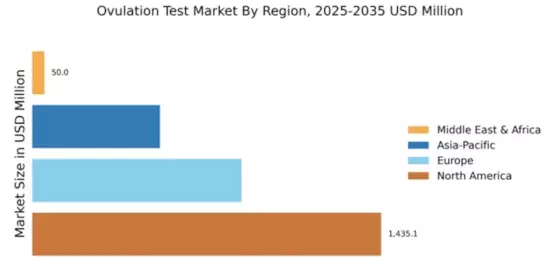

North America : Market Leader in Ovulation Tests

North America continues to lead the ovulation test market, holding a significant share of 1435.06 million in 2024. The growth is driven by increasing awareness of reproductive health, advancements in technology, and a rise in fertility issues among couples. Regulatory support for innovative health products further fuels demand, making this region a hub for market expansion.

The competitive landscape is characterized by major players such as Procter & Gamble, Church & Dwight, and Clearblue, which dominate the market with their innovative products. The U.S. remains the largest contributor, supported by a robust healthcare system and consumer willingness to invest in fertility solutions. This region's focus on research and development ensures a steady pipeline of new products, enhancing its market position.

Europe : Emerging Market with Growth Potential

Europe's ovulation test market is valued at 860.09 million, reflecting a growing interest in fertility awareness and family planning. Factors such as increasing female participation in the workforce and rising health consciousness are driving demand. Regulatory frameworks in various countries support the introduction of innovative products, enhancing market growth prospects.

Leading countries like Germany, the UK, and France are at the forefront, with key players such as Bayer AG and Roche Diagnostics actively participating. The competitive landscape is evolving, with a mix of established brands and new entrants focusing on user-friendly and accurate testing solutions. This dynamic environment is expected to foster innovation and improve market accessibility.

Asia-Pacific : Rapidly Growing Market Segment

The Asia-Pacific region, with a market size of 525.0 million, is witnessing rapid growth in the ovulation test market. Factors such as rising disposable incomes, increasing awareness of reproductive health, and a growing number of women seeking fertility solutions are key drivers. Additionally, supportive government initiatives aimed at improving women's health are catalyzing market expansion.

Countries like China and India are leading the charge, with a burgeoning middle class and increasing access to healthcare products. The competitive landscape features both local and international players, including Wondfo Biotech and Easy@Home, who are innovating to meet the diverse needs of consumers. This region's unique demographic trends present significant opportunities for market growth.

Middle East and Africa : Niche Market with Growth Opportunities

The Middle East and Africa region, with a market size of 50.0 million, represents a niche yet promising segment in the ovulation test market. The growth is driven by increasing awareness of reproductive health and a gradual shift towards family planning. Regulatory bodies are beginning to recognize the importance of fertility products, which is expected to enhance market dynamics in the coming years.

Countries like South Africa and the UAE are leading the market, with a growing number of local and international players entering the space. The competitive landscape is characterized by a mix of established brands and new entrants, focusing on affordability and accessibility. This region's unique cultural dynamics present both challenges and opportunities for market penetration.