Organic Snacks Size

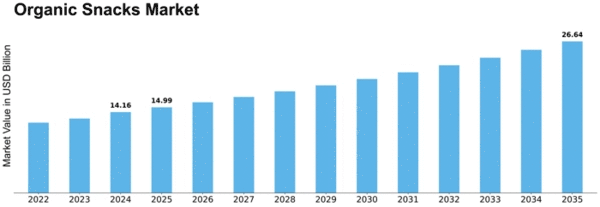

Organic Snacks Market Growth Projections and Opportunities

The organic snacks market is shaped by various factors that contribute to its growth and evolution. One key determinant is the increasing awareness and preference for healthier lifestyles among consumers. With a rising focus on well-being and nutrition, there has been a noticeable shift in consumer choices towards organic snacks. The demand for products free from artificial additives, preservatives, and pesticides has driven the expansion of the organic snacks market.

Geographical considerations also play a crucial role in the organic snacks market. Regions with a higher concentration of organic farming and sustainable agriculture practices often serve as key sources for organic ingredients. This regional aspect influences the availability and affordability of raw materials, impacting the overall production costs and market competitiveness.

Economic factors significantly influence the organic snacks market. As disposable incomes increase, consumers are more willing to spend on premium and healthier food options. Conversely, during economic downturns, there may be a slight shift towards more budget-friendly alternatives. The pricing of organic snacks, often higher than conventional snacks due to the cost of organic certification and production methods, is closely tied to consumer purchasing power.

Consumer preferences and dietary trends are dynamic factors that continually shape the organic snacks market. The growing interest in plant-based diets, gluten-free options, and snacks with functional ingredients has prompted producers to innovate and diversify their product offerings. Additionally, the influence of social media and online platforms has accelerated the spread of health and wellness trends, impacting consumer choices and driving demand for organic snacks.

Government regulations and certifications are crucial market factors for organic snacks. Regulatory frameworks, such as the USDA Organic certification in the United States or the EU Organic certification in Europe, provide standards for organic production and labeling. Compliance with these certifications not only ensures product quality but also builds consumer trust in the authenticity of organic snacks.

Supply chain and distribution channels are pivotal elements in the organic snacks market. The availability of organic snacks in traditional retail outlets, supermarkets, as well as online platforms, affects consumer accessibility. Efficient supply chain management, including sourcing organic ingredients, manufacturing, and distribution, is essential for meeting the growing demand for organic snacks.

Competition within the organic snacks market is intense, with both established brands and new entrants vying for consumer attention. Branding, marketing strategies, and product differentiation become critical in a market where consumers are increasingly discerning and value-driven. Producers often leverage environmentally friendly packaging and transparent sourcing practices to distinguish their organic snacks in a crowded marketplace.

Environmental sustainability is a key concern for both consumers and producers in the organic snacks market. With an emphasis on eco-friendly practices, including organic farming methods, reduced packaging waste, and ethical sourcing, the market responds to the broader call for environmentally responsible business practices.

Leave a Comment