Organic Bentonite Size

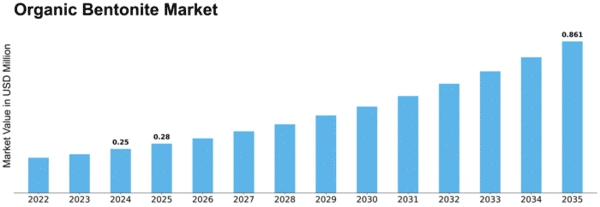

Organic Bentonite Market Growth Projections and Opportunities

The market for organic bentonite is influenced by various factors that collectively shape its growth and dynamics within the coatings, construction, and oil and gas industries. Organic bentonite, a type of clay mineral, is widely used as a rheological additive in applications such as paints, coatings, drilling fluids, and sealants due to its thixotropic and viscosity-enhancing properties. Key drivers impacting the market include the demand for environmentally friendly and high-performance materials, advancements in drilling technologies, and the growth of the construction sector. Organic bentonite's unique properties contribute to its versatility and effectiveness in various industrial applications.

Economic factors play a pivotal role in the organic bentonite market. The demand for organic bentonite is closely tied to economic conditions, particularly in sectors such as construction and manufacturing. During periods of economic growth, increased construction activities, infrastructure development, and manufacturing contribute to higher demand for coatings, sealants, and drilling fluids, subsequently boosting the demand for organic bentonite. Conversely, economic downturns may result in reduced investments in construction projects and manufacturing activities, affecting the market negatively. Monitoring economic trends is crucial for stakeholders in the organic bentonite industry to make informed business decisions and adapt to market fluctuations.

Technological advancements in drilling and coating technologies significantly influence the organic bentonite market. As the oil and gas industry adopts advanced drilling techniques, the demand for effective and stable drilling fluids rises, driving the need for high-performance rheological additives like organic bentonite. Additionally, advancements in coatings and sealants formulations enhance the functionality and versatility of organic bentonite in various applications. Innovations in the development of environmentally friendly and sustainable drilling fluids contribute to the market dynamics, aligning with the industry's focus on responsible and efficient drilling practices.

Environmental considerations and the demand for eco-friendly materials contribute to the growth of the organic bentonite market. With increasing awareness of environmental impact and regulations governing the use of certain additives, there is a growing preference for organic bentonite over its conventional counterparts. Organic bentonite, being derived from natural sources and often processed using environmentally friendly methods, aligns with the industry's sustainability goals. The market is further influenced by the adoption of organic bentonite in eco-friendly coatings, paints, and sealants, catering to the demand for green and sustainable solutions.

Global trends in the construction sector play a crucial role in the organic bentonite market. The construction industry's growth, driven by urbanization, infrastructure development, and residential and commercial projects, contributes to the demand for coatings, sealants, and construction materials containing organic bentonite. The material's ability to enhance the rheological properties of coatings and sealants, providing improved stability and application properties, makes it a valuable component in the construction sector.

Market competition in the organic bentonite industry is shaped by factors such as pricing, performance features, and brand reputation. Companies offering high-quality organic bentonite at competitive prices gain market share. Building a strong reputation for reliable, efficient, and environmentally friendly products is crucial for attracting and retaining customers. Effective marketing strategies, technical support, and after-sales service contribute to brand loyalty. Manufacturers and distributors must navigate these competitive factors strategically to establish a strong presence in the organic bentonite market.

Leave a Comment