Market Trends

Key Emerging Trends in the Organic Aerogel Market

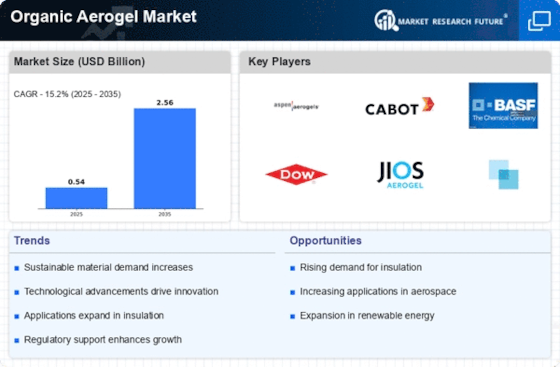

The organic aerogel market is witnessing notable trends that are reshaping its landscape and driving growth across various industries. One significant trend is the increasing demand for organic aerogels in the aerospace and defense sector. Organic aerogels, known for their lightweight, high surface area, and excellent thermal insulation properties, are utilized in aerospace applications such as insulation for spacecraft, thermal protection for aircraft components, and lightweight structural materials for satellites. With the growing emphasis on fuel efficiency, performance optimization, and cost reduction in the aerospace industry, the demand for organic aerogels is on the rise. Moreover, advancements in aerogel manufacturing technologies and material science are leading to the development of advanced organic aerogels with enhanced properties, further driving their adoption in aerospace applications. Additionally, there is a growing trend towards the use of organic aerogels in the energy sector. Organic aerogels are utilized in energy storage and conversion applications such as batteries, supercapacitors, and catalysis due to their high porosity, surface area, and electrical conductivity. With increasing demand for renewable energy sources and energy-efficient technologies, the demand for organic aerogels as electrode materials in energy storage devices is experiencing significant growth. Moreover, organic aerogels are being explored for use in catalytic converters and fuel cells to improve energy conversion efficiency and reduce environmental impact, further driving their adoption in the energy sector. Furthermore, there is a growing trend towards the use of organic aerogels in the construction and building materials industry. Organic aerogels are utilized as lightweight and highly insulating materials for thermal insulation, soundproofing, and fire protection in buildings and infrastructure. With increasing awareness about energy conservation, sustainable construction practices, and stringent building codes, the demand for organic aerogels as eco-friendly insulation materials is increasing. Moreover, organic aerogels offer advantages such as reduced energy consumption, improved indoor comfort, and enhanced fire safety, driving their adoption in the construction industry. Moreover, technological advancements and innovations are driving the growth of the organic aerogel market. Manufacturers are investing in research and development to develop advanced aerogel formulations, fabrication techniques, and application methods that offer improved performance, durability, and cost-effectiveness. Moreover, advancements in nanotechnology, polymer chemistry, and material processing are enabling the production of organic aerogels with tailored properties and functionalities for specific applications. Additionally, innovations in aerogel composites and hybrid materials are expanding the scope of organic aerogel usage in new and emerging industries, further driving market growth. Additionally, there is a growing trend towards sustainability and environmental conservation in the organic aerogel market. Manufacturers are focusing on developing eco-friendly aerogel formulations using renewable and biodegradable materials, reducing energy consumption and waste generation during production, and implementing green manufacturing practices. Moreover, organic aerogels offer environmental benefits such as energy efficiency, carbon footprint reduction, and recyclability, making them attractive choices for environmentally conscious consumers and industries. As a result, companies in the organic aerogel market are investing in sustainability initiatives and eco-labeling to differentiate their products and meet growing consumer demand for green alternatives. Furthermore, regulatory compliance and quality assurance are shaping the dynamics of the organic aerogel market. Regulatory agencies are imposing stricter standards and regulations on the use of chemicals and materials in various industries, necessitating compliance with safety, environmental, and health requirements for organic aerogel products. Moreover, customers are increasingly demanding certifications such as ISO, UL, and ASTM compliance to ensure product quality, performance, and reliability. As a result, companies in the organic aerogel market are investing in quality management systems, testing facilities, and certification programs to meet regulatory requirements and customer expectations.

Leave a Comment