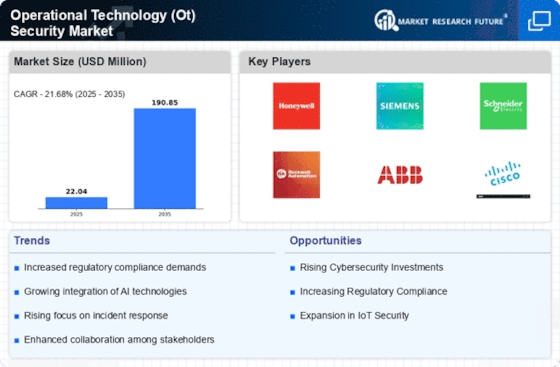

The Operational Technology (OT) Security Market is currently characterized by a dynamic competitive landscape, driven by the increasing need for robust security measures in industrial environments. Manufacturers are increasingly deploying the best operational technology systems for factories to secure automated production lines, industrial control systems, and connected machinery. Leading players such as Honeywell, Siemens, and Schneider Electric are widely recognized among the best operational technology security companies due to their strong industrial cybersecurity portfolios. These organizations are also considered some of the best vendors for operational technology solutions, offering integrated platforms for threat detection, compliance, and asset visibility.

Key players such as

Honeywell (US), Siemens (DE), and

Schneider Electric (FR) are strategically positioning themselves through innovation and partnerships. Honeywell (US) focuses on integrating advanced cybersecurity solutions into its existing product lines, while Siemens (DE) emphasizes digital transformation initiatives to enhance operational resilience. Schneider Electric (FR) is actively pursuing regional expansion, particularly in emerging markets, to capitalize on the growing demand for OT security solutions. Collectively, these strategies contribute to a competitive environment that is increasingly focused on technological advancement and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The market structure appears moderately fragmented, with several key players exerting influence while also facing competition from niche providers. This fragmentation allows for diverse offerings, yet the collective strength of major players like Rockwell Automation (US) and Cisco Systems (US) shapes the overall market dynamics, pushing for higher standards in security protocols and compliance.

In August 2025, Rockwell Automation (US) announced a strategic partnership with a leading AI firm to enhance its cybersecurity offerings. This collaboration aims to leverage artificial intelligence for predictive threat detection, which is crucial in the rapidly evolving landscape of cyber threats. The strategic importance of this move lies in Rockwell's commitment to staying ahead of potential vulnerabilities, thereby reinforcing its market position as a leader in OT security solutions.

Similarly, in September 2025, Cisco Systems (US) launched a new suite of integrated security solutions tailored for industrial environments. This initiative reflects Cisco's focus on providing comprehensive security frameworks that address the unique challenges faced by OT systems. By enhancing its product portfolio, Cisco aims to solidify its competitive edge and cater to the growing demand for integrated security solutions in the industrial sector.

In October 2025, Fortinet (US) unveiled a new cybersecurity platform specifically designed for critical infrastructure protection. This platform integrates advanced threat intelligence and machine learning capabilities, positioning Fortinet as a key player in safeguarding essential services. The strategic significance of this launch is underscored by the increasing regulatory pressures on critical infrastructure operators to enhance their security postures, thus creating a timely opportunity for Fortinet to capture market share.

As of October 2025, the competitive trends in the OT security market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming pivotal, as companies recognize the need for collaborative approaches to tackle complex security challenges. Looking ahead, competitive differentiation is likely to evolve from traditional price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This shift suggests that companies that prioritize these elements will be better positioned to thrive in an increasingly complex and demanding market.