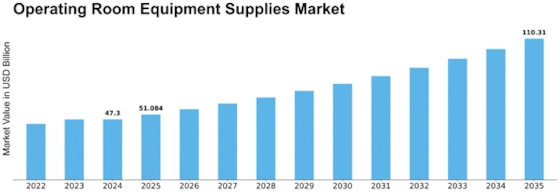

Operating Room Equipment Supplies Size

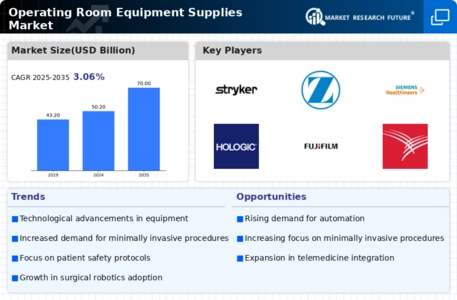

Operating Room Equipment Supplies Market Growth Projections and Opportunities

In the vast landscape of the Operating Room Equipment Supplies Market, market share is a crucial metric reflecting key players' competitive dynamics and positioning. Several factors contribute to the distribution of market share within this sector. Firstly, product innovation and technological advancements play a pivotal role. Companies that consistently introduce cutting-edge equipment and supplies, integrating the latest technologies such as robotics, advanced imaging, and smart monitoring systems, often gain a competitive edge, attracting healthcare providers seeking state-of-the-art solutions. Additionally, the ability to maintain regulatory compliance and meet stringent quality standards influences market share. Regulatory approvals and certifications are paramount given the nature of operating room equipment, which directly impacts patient outcomes. Companies committed to adhering to these standards build trust among healthcare professionals and are more likely to secure a significant market share. Market share is also closely tied to the efficiency of distribution channels and strategic partnerships. Both domestically and internationally, companies with robust distribution networks can efficiently reach healthcare facilities needing operating room equipment and supplies. Collaborations with hospitals, clinics, and group purchasing organizations strengthen market presence, as these partnerships facilitate a steady flow of products to end-users. Furthermore, pricing strategies and overall cost-effectiveness are pivotal in determining market share. While offering high-quality and innovative products is crucial, companies that can provide competitive pricing without compromising quality are well-positioned to capture a larger market share. This is particularly relevant as healthcare providers often seek cost-effective solutions to manage their budgets efficiently. Geographical factors also contribute significantly to market share distribution. Regional variations in healthcare infrastructure, government policies, and economic conditions impact the demand for operating room equipment supplies. Companies that tailor their strategies to meet the specific needs of different regions and establish a strong presence in key markets can secure a larger market share than those with a more generalized approach. The competitive landscape, characterized by mergers, acquisitions, and partnerships, further influences market share dynamics. Strategic alliances can create industry giants with diverse product portfolios, extensive distribution networks, and enhanced R&D capabilities. Such entities are better positioned to dominate the market and capture a significant share than smaller, standalone companies. Customer satisfaction and after-sales support are vital in determining market share. Healthcare providers value suppliers who deliver high-quality products and provide excellent customer service, training, and ongoing support. Positive customer experiences contribute to brand loyalty, fostering a strong market presence and influencing future purchasing decisions.

Leave a Comment