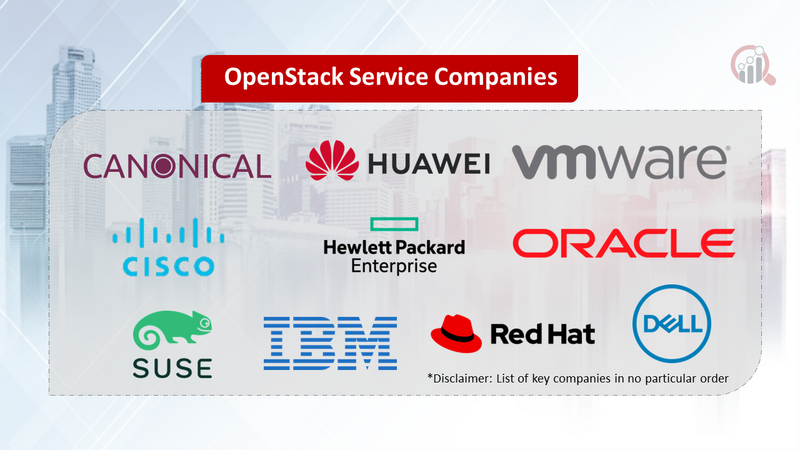

Top Industry Leaders in the OpenStack service Market

Competitive Landscape of OpenStack Service Market:

The OpenStack service market, encompassing deployment, management, and support services for the open-source cloud computing platform, is experiencing a surge in growth. This dynamic environment is characterized by a diverse range of players, from established giants to nimble startups, all vying for a piece of the pie.

Key Players:

- Canonical (U.K)

- Huawei (China)

- Cisco Systems (U.S.)

- SUSE (Germany)

- VMware (U.S.)

- Hewlett Packard Enterprise (U.S.)

- Oracle Corporation (U.S.)

- Dell Inc (U.S.)

- IBM Corporation (U.S.)

- Red Hat (U.S.)

Market Share Analysis:

Evaluating market share in this dynamic landscape requires a multi-faceted approach. Factors to consider include:

- Revenue share: This provides a traditional metric of market size, but can be skewed towards larger players with diverse service portfolios.

- Customer base: Analyzing the number and types of customers served helps understand the reach and focus of each competitor.

- Service portfolio depth and breadth: Assessing the range and specialization of services offered reveals a player's competitive advantage and target audience.

- Geographic presence: Understanding the regional distribution of players and their market penetration in specific areas is crucial.

- Technological innovation: Evaluating a company's contribution to OpenStack development, integration with other technologies, and adoption of new trends provides insights into future potential.

New and Emerging Companies:

The OpenStack service market welcomes new entrants regularly, driven by technological advancements and niche opportunities. Some notable examples include:

- CloudHedge: Offers a pay-as-you-go OpenStack platform with automated deployment and management, targeting cost-conscious businesses.

- OpenStack-as-a-Service (OaaS) providers: Companies like Upcloud and vXCloud offer containerized OpenStack deployments, enabling rapid scaling and portability for cloud-native applications.

- Industry-specific players: Startups like CloudHealth and CloudHealthTech cater to healthcare and financial services with OpenStack-based solutions addressing compliance and data security requirements.

Current Investment Trends:

Companies in the OpenStack service market are investing in various areas to maintain competitiveness and drive growth:

- Automation and managed services: Tools for automated deployments, configuration management, and proactive monitoring are gaining traction, reducing operational costs and improving efficiency.

- Integration with other technologies: OpenStack's interoperability with Kubernetes, containers, and other cloud-native technologies is a key focus area for integration and service development.

- Security and compliance: Enhanced security features and compliance certifications are becoming essential to attract regulated industries and government agencies.

- Vertical market specialization: Developing expertise and solutions tailored to specific industries like healthcare, finance, and telecommunications is a growing trend.

Latest Company Updates:

December 2023, SBAB will become one of the first European banks to migrate parts of its IT infrastructure to an OpenStack-based service.

December 2023, This OpenStack provider launched a new consulting service to help customers implement and manage their cloud environments.

December 2023, The company joined the OpenStack Marketplace, offering remotely-managed private clouds built on the open-source platform.