Rise of Digital Payment Solutions

The rise of digital payment solutions is a pivotal driver for the Open Banking Systems Market. With the increasing prevalence of mobile wallets and contactless payments, consumers are gravitating towards more convenient and efficient payment methods. Data suggests that digital payment transactions have surged by approximately 40% in the past year, underscoring a shift in consumer behavior. This trend compels banks to adopt open banking frameworks that facilitate integration with various payment platforms. Consequently, the Open Banking Systems Market is likely to expand as financial institutions innovate to meet the evolving needs of tech-savvy consumers.

Increased Investment in Fintech Startups

The Open Banking Systems Market is witnessing increased investment in fintech startups, which is driving innovation and competition. Venture capital funding for fintech companies has reached unprecedented levels, with investments exceeding billions in recent years. This influx of capital enables startups to develop cutting-edge solutions that leverage open banking principles, such as personalized financial management tools and advanced analytics. As these startups gain traction, they challenge traditional banking models, prompting established institutions to collaborate or compete. This dynamic environment is likely to accelerate the growth of the Open Banking Systems Market, as both fintechs and banks strive to enhance their offerings.

Consumer Demand for Financial Transparency

There is a growing consumer demand for financial transparency, which is significantly influencing the Open Banking Systems Market. Customers are increasingly seeking control over their financial data and expect banks to provide clear insights into their financial health. This trend is reflected in a survey indicating that over 70% of consumers prefer banks that offer transparent data sharing practices. As financial institutions respond to this demand, they are likely to enhance their open banking capabilities, thereby fostering trust and loyalty among customers. This shift towards transparency is expected to propel the Open Banking Systems Market forward, as more institutions invest in technologies that support consumer-centric data sharing.

Regulatory Frameworks Promoting Open Banking

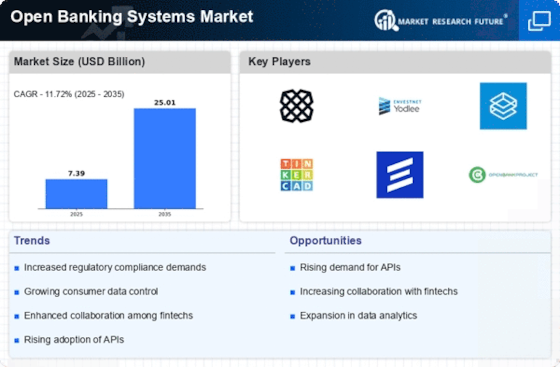

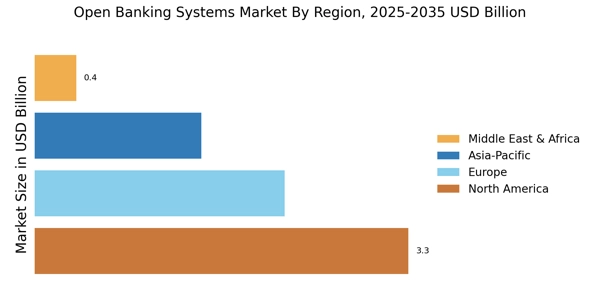

Regulatory frameworks are playing a crucial role in promoting the Open Banking Systems Market. Governments and regulatory bodies are increasingly recognizing the benefits of open banking, leading to the establishment of guidelines that encourage data sharing among financial institutions. For instance, regulations such as the Revised Payment Services Directive (PSD2) in Europe have mandated banks to open their APIs to third-party providers. This regulatory push not only enhances competition but also fosters innovation within the financial sector. As more regions adopt similar regulations, the Open Banking Systems Market is poised for substantial growth, as compliance becomes a priority for financial institutions.

Technological Advancements in Financial Services

The Open Banking Systems Market is experiencing a surge in technological advancements that facilitate seamless integration between banks and third-party providers. Innovations such as Application Programming Interfaces (APIs) enable secure data sharing, which enhances service offerings. According to recent data, the adoption of APIs in banking has increased by over 30% in the last two years, indicating a strong trend towards digital transformation. This technological evolution not only streamlines operations but also fosters competition, as new entrants can offer innovative financial products. As a result, traditional banks are compelled to adapt, thereby driving growth in the Open Banking Systems Market.